Cloud monitoring software company Datadog (NASDAQ: DDOG) reported Q4 CY2024 results exceeding the market’s revenue expectations, with sales up 25.1% year on year to $737.7 million. The company expects next quarter’s revenue to be around $739 million, close to analysts’ estimates. Its non-GAAP profit of $0.49 per share was 13.3% above analysts’ consensus estimates.

Is now the time to buy Datadog? Find out by accessing our full research report, it’s free.

Datadog (DDOG) Q4 CY2024 Highlights:

- Revenue: $737.7 million vs analyst estimates of $715.2 million (25.1% year-on-year growth, 3.2% beat)

- Adjusted EPS: $0.49 vs analyst estimates of $0.43 (13.3% beat)

- Adjusted Operating Income: $179.2 million vs analyst estimates of $166.2 million (24.3% margin, 7.8% beat)

- Management’s revenue guidance for the upcoming financial year 2025 is $3.19 billion at the midpoint, missing analyst estimates by 1.7% and implying 18.7% growth (vs 26.2% in FY2024)

- Adjusted EPS guidance for the upcoming financial year 2025 is $1.65 at the midpoint, missing analyst estimates by 16.8%

- Operating Margin: 1.3%, down from 4.7% in the same quarter last year

- Free Cash Flow Margin: 32.7%, up from 29.5% in the previous quarter

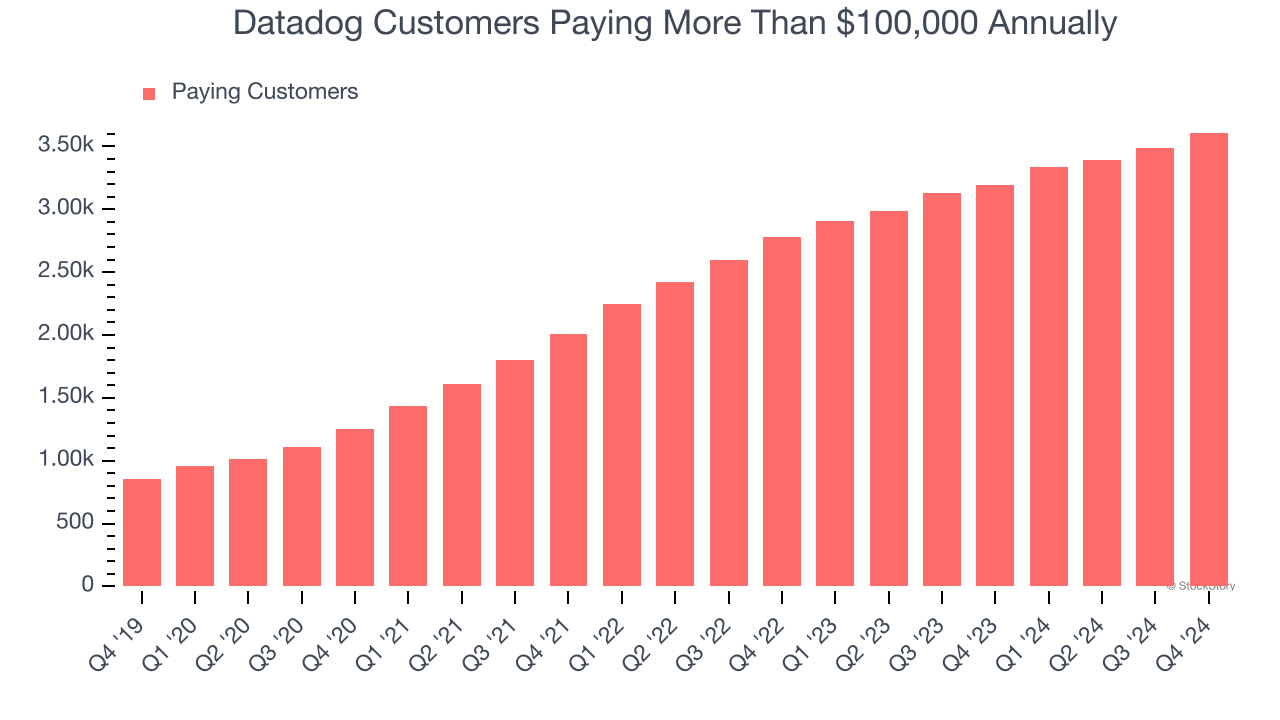

- Customers: 3,610 customers paying more than $100,000 annually

- Market Capitalization: $50.31 billion

Company Overview

Named after a database the founders had to painstakingly look after at their previous company, Datadog (NASDAQ: DDOG) is a software-as-a-service platform that makes it easier to monitor cloud infrastructure and applications.

Cloud Monitoring

Software is eating the world, increasing organizations’ reliance on digital-only solutions. As more workloads and applications move to the cloud, the reliability of the underlying cloud infrastructure becomes ever more critical and ever more complex. To solve this challenge, companies and their engineering teams have turned to a range of cloud monitoring tools that provide them with the visibility to troubleshoot issues in real-time.

Sales Growth

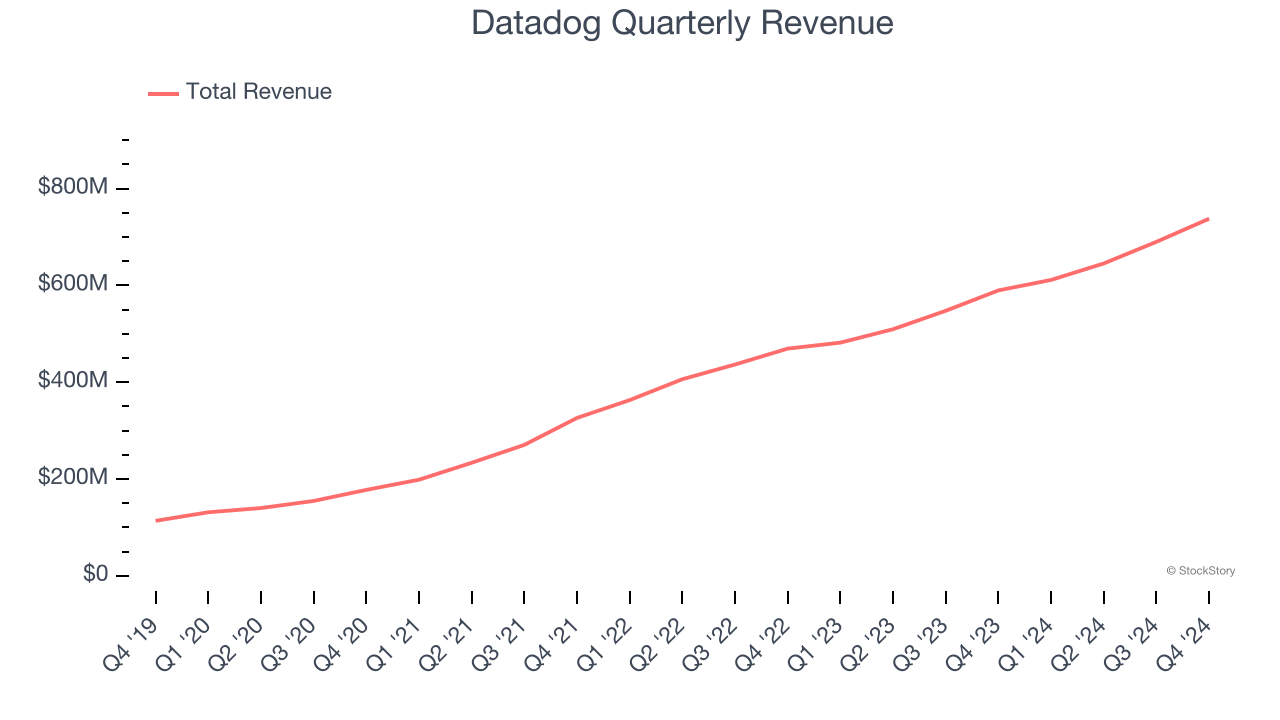

A company’s long-term performance is an indicator of its overall quality. While any business can experience short-term success, top-performing ones enjoy sustained growth for years. Luckily, Datadog’s sales grew at an exceptional 37.7% compounded annual growth rate over the last three years. Its growth surpassed the average software company and shows its offerings resonate with customers, a great starting point for our analysis.

This quarter, Datadog reported robust year-on-year revenue growth of 25.1%, and its $737.7 million of revenue topped Wall Street estimates by 3.2%. Company management is currently guiding for a 20.9% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 20.4% over the next 12 months, a deceleration versus the last three years. Still, this projection is noteworthy and suggests the market is factoring in success for its products and services.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

Enterprise Customer Base

This quarter, Datadog reported 3,610 enterprise customers paying more than $100,000 annually, an increase of 120 from the previous quarter. That’s quite a bit more contract wins than last quarter but also quite a bit below what we’ve observed over the previous year. This indicates the company is optimizing its go-to-market strategy to reinvigorate growth.

Key Takeaways from Datadog’s Q4 Results

It was encouraging to see Datadog beat analysts’ revenue and operating profit expectations this quarter. We were also glad it had many new large contract wins. On the other hand, its full-year revenue and EPS guidance both fell short of Wall Street’s estimates. Overall, this quarter could have been better, and the guidance is weighing on shares. The stock traded down 7.2% to $137.50 immediately after reporting.

Datadog’s latest earnings report disappointed. One quarter doesn’t define a company’s quality, so let’s explore whether the stock is a buy at the current price. If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.