While the S&P 500 is up 16.4% since May 2025, Penguin Solutions (currently trading at $20.76 per share) has lagged behind, posting a return of 6.9%. This might have investors contemplating their next move.

Is now the time to buy Penguin Solutions, or should you be careful about including it in your portfolio? Check out our in-depth research report to see what our analysts have to say, it’s free for active Edge members.

Why Do We Think Penguin Solutions Will Underperform?

We're sitting this one out for now. Here are three reasons we avoid PENG and a stock we'd rather own.

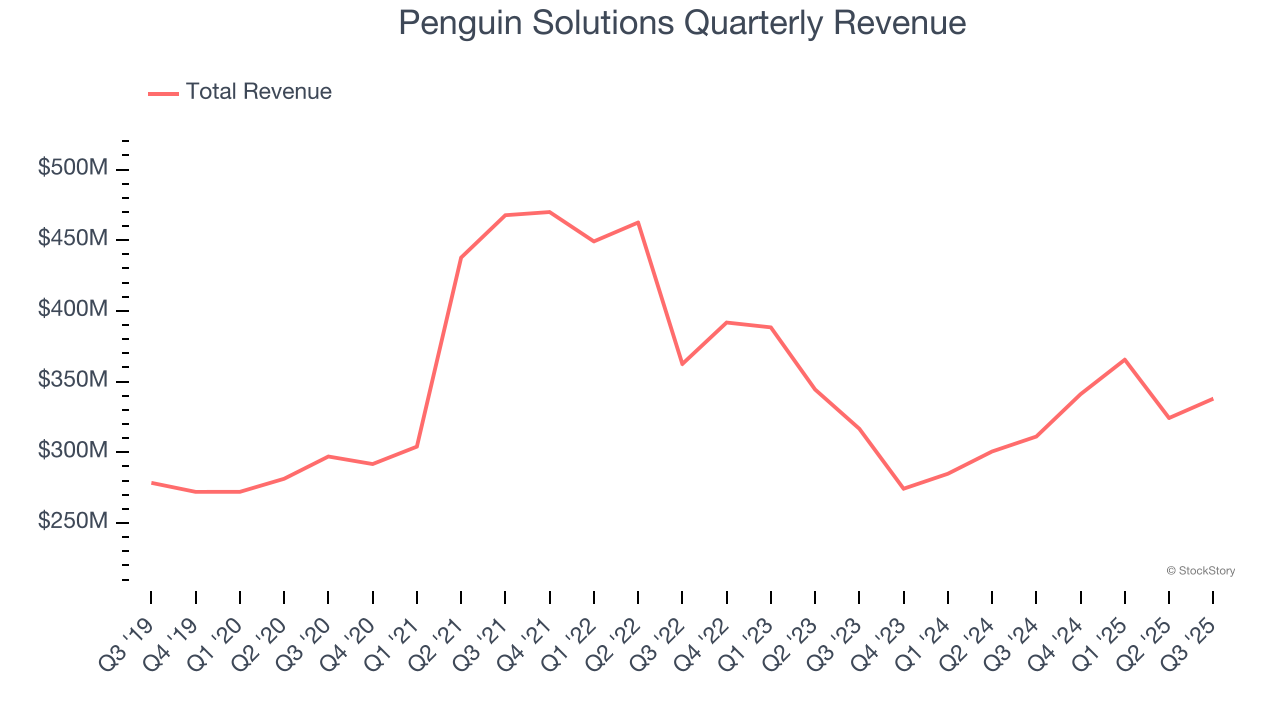

1. Long-Term Revenue Growth Disappoints

A company’s long-term sales performance is one signal of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Regrettably, Penguin Solutions’s sales grew at a mediocre 4% compounded annual growth rate over the last five years. This fell short of our benchmark for the semiconductor sector. Semiconductors are a cyclical industry, and long-term investors should be prepared for periods of high growth followed by periods of revenue contractions.

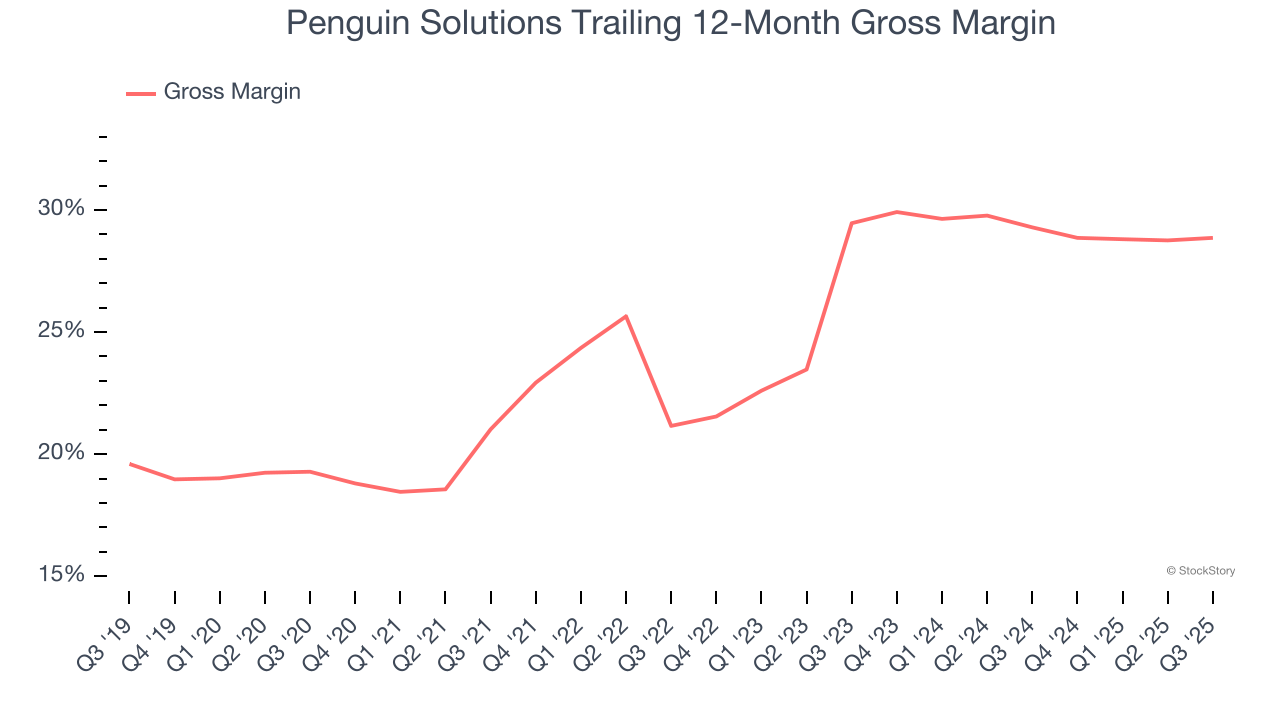

2. Low Gross Margin Reveals Weak Structural Profitability

Gross profit margin is a key metric to track because it shows how much money a semiconductor company gets to keep after paying for its raw materials, manufacturing, and other input costs.

Penguin Solutions’s gross margin is one of the worst in the semiconductor industry, signaling it operates in a competitive market and lacks pricing power. As you can see below, it averaged a 29.1% gross margin over the last two years. That means Penguin Solutions paid its suppliers a lot of money ($70.94 for every $100 in revenue) to run its business.

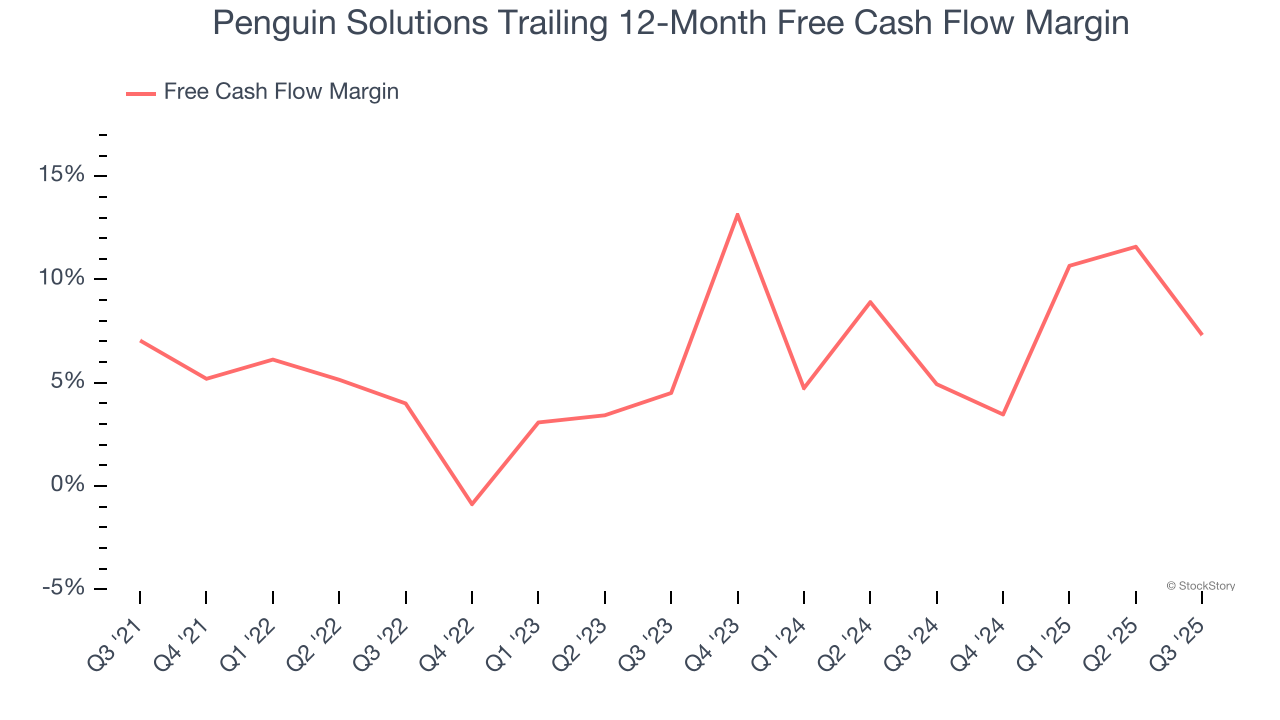

3. Mediocre Free Cash Flow Margin Limits Reinvestment Potential

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Penguin Solutions has shown poor cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 6.2%, lousy for a semiconductor business.

Final Judgment

We cheer for all companies solving complex technology issues, but in the case of Penguin Solutions, we’ll be cheering from the sidelines. With its shares underperforming the market lately, the stock trades at 10.1× forward P/E (or $20.76 per share). This valuation multiple is fair, but we don’t have much confidence in the company. There are superior stocks to buy right now. We’d recommend looking at a top digital advertising platform riding the creator economy.

Stocks We Would Buy Instead of Penguin Solutions

Your portfolio can’t afford to be based on yesterday’s story. The risk in a handful of heavily crowded stocks is rising daily.

The names generating the next wave of massive growth are right here in our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.