What a fantastic six months it’s been for Vita Coco. Shares of the company have skyrocketed 52.4%, setting a new 52-week high of $55. This was partly due to its solid quarterly results, and the run-up might have investors contemplating their next move.

Is now still a good time to buy COCO? Or are investors being too optimistic? Find out in our full research report, it’s free for active Edge members.

Why Does Vita Coco Spark Debate?

Founded in 2004 followed by a 2021 IPO, The Vita Coco Company (NASDAQ: COCO) offers coconut water products that are a natural way to quench thirst.

Two Things to Like:

1. Elevated Demand Drives Higher Sales Volumes

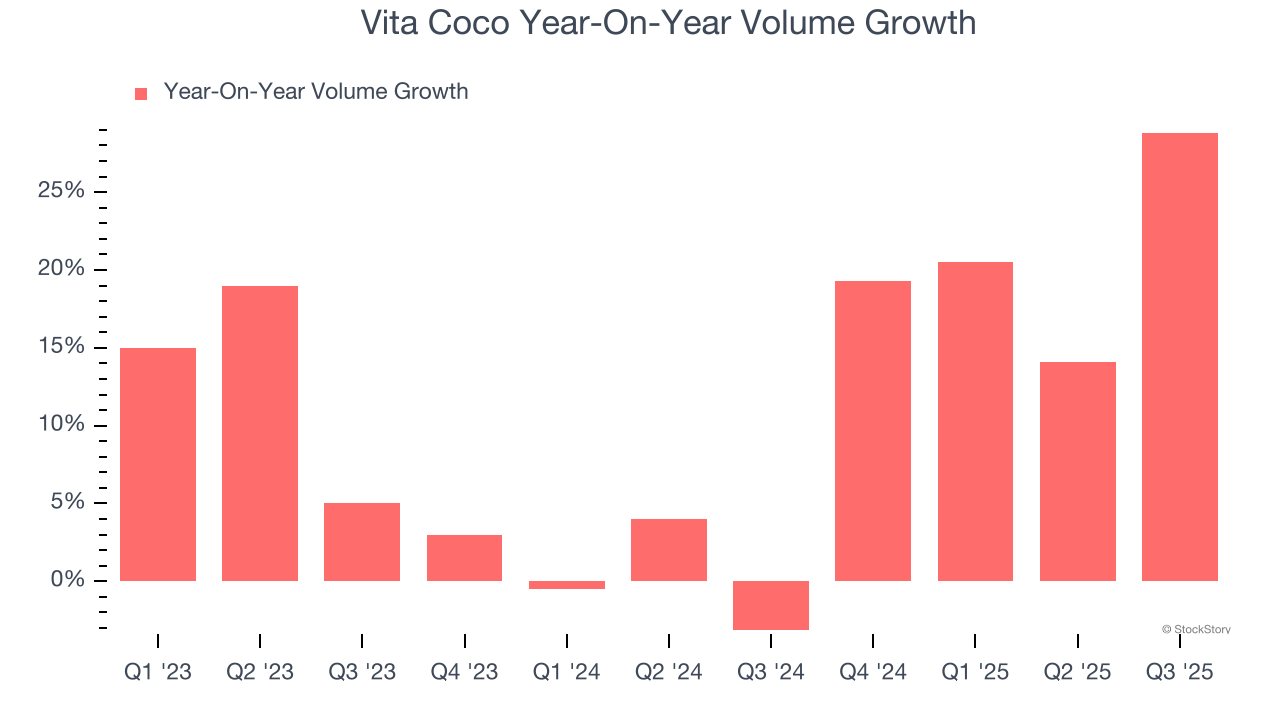

Revenue growth can be broken down into changes in price and volume (the number of units sold). While both are important, volume is the lifeblood of a successful staples business as there’s a ceiling to what consumers will pay for everyday goods; they can always trade down to non-branded products if the branded versions are too expensive.

Vita Coco’s average quarterly volume growth of 10.8% over the last two years has beaten the competition by a long shot. This is great because companies with significant volume growth are needles in a haystack in the stable consumer staples sector.

2. Outstanding Long-Term EPS Growth

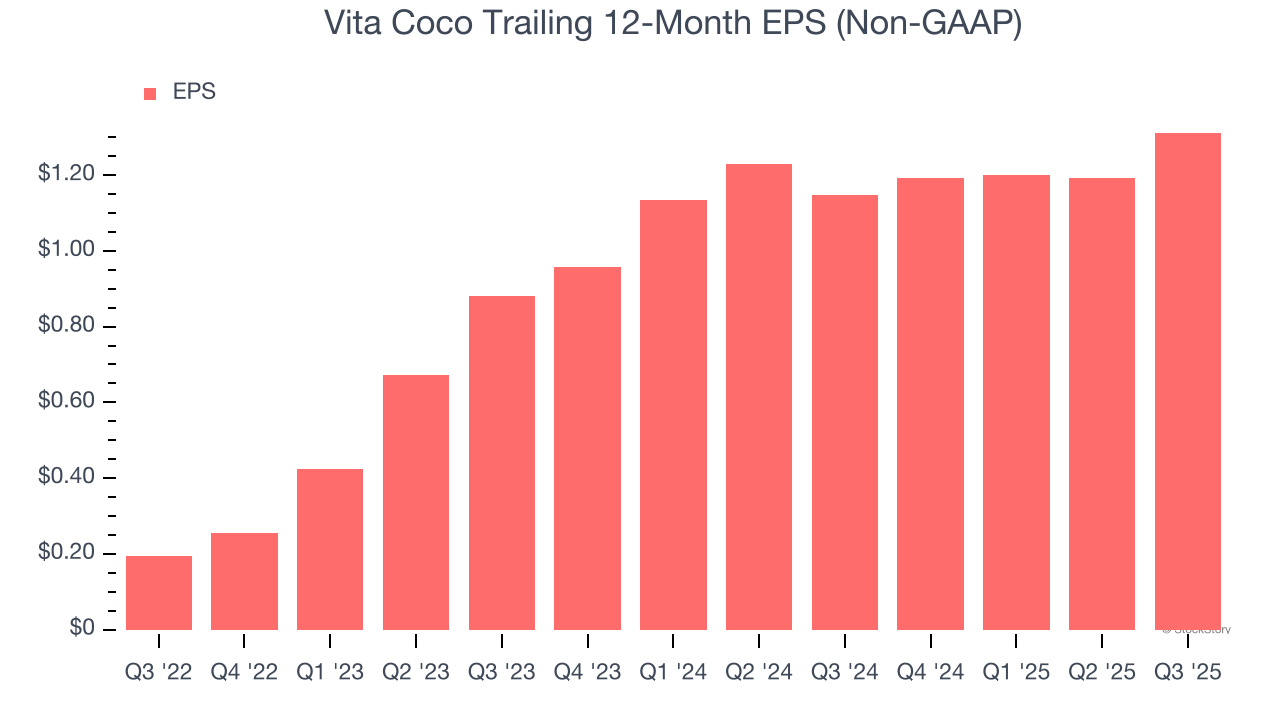

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Vita Coco’s EPS grew at an astounding 89.3% compounded annual growth rate over the last three years, higher than its 13% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

One Reason to be Careful:

Fewer Distribution Channels Limit its Ceiling

With $609.3 million in revenue over the past 12 months, Vita Coco is a small consumer staples company, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and negotiating leverage with retailers. On the bright side, it can grow faster because it has a longer list of untapped store chains to sell into.

Final Judgment

Vita Coco’s positive characteristics outweigh the negatives, and after the recent surge, the stock trades at 36.9× forward P/E (or $55 per share). Is now a good time to buy despite the apparent froth? See for yourself in our full research report, it’s free for active Edge members.

High-Quality Stocks for All Market Conditions

The market’s up big this year - but there’s a catch. Just 4 stocks account for half the S&P 500’s entire gain. That kind of concentration makes investors nervous, and for good reason. While everyone piles into the same crowded names, smart investors are hunting quality where no one’s looking - and paying a fraction of the price. Check out the high-quality names we’ve flagged in our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.