Seacoast Banking’s 23.5% return over the past six months has outpaced the S&P 500 by 10.2%, and its stock price has climbed to $32.25 per share. This was partly thanks to its solid quarterly results, and the performance may have investors wondering how to approach the situation.

Is now the time to buy Seacoast Banking, or should you be careful about including it in your portfolio? Check out our in-depth research report to see what our analysts have to say, it’s free for active Edge members.

Why Do We Think Seacoast Banking Will Underperform?

Despite the momentum, we're sitting this one out for now. Here are three reasons why SBCF doesn't excite us and a stock we'd rather own.

1. Lackluster Revenue Growth

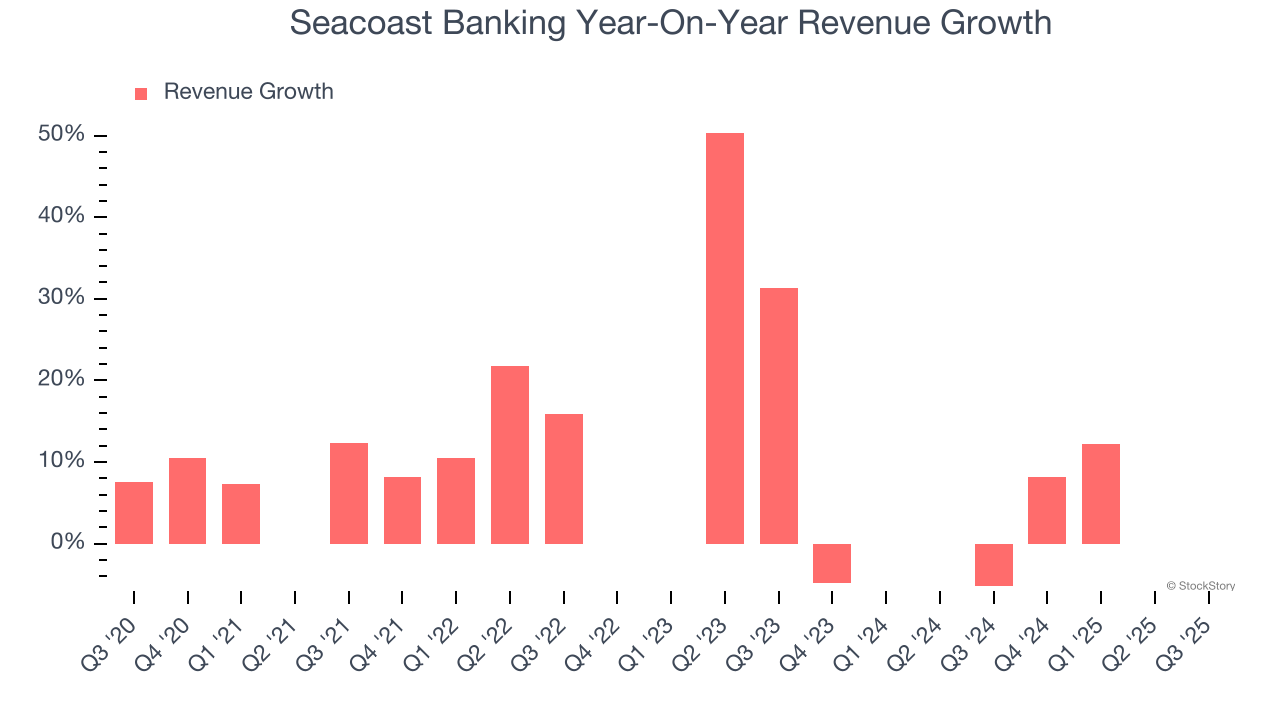

Long-term growth is the most important, but within financials, a stretched historical view may miss recent interest rate changes and market returns. Seacoast Banking’s recent performance shows its demand has slowed as its annualized revenue growth of 1.5% over the last two years was below its five-year trend.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

2. EPS Barely Growing

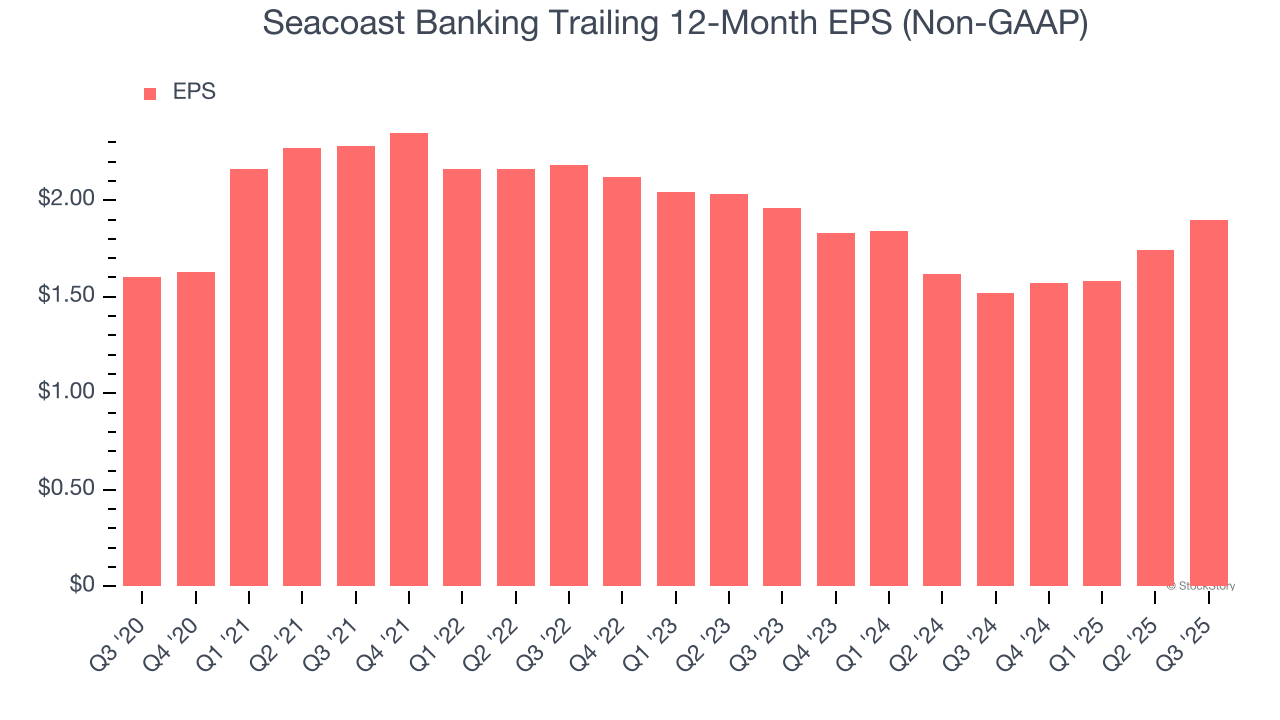

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Seacoast Banking’s EPS grew at a weak 3.5% compounded annual growth rate over the last five years, lower than its 13.4% annualized revenue growth. This tells us the company became less profitable on a per-share basis as it expanded.

3. TBVPS Projections Show Stormy Skies Ahead

Tangible book value per share (TBVPS) growth comes from a bank’s ability to profitably lend while maintaining prudent risk management and efficient operations.

Over the next 12 months, Consensus estimates call for Seacoast Banking’s TBVPS to shrink by 1.8% to $17.51, a sour projection.

Final Judgment

We see the value of companies driving economic growth, but in the case of Seacoast Banking, we’re out. With its shares topping the market in recent months, the stock trades at 1.2× forward P/B (or $32.25 per share). This valuation tells us a lot of optimism is priced in - we think there are better opportunities elsewhere. We’d suggest looking at one of Charlie Munger’s all-time favorite businesses.

Stocks We Would Buy Instead of Seacoast Banking

If your portfolio success hinges on just 4 stocks, your wealth is built on fragile ground. You have a small window to secure high-quality assets before the market widens and these prices disappear.

Don’t wait for the next volatility shock. Check out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.