Battery and lighting company Energizer (NYSE: ENR) met Wall Street’s revenue expectations in Q3 CY2024, but sales were flat year on year at $805.7 million. Its GAAP profit of $0.65 per share increased from $0.27 in the same quarter last year.

Is now the time to buy Energizer? Find out by accessing our full research report, it’s free.

Energizer (ENR) Q3 CY2024 Highlights:

- Revenue: $805.7 million vs analyst estimates of $805.4 million (flat year on year, in line)

- Adjusted EBITDA: $187.3 million vs analyst estimates of $185 million (1.2% beat)

- EBITDA guidance for the upcoming financial year 2025 is $635 million at the midpoint, above analyst estimates of $622.3 million

- Gross Margin (GAAP): 38.1%, down from 40% in the same quarter last year

- Operating Margin: 7.4%, down from 14.4% in the same quarter last year

- Adjusted EBITDA Margin: 23.2%, in line with the same quarter last year

- Free Cash Flow Margin: 17.9%, up from 9.6% in the same quarter last year

- Organic Revenue was flat year on year (2% in the same quarter last year)

- Market Capitalization: $2.45 billion

"We finished fiscal 2024 with solid performances across both Battery and Auto Care, driving adjusted earnings growth above our initial expectations," said Mark LaVigne, President and Chief Executive Officer.

Company Overview

Masterminds behind the viral Energizer Bunny mascot, Energizer (NYSE: ENR) is one of the world's largest manufacturers of batteries.

Household Products

Household products stocks are generally stable investments, as many of the industry's products are essential for a comfortable and functional living space. Recently, there's been a growing emphasis on eco-friendly and sustainable offerings, reflecting the evolving consumer preferences for environmentally conscious options. These trends can be double-edged swords that benefit companies who innovate quickly to take advantage of them and hurt companies that don't invest enough to meet consumers where they want to be with regards to trends.

Sales Growth

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years.

Energizer carries some recognizable products but is a mid-sized consumer staples company. Its size could bring disadvantages compared to larger competitors benefiting from better brand awareness and economies of scale.

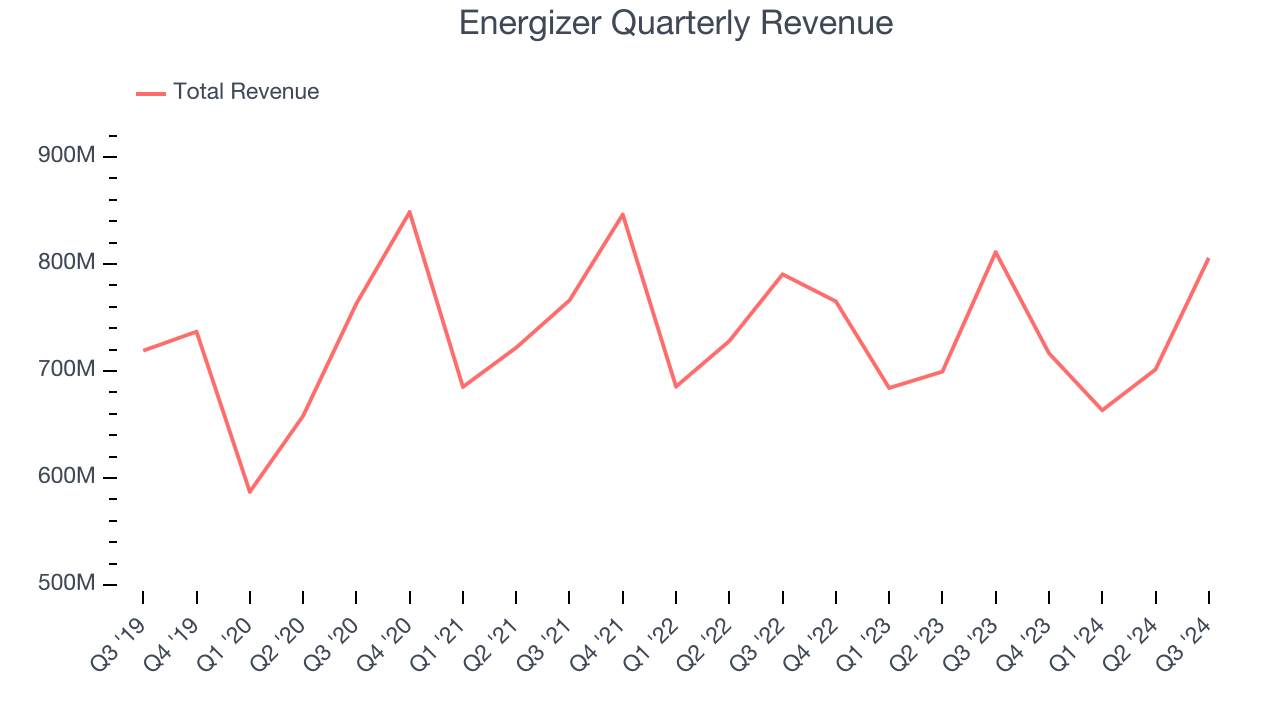

As you can see below, Energizer’s revenue declined by 1.5% per year over the last three years, showing demand was weak. This is a tough starting point for our analysis.

This quarter, Energizer’s $805.7 million of revenue was flat year on year and in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 1.6% over the next 12 months, an acceleration versus the last three years. While this projection implies its newer products will catalyze better performance, it is still below the sector average.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Organic Revenue Growth

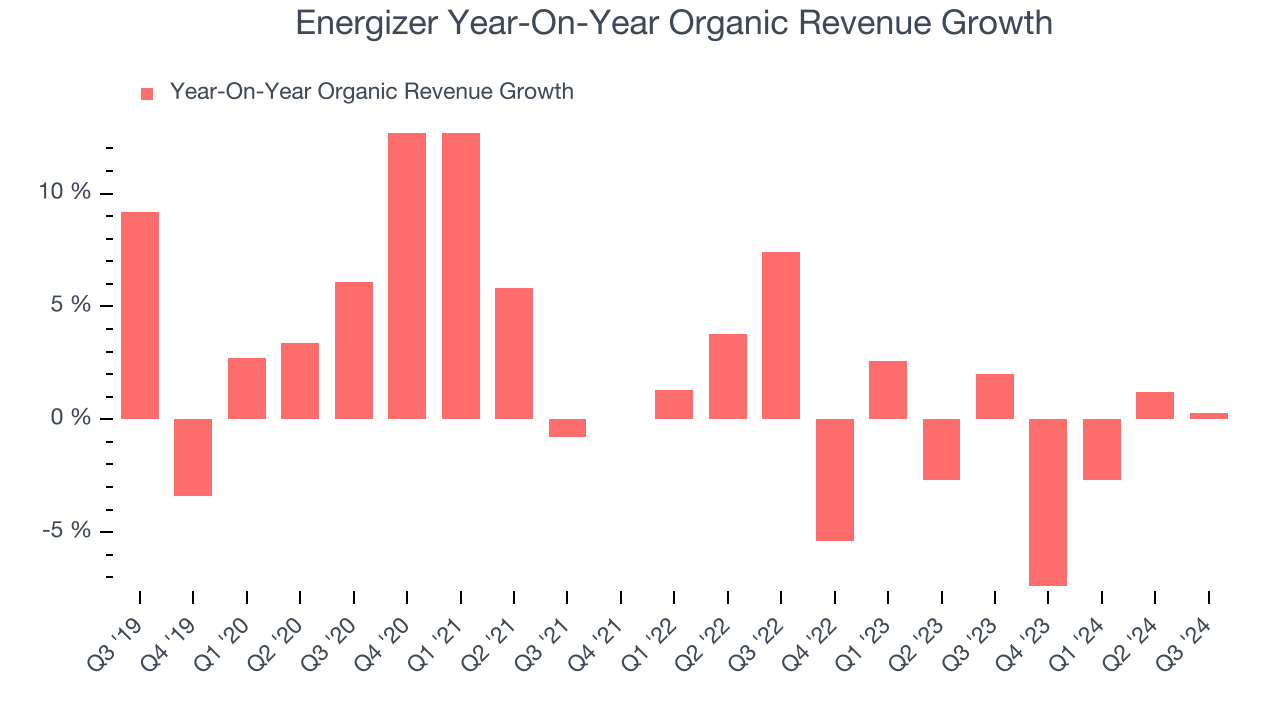

When analyzing revenue growth, we care most about organic revenue growth. This metric captures a business’s performance excluding one-time events such as mergers, acquisitions, and divestitures as well as foreign currency fluctuations.

Energizer’s demand has been falling over the last eight quarters, and on average, its organic sales have declined by 1.5% year on year.

In the latest quarter, Energizer’s year on year organic sales were flat. This performance was a well-appreciated turnaround from its historical levels, showing the business is improving.

Key Takeaways from Energizer’s Q3 Results

It was good to see Energizer beat Wall Street’s organic revenue and EBITDA estimates. On the other hand, its gross margin missed. Overall, this quarter was mixed. The stock traded up 1.6% to $34.68 immediately following the results.

Is Energizer an attractive investment opportunity right now? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.