Google parent Alphabet (NASDAQ: GOOGL), Microsoft (NASDAQ: MSFT), Amazon (NASDAQ: AMZN), Meta Platforms (NASDAQ: META), and Salesforce (NYSE: CRM) are the most oversold stocks on the market. The most oversold stocks that matter, anyway.

These stock prices are down after a significant round of selling and have been down long enough that a rebound can be expected. That is a critical detail because this list includes four Magnificent Seven stocks and a Magnificent Want-to-Be that all have a considerable impact on the S&P 500; the Magnificent Seven make up about 30% of the S&P 500 index, and when they rebound, the S&P 500 will likely follow.

There are many methods of determining oversold. This article uses the stochastic oscillator and charts of weekly price action. The stochastic oscillator and method derived from it assume that random, day-to-day market movement will make a pattern over time, like a dog on a leash. The dog may jump back and forth with no seeming pattern, but the jumps will track in line with whoever is holding the leash and can be predicted with reasonable accuracy. Where the leash goes, so goes the dog.

Why the weekly charts? The weekly charts give a more representative view of the market. Weekly bars erase much of the day-to-day volatility in favor of the long-term trend. To put this in perspective of the dog and its leash, the trend is the one holding the leash. The critical takeaway is that these stocks are not only oversold but oversold within an uptrend with fundamentally sound economic conditions and an outlook for growth, cash flow, and improving capital return.

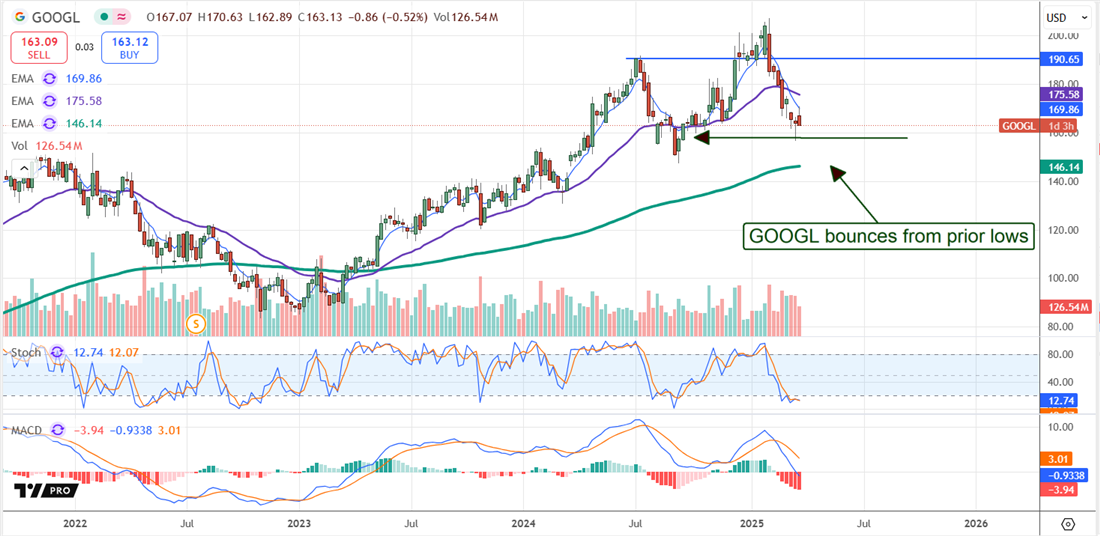

Alphabet Corrects by 20% and Could Be at Its Bottom

[content-module:CompanyOverview|NASDAQ: GOOGL]Google parent Alphabet’s share price correction reached 20% in late March but may not go any further.

Not only are oversold conditions indicated by the stochastic signal line falling into the lower extreme, but the market is at a critical support level.

That level aligns with prior lows and the bottom of what is now a consolidation range.

The market may move below this level but will likely rebound soon because the bar is set low for Q1 results. The analysts are generally bullish on the stock price, forecasting about a 30% upside at the consensus relative to late March price action.

Microsoft Begins to Regain Price Traction

[content-module:CompanyOverview|NASDAQ: MSFT]Microsoft also shows signs of rebounding from its 20% correction. The stock price is regaining traction at the end of March and could continue higher as April progresses.

The analysts forecast a 30% upside that its Q1 report could unleash.

The company is forecasted to sustain a slower but double-digit top-line growth pace when it reports late in the month and may easily outperform.

Its diversified business is aided by AI technology at all levels, including internal efficiencies and utilities for clients that drive adoption and penetration.

Amazon Bounces; Could Gain 30%

[content-module:CompanyOverview|NASDAQ: AMZN]Amazon’s stock price action and analyst outlook are the same.

The market is bouncing from the 20%-correction level, and the analysts forecast a 30% upside.

The risk is that this market is below its 150-day EMA, which could provide sufficient resistance to cap gains and keep the stock near recent lows.

It is scheduled to report earnings at the end of the month and has an easy bar to beat, with more analysts lowering their expectations than raising them in March.

Meta Platforms' Uptrend Is Intact

[content-module:CompanyOverview|NASDAQ: META]Meta Platforms is yet another major tech stock whose 20% correction was halted at a critical support target.

This time, the target is the 150-day EMA, suggesting the uptrend is intact. It may take time for the market to regain momentum, but higher highs remain in the forecast.

The analysts’ consensus forecast aligns the stock with the current all-time high, but it is rising with most fresh targets in the high-end range.

That adds nearly 30% to the consensus and could be reached this year if the upcoming earnings report extends the trends from 2024.

Salesforce: A Contender for Mag 8

[content-module:CompanyOverview|NYSE: CRM]Salesforce still has ground to cover before hitting a $1 trillion valuation, but its strong position in CRM and the rising role of AI in business make it a real possibility.

Salesforce is the leading player, offering the industry standard in service, with its Agentforce gaining traction in its first quarter of availability.

Agentforce is the application end of Salesforce’s business, applying the data insights gleaned from Data Cloud to automate and enhance customer service.

Although its stock price is down more than 20% from its high, it is also showing signs of support at a critical level.

Where Should You Invest $1,000 Right Now?

Before you make your next trade, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis.

Our team has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and none of the big name stocks were on the list.

They believe these five stocks are the five best companies for investors to buy now...