At $1,300 a month, with limited supply, and side effects including nausea, vomiting and gastrointestinal maladies, there are plenty of reasons to find more cost-effective and appetizing ways to lose weight other than turning to the medical sector and resorting to GLP-1 weight loss drugs like Ozempic and Wegovy from Novo Nordisk A/S (NYSE: NVO). And those underlying reasons are putting the carnivore diet back in the spotlight for people seeking GLP-1 alternatives.

The NASDAQ: BLMN">carnivore diet is comprised strictly of meats and animal-produced fats and proteins. The ketogenic diet may be more palatable for those needing fiber and variety. Both diets are low-carb alternatives, which also benefit people with type 2 diabetes. The only requirement is meat and lots of it. Here are two stocks fueling carnivores and benefitting from the Ozempic craze.

Tyson Foods

While mainly known for chicken and poultry products, Tyson Foods Inc. (NYSE: TSN) is the largest beef producer in the United States. Tyson's beef and pork are sold under brands including Chairman's Reserve Meats, Star Ranch Angus Beef, ibp Trusted Excellence Brand, Reuben Corned Beef and Open Prairie Natural Pork. It recently opened its $42 million state-of-the-art facility in Columbia, South Carolina, for its Tyson Fresh Meats division. Familiar meat brands include Jimmy Dean, Ball Park, Hillshire Farm and Aidells.

Solid Fiscal Q1 2024 Beat

On February 5, 2024, Tyson reported an EPS of 69 cents, beating analyst estimates by 28 cents. GAAP operating income fell 51% YoY to $231 million. Adjusted operating income fell 9% YoY to $411 million. The total adjusted operation margin was 3.1%. Revenues rose 0.4% YoY to $13.32 billion versus $13.34 billion analyst estimates. Total liquidity was $3.7 billion as of December 30, 2023. Check out the sector heatmap on MarketBeat.

Sales by Segment

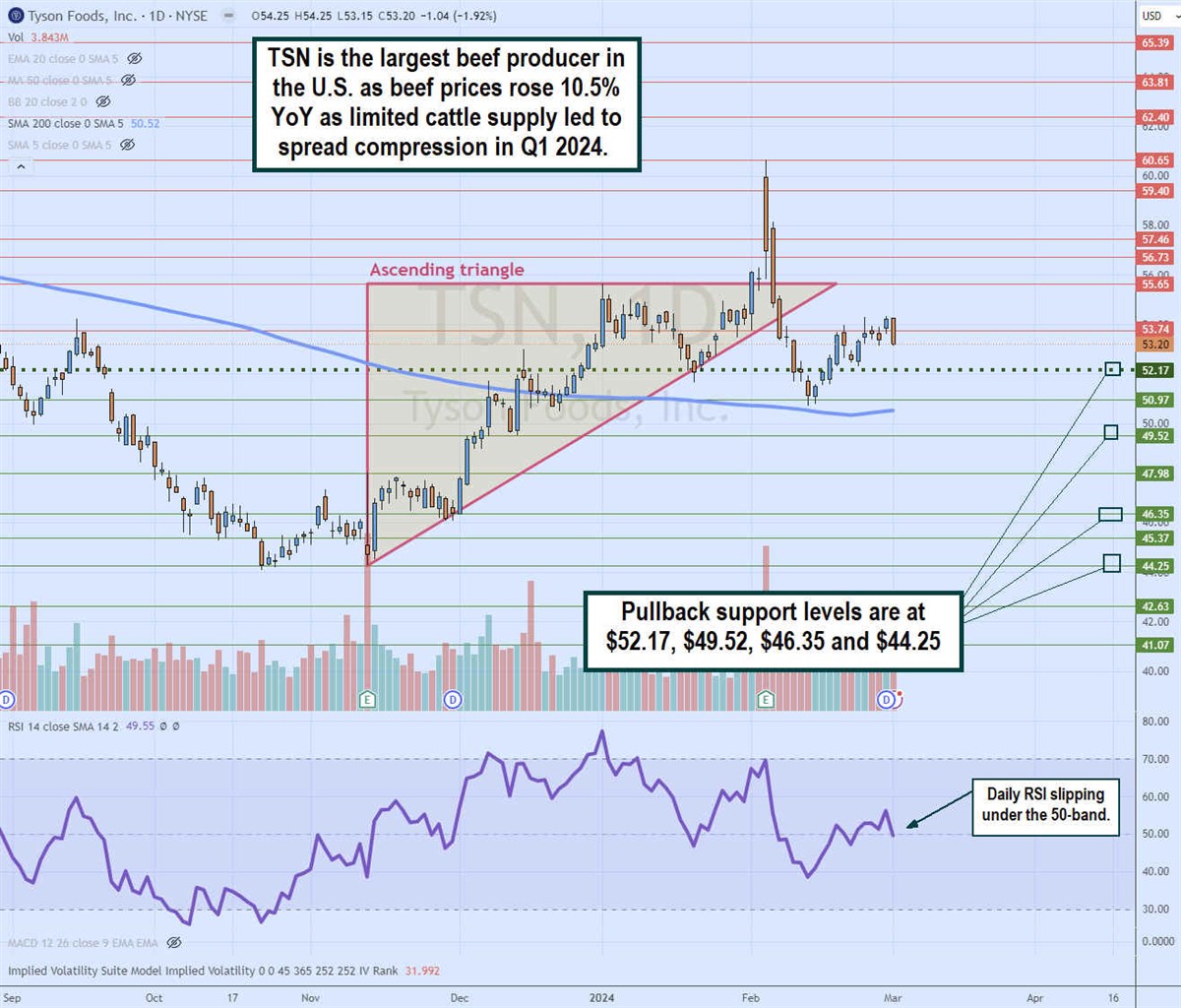

Chicken sales came in at around $4.03 billion. Prices fell 3.9% YoY, and volume slipped 1.5% YoY. Beef sales came in at $5.02 billion. Prices surged 10.5% while volume fell 4.1% YoY. The beef industry remains "fundamentally challenging" as limited cattle supply led to spread compression. Nearly 50% of the loss in the quarter was related to inventory valuation adjustment. Sales were driven by higher price per pound offset by lower head throughput. Pork sales came in at $1.5 billion, driven by lower pricing, down 8.5%, offset by volume growth rising 7.7% YoY. Spreads are improving in pork.

In-line Guidance

Tyson expects the fiscal full year 2024 revenues to be relatively flat, with the full year 2023 of $52.81 billion versus $53.08 billion analyst estimates.

CEO Insights

Tyson CEO Donnie King acknowledged that inflation is decreasing, but consumers still face higher prices than 2 years ago. However, they are still willing to purchase brands they know and trust.

King commented, "The value proposition of our iconic brands resonates strongly with consumers. Over the past year, nearly three out of four US households purchased a Tyson core business line product, and this penetration rate is growing. What gets me even more excited is that our product line with the highest penetration rate is only in about a third of households, leaving us plenty of room for continued growth over the long run."

Tyson Food analyst ratings and price targets are at MarketBeat. Tyson Food's peer and competitor stocks can be found with the MarketBeat stock screener.

Daily ascending triangle

The daily candlestick chart on TSN illustrates an ascending triangle pattern that triggered a breakout on the earnings gap to $60.65 on February 5, 2024. However, it formed a gap and crap as shares sold off from the highs for the next four days falling below the ascending lower trendline. Shares bottomed near the daily 200-period moving average (MA) support to trigger a daily market structure low (MSL) breakout through $52.17. The daily relative strength index turned back down through the 50-band. Pullback support levels are at $52.17, $49.52, $46.35 and $44.25.

Pilgrim's Pride

Pilgrim's Pride Co. (NASDAQ: PPC) is one of the world's largest chicken producers. They market under various brands, including Pilgrim's Chicken, Just Bare, Gold'n Plump, Moy Park, and Pilgrim's UK. Pilgrim's Fresco, Pilgrim's Value Added, Del Dia, Country Pride Chicken, O'Kane, Pierce Chicken, To-Rico's, Savoro and Gold Kist. Poultry sales have been strong, notably in its Prepared Foods business, which saw sales of Just Bare and Pilgrim's grow 59% YoY. Get AI-powered insights on MarketBeat.

Knocks It Out of the Park

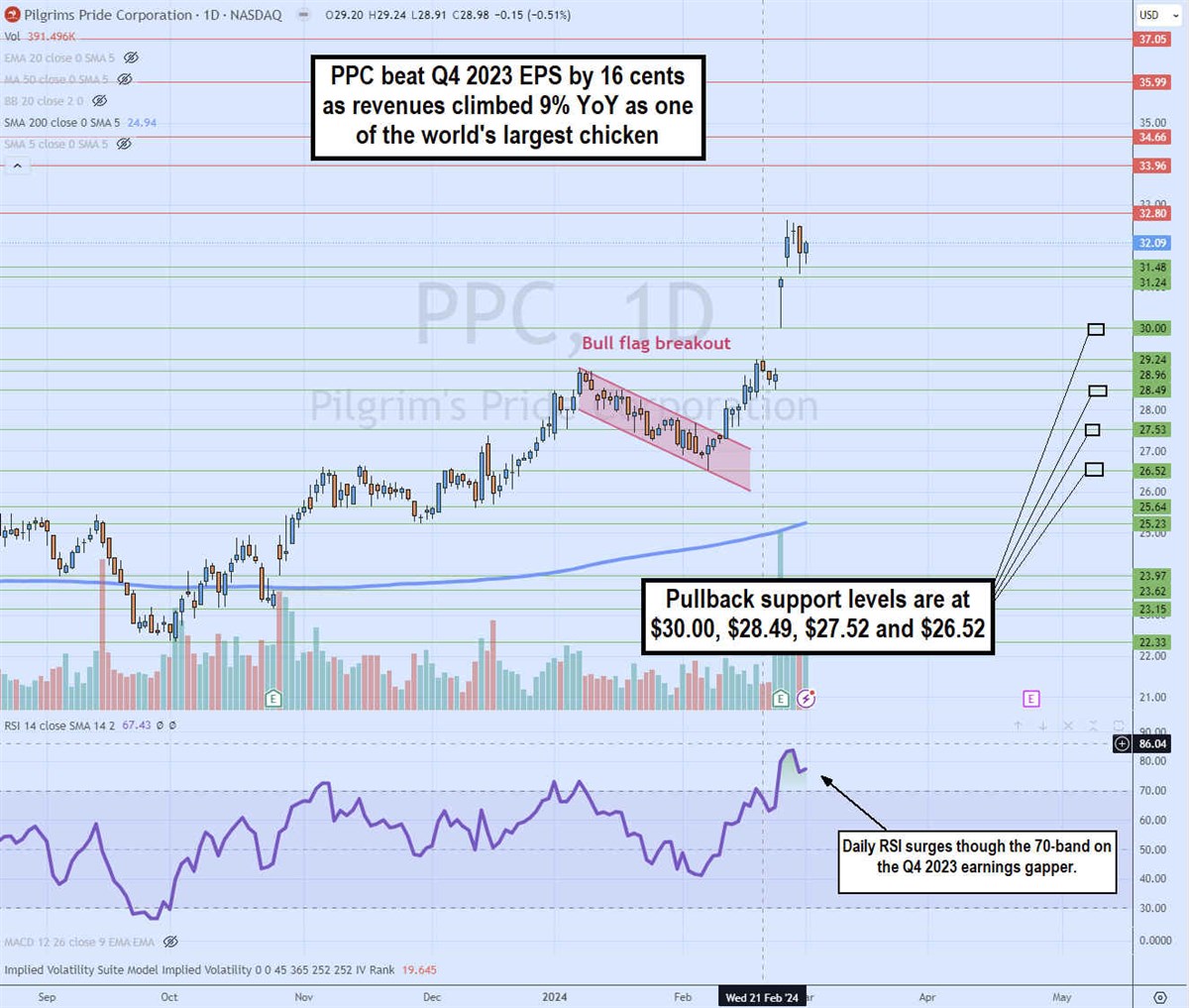

Pilgrim's Pride reported Q4 2023 EPS of 59 cents, beating consensus analyst expectations by 16 cents. GAAP operating margin was 3%. GAAP net income was $321.6 million, and adjusted net income was $400.3 million. Revenues grew 9% YoY to $4.5 billion, beating $4.48 billion consensus estimates.

CEO Insights

Pilgrim's Pride CEO Fabio Sandri noted that 2023 was a challenging year, but they were able to drive growth under the most difficult circumstances. The affordability and availability of chicken resonated with its customers. The company worked closely with key retail and food service customers to drive increased traffic through promotions.

The company completed the construction of its hatchery and feed mill in Merida, with production expected to commence in March 2024. Sandri commented, "Moving forward, expanding distribution of our existing innovation through retail and further diversifying our portfolio in food service will be key to driving continued growth. Our investments in people over the past few years have resulted in suitable net staffing and reduced turnover levels throughout our US facilities."

Pilgrim's Pride analyst ratings and price targets are at MarketBeat.

Daily Bull Flag Breakout

The daily candlestick chart on PPC illustrates a bull flag breakout pattern. The flagpole formed on the rally from $22.23 on October 3, 2023, to the swing high of $29.02 on January 8, 2024. After peaking, PPC shares pulled back in a parallel descending channel to form the flag. The bull flag breakout occurred on the breakout through $27.31 on February 12, 2024, sending shares higher into its Q4 2023 earnings release. The strong performance caused shares to gap up to $31.24 and peak at $32.63 in the following days. Pullback support levels are at $30.00, $28.49, $27.52 and $26.52.