Allegion has followed the market’s trajectory closely, rising in tandem with the S&P 500 over the past six months. The stock has climbed by 17.4% to $141.41 per share while the index has gained 13%.

Is now the time to buy ALLE? Find out in our full research report, it’s free.

Why Does ALLE Stock Spark Debate?

Allegion plc (NYSE: ALLE) is a provider of security products and solutions that keep people and assets safe and secure in various environments.

Two Things to Like:

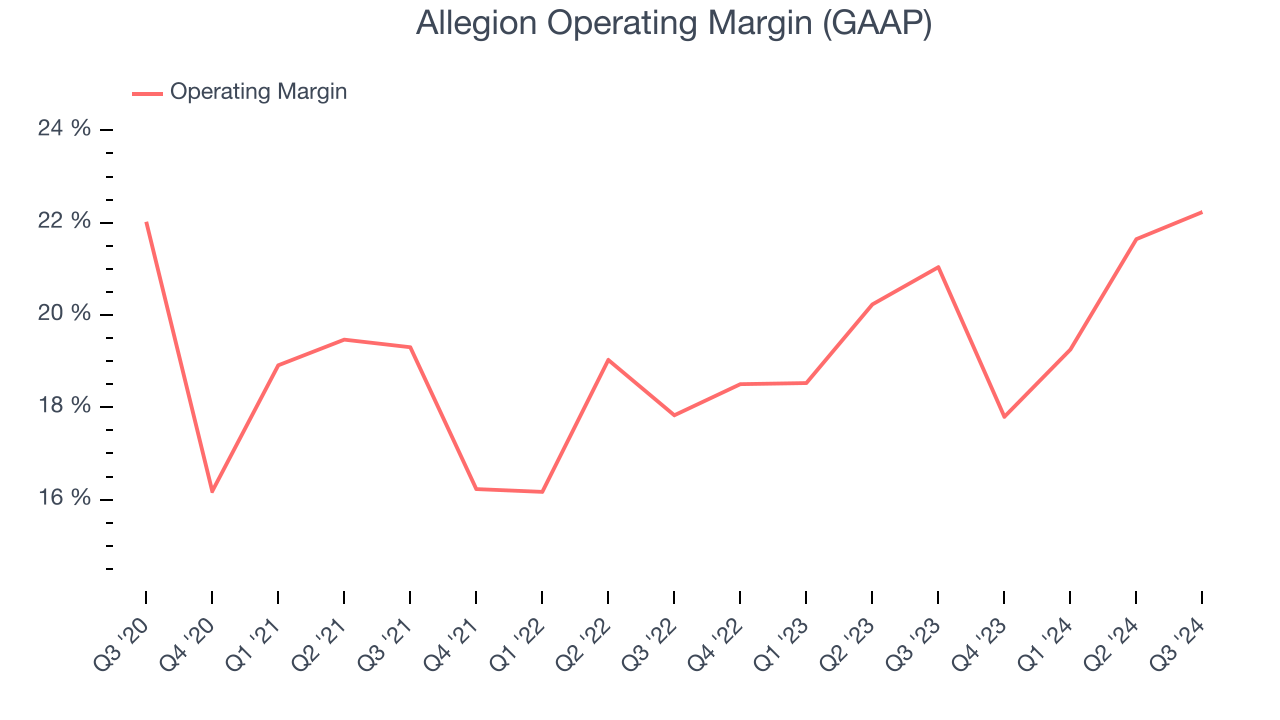

1. Operating Margin Reveals a Well-Run Organization

Operating margin is one of the best measures of profitability because it tells us how much money a company takes home after procuring and manufacturing its products, marketing and selling those products, and most importantly, keeping them relevant through research and development.

Allegion has been a well-oiled machine over the last five years. It demonstrated elite profitability for an industrials business, boasting an average operating margin of 18.5%. This result isn’t surprising as its high gross margin gives it a favorable starting point.

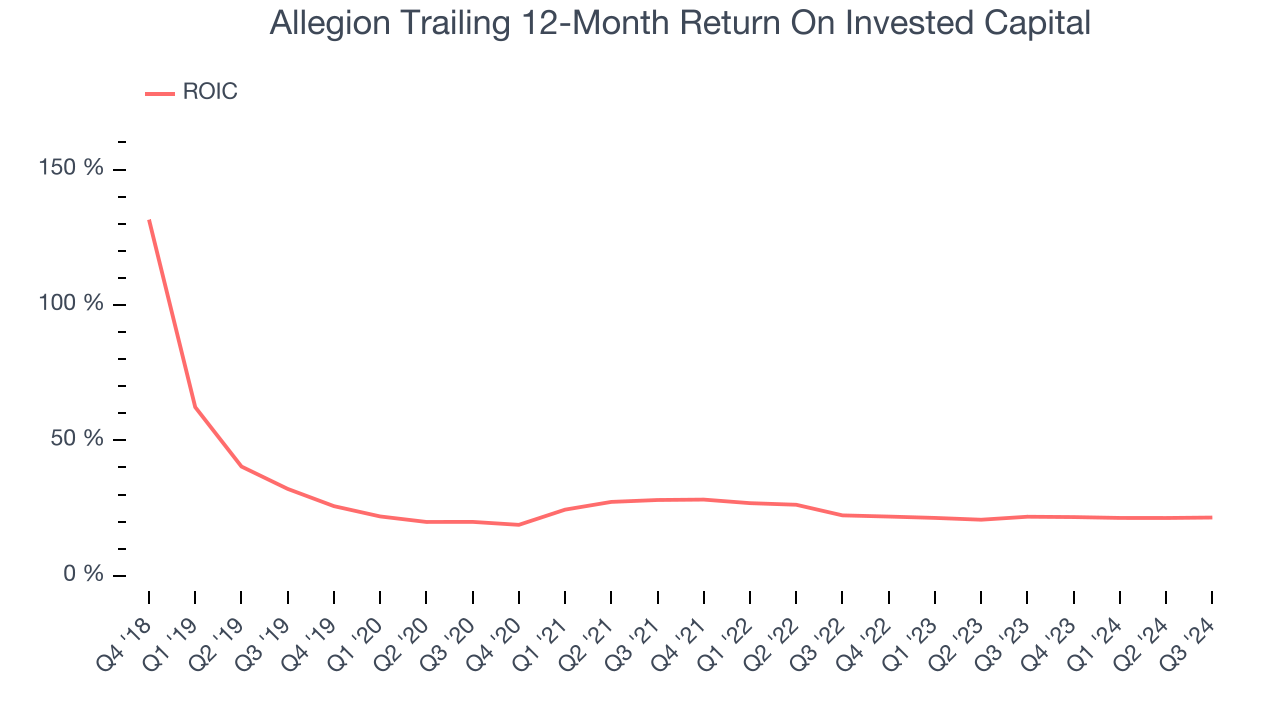

2. Stellar ROIC Showcases Lucrative Growth Opportunities

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Allegion’s five-year average ROIC was 22.7%, placing it among the best industrials companies. This illustrates its management team’s ability to invest in highly profitable ventures and produce tangible results for shareholders.

One Reason to be Careful:

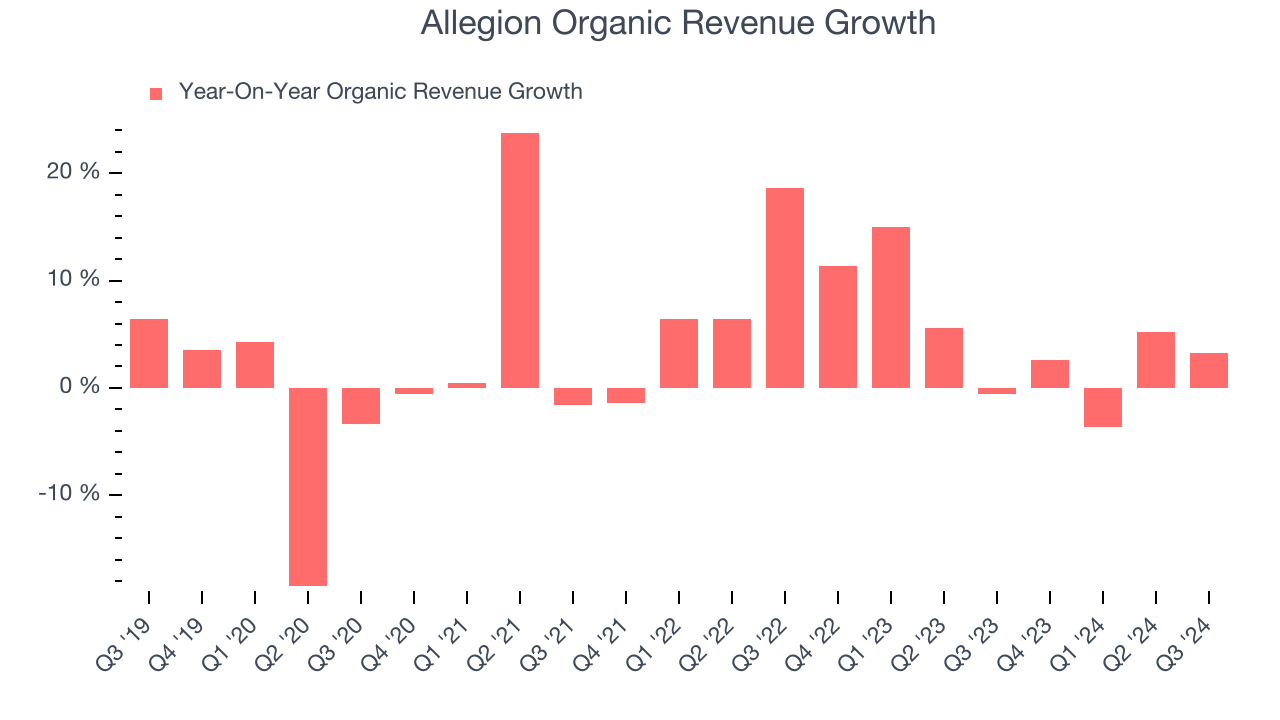

Slow Organic Growth Suggests Waning Demand In Core Business

Investors interested in Electrical Systems companies should track organic revenue in addition to reported revenue. This metric gives visibility into Allegion’s core business because it excludes one-time events such as mergers, acquisitions, and divestitures along with foreign currency fluctuations - non-fundamental factors that can manipulate the income statement.

Over the last two years, Allegion’s organic revenue averaged 4.9% year-on-year growth. This performance was underwhelming and suggests it may need to improve its products, pricing, or go-to-market strategy, which can add an extra layer of complexity to its operations.

Final Judgment

Allegion has huge potential even though it has some open questions, but at $141.41 per share (or 18.6x forward price-to-earnings), is now the time to initiate a position? See for yourself in our comprehensive research report, it’s free.

Stocks We Like Even More Than Allegion

With rates dropping, inflation stabilizing, and the elections in the rearview mirror, all signs point to the start of a new bull run - and we’re laser-focused on finding the best stocks for this upcoming cycle.

Put yourself in the driver’s seat by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like United Rentals (+550% five-year return). Find your next big winner with StockStory today for free.