What a fantastic six months it’s been for Coherent. Shares of the company have skyrocketed 102%, setting a new 52-week high of $130.60. This was partly thanks to its solid quarterly results, and the run-up might have investors contemplating their next move.

Is now still a good time to buy COHR? Or is this a case of a company fueled by heightened investor enthusiasm? Find out in our full research report, it’s free for active Edge members.

Why Does COHR Stock Spark Debate?

Created through the 2022 rebranding of II-VI Incorporated, a company with roots dating back to 1971, Coherent (NYSE: COHR) develops and manufactures advanced materials, lasers, and optical components for applications ranging from telecommunications to industrial manufacturing.

Two Things to Like:

1. Skyrocketing Revenue Shows Strong Momentum

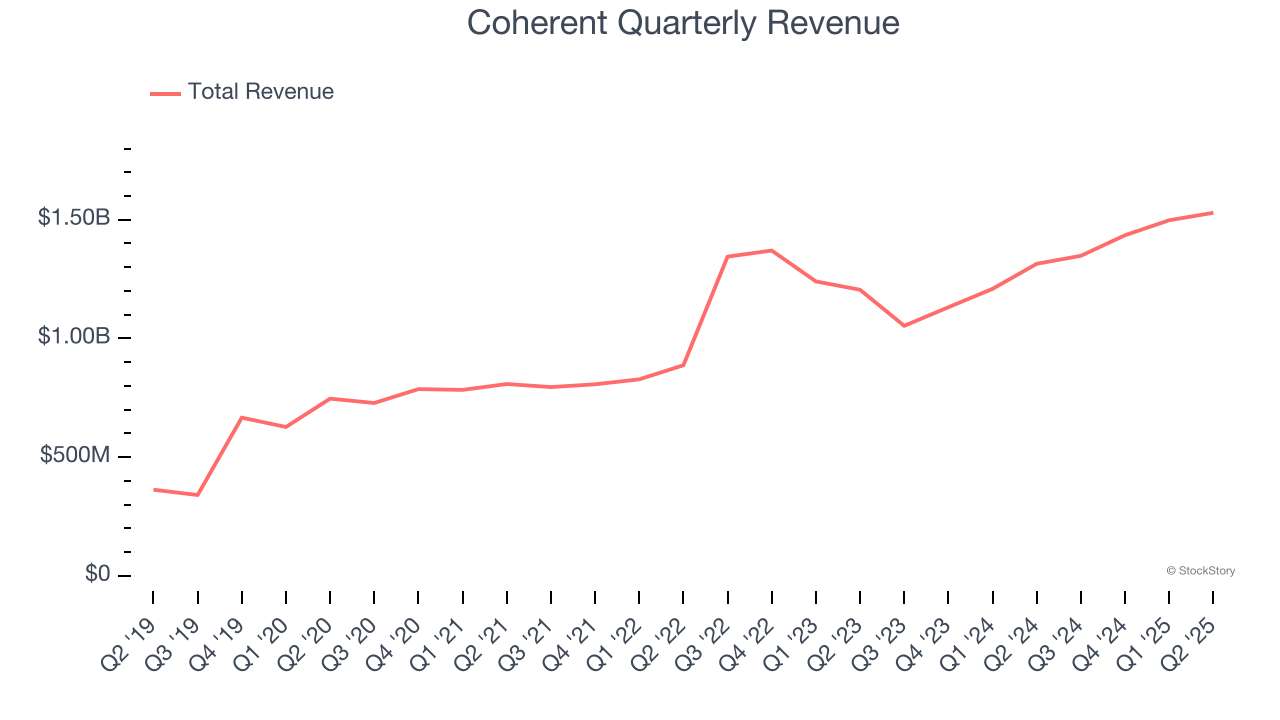

A company’s long-term performance is an indicator of its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Luckily, Coherent’s sales grew at an incredible 19.5% compounded annual growth rate over the last five years. Its growth surpassed the average business services company and shows its offerings resonate with customers.

2. Wall Street Expects Impressive Revenue Gains

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite, though some deceleration is natural as businesses become larger.

Over the next 12 months, sell-side analysts expect Coherent’s revenue to rise by 8.7%, an improvement versus its 19.5% annualized growth for the past five years. This projection is healthy and implies its newer products and services will fuel better top-line performance.

One Reason to be Careful:

Free Cash Flow Margin Dropping

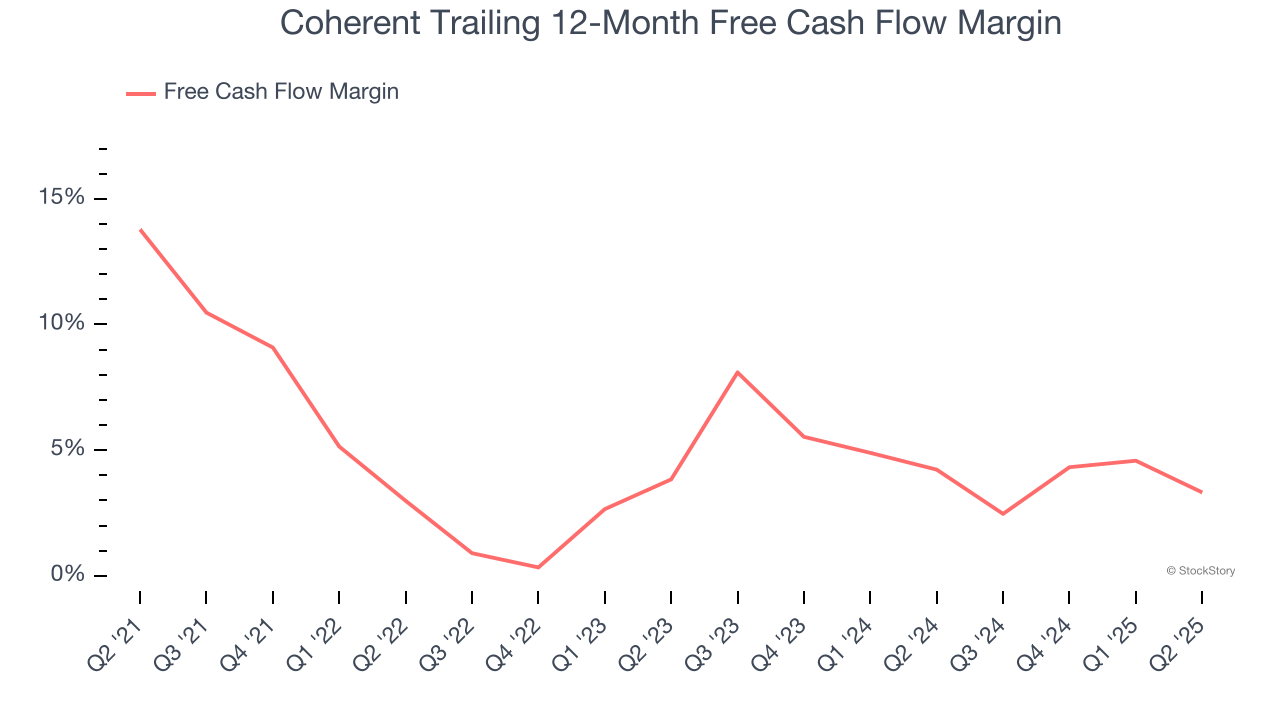

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

As you can see below, Coherent’s margin dropped by 10.5 percentage points over the last five years. If its declines continue, it could signal increasing investment needs and capital intensity. Coherent’s free cash flow margin for the trailing 12 months was 3.3%.

Final Judgment

Coherent has huge potential even though it has some open questions, and with the recent rally, the stock trades at 28.2× forward P/E (or $130.60 per share). Is now the time to buy despite the apparent froth? See for yourself in our full research report, it’s free for active Edge members.

Stocks We Like Even More Than Coherent

Trump’s April 2025 tariff bombshell triggered a massive market selloff, but stocks have since staged an impressive recovery, leaving those who panic sold on the sidelines.

Take advantage of the rebound by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.