Auto parts and accessories retailer Advance Auto Parts (NYSE: AAP) reported Q3 CY2025 results exceeding the market’s revenue expectations, but sales fell by 5.2% year on year to $2.04 billion. The company expects the full year’s revenue to be around $8.58 billion, close to analysts’ estimates. Its non-GAAP profit of $0.92 per share was 23.4% above analysts’ consensus estimates.

Is now the time to buy Advance Auto Parts? Find out by accessing our full research report, it’s free for active Edge members.

Advance Auto Parts (AAP) Q3 CY2025 Highlights:

- Revenue: $2.04 billion vs analyst estimates of $2.02 billion (5.2% year-on-year decline, 0.7% beat)

- Adjusted EPS: $0.92 vs analyst estimates of $0.75 (23.4% beat)

- The company slightly lifted its revenue guidance for the full year to $8.58 billion at the midpoint from $8.5 billion

- Management raised its full-year Adjusted EPS guidance to $1.80 at the midpoint, a 5.9% increase

- Operating Margin: 1.1%, up from 0% in the same quarter last year

- Free Cash Flow Margin: 9.9%, up from 1.5% in the same quarter last year

- Locations: 4,297 at quarter end, down from 4,781 in the same quarter last year

- Same-Store Sales rose 3% year on year (-2.3% in the same quarter last year)

- Market Capitalization: $3.31 billion

Company Overview

Founded in Virginia in 1932, Advance Auto Parts (NYSE: AAP) is an auto parts and accessories retailer that sells everything from carburetors to motor oil to car floor mats.

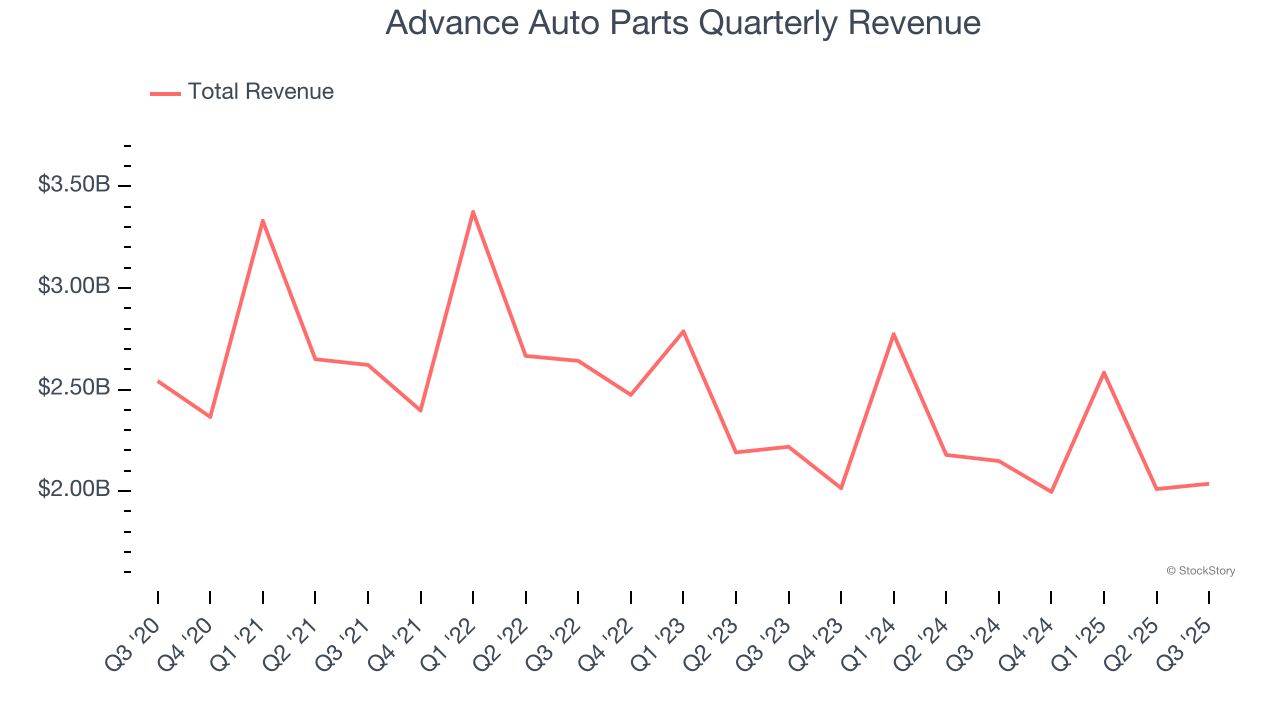

Revenue Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can put up a good quarter or two, but many enduring ones grow for years.

With $8.63 billion in revenue over the past 12 months, Advance Auto Parts is a mid-sized retailer, which sometimes brings disadvantages compared to larger competitors benefiting from better economies of scale.

As you can see below, Advance Auto Parts’s demand was weak over the last six years (we compare to 2019 to normalize for COVID-19 impacts). Its sales fell by 1.9% annually as it closed stores.

This quarter, Advance Auto Parts’s revenue fell by 5.2% year on year to $2.04 billion but beat Wall Street’s estimates by 0.7%.

Looking ahead, sell-side analysts expect revenue to remain flat over the next 12 months. Although this projection suggests its newer products will fuel better top-line performance, it is still below the sector average.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

Store Performance

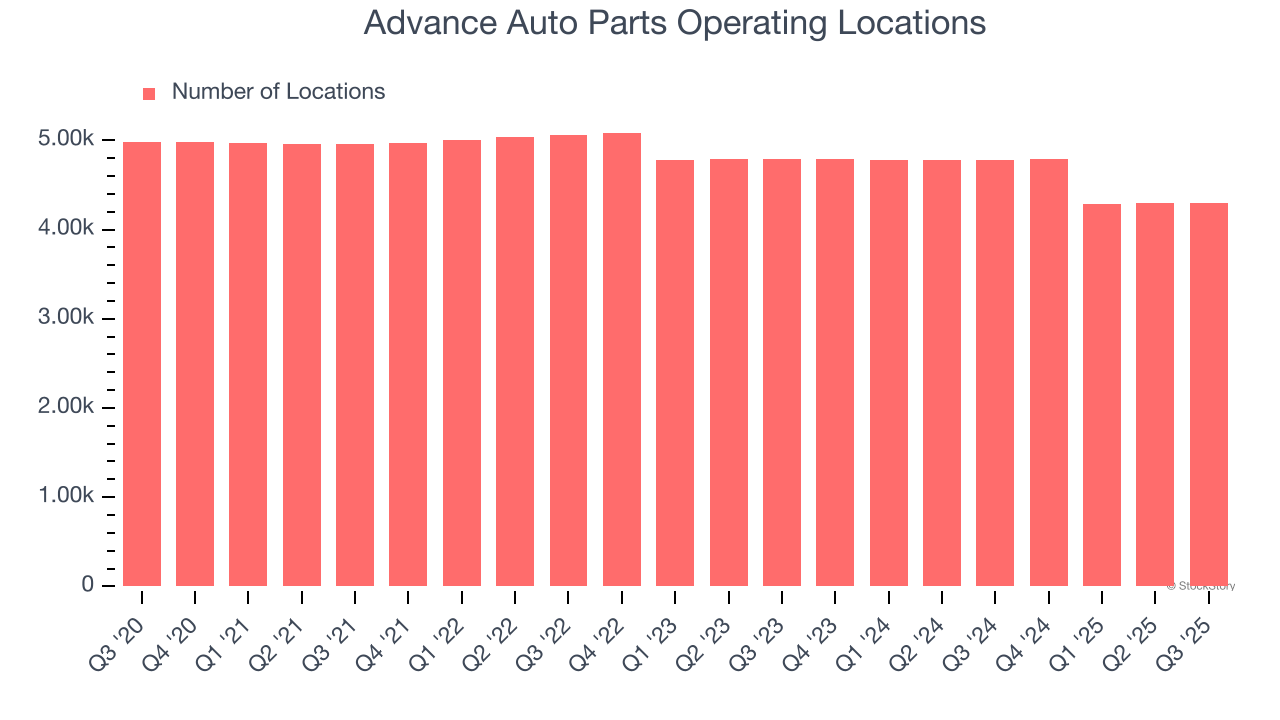

Number of Stores

Advance Auto Parts listed 4,297 locations in the latest quarter and has generally closed its stores over the last two years, averaging 4.6% annual declines.

When a retailer shutters stores, it usually means that brick-and-mortar demand is less than supply, and it is responding by closing underperforming locations to improve profitability.

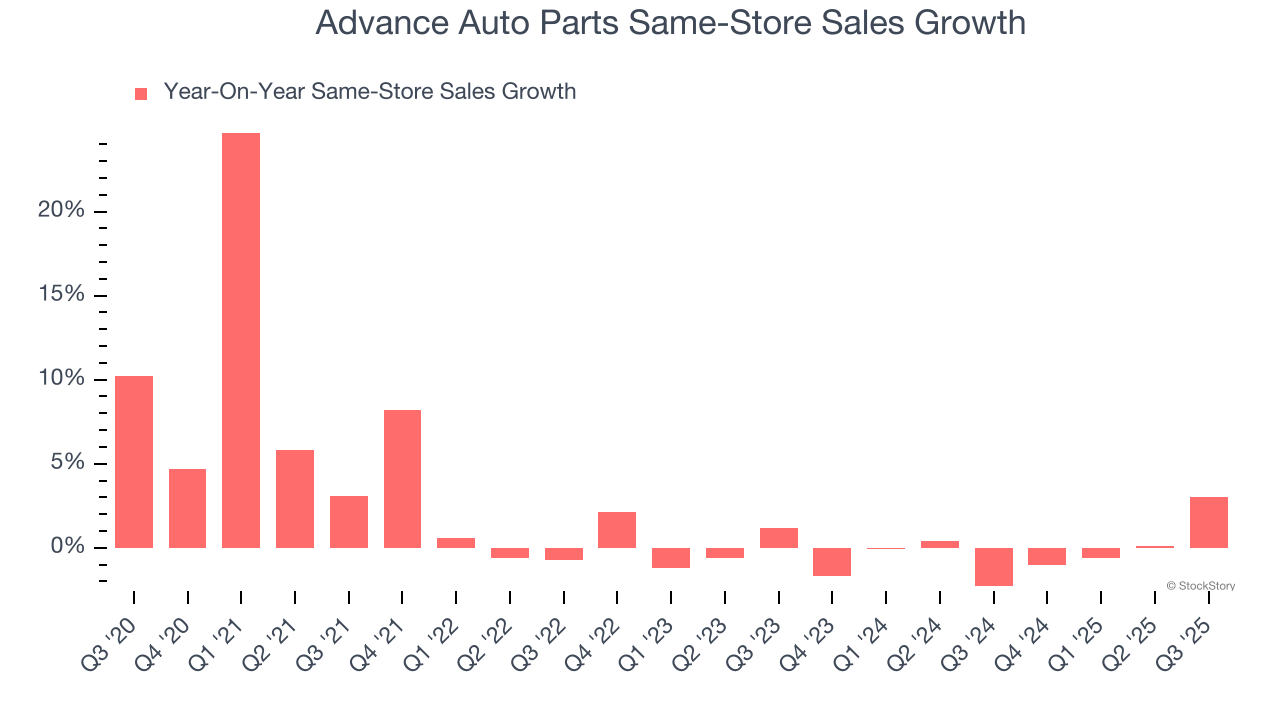

Same-Store Sales

The change in a company's store base only tells one side of the story. The other is the performance of its existing locations and e-commerce sales, which informs management teams whether they should expand or downsize their physical footprints. Same-store sales gives us insight into this topic because it measures organic growth for a retailer's e-commerce platform and brick-and-mortar shops that have existed for at least a year.

Advance Auto Parts’s demand within its existing locations has barely increased over the last two years as its same-store sales were flat. This performance isn’t ideal, and Advance Auto Parts is attempting to boost same-store sales by closing stores (fewer locations sometimes lead to higher same-store sales).

In the latest quarter, Advance Auto Parts’s same-store sales rose 3% year on year. This growth was a well-appreciated turnaround from its historical levels, showing the business is regaining momentum.

Key Takeaways from Advance Auto Parts’s Q3 Results

It was great to see Advance Auto Parts’s full-year EPS guidance top analysts’ expectations. We were also glad its same-store sales rose and its EPS outperformed Wall Street’s estimates. On the other hand, its gross margin fell short of Wall Street’s estimates. Overall, this print was mixed but still had some key positives. The stock traded up 7% to $59.01 immediately after reporting.

Is Advance Auto Parts an attractive investment opportunity at the current price? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.