Since September 2024, Caterpillar has been in a holding pattern, floating around $340.30.

Is now the time to buy CAT? Find out in our full research report, it’s free.

Why Does CAT Stock Spark Debate?

With its iconic yellow machinery working on construction sites, Caterpillar (NYSE: CAT) manufactures construction equipment like bulldozers, excavators, and parts and maintenance services.

Two Things to Like:

1. Outstanding Long-Term EPS Growth

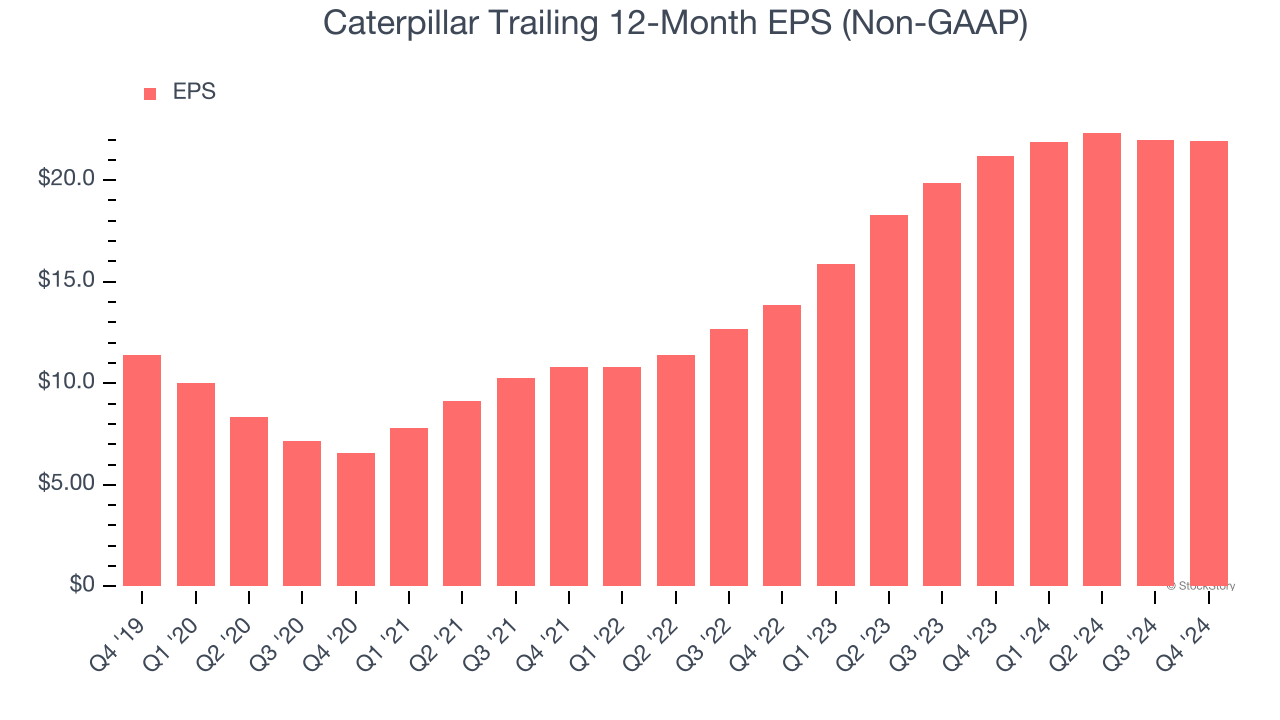

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

Caterpillar’s EPS grew at a remarkable 14% compounded annual growth rate over the last five years, higher than its 3.8% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

2. New Investments Bear Fruit as ROIC Jumps

ROIC, or return on invested capital, is a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Fortunately, Caterpillar’s ROIC has increased significantly over the last few years. This is a great sign when paired with its already strong returns. It could suggest its competitive advantage or profitable growth opportunities are expanding.

One Reason to be Careful:

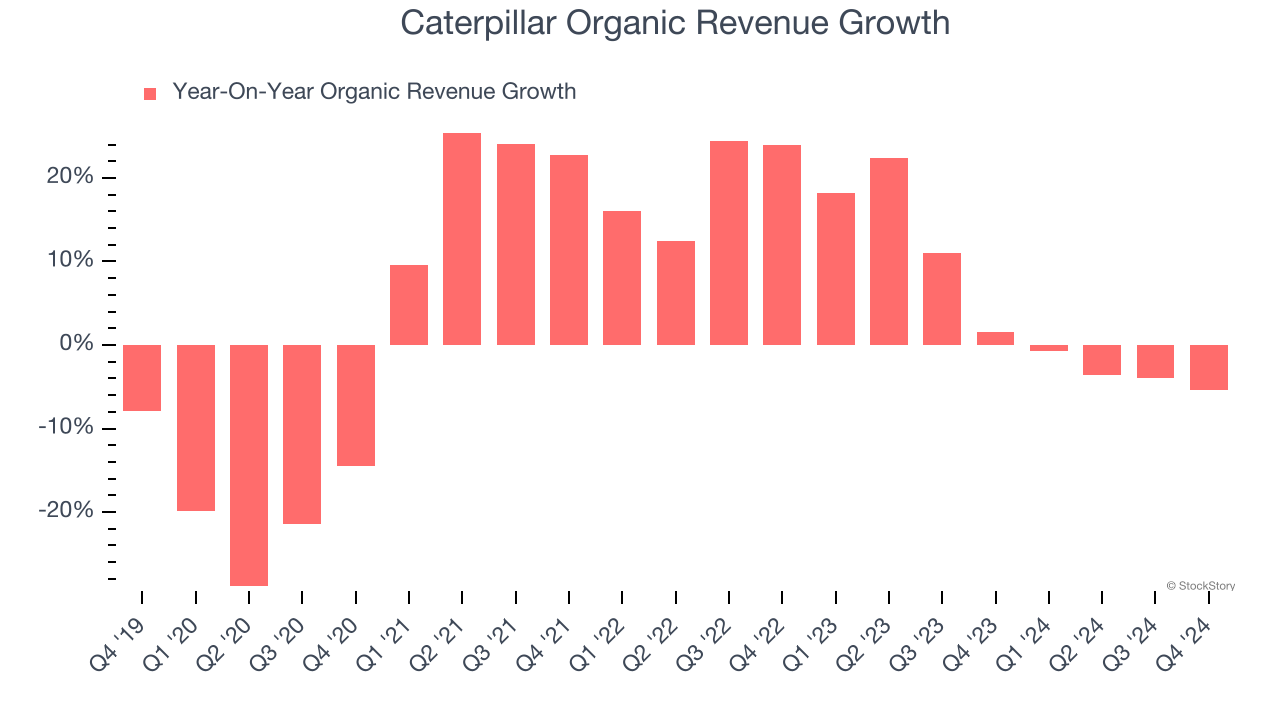

Slow Organic Growth Suggests Waning Demand In Core Business

In addition to reported revenue, organic revenue is a useful data point for analyzing Construction Machinery companies. This metric gives visibility into Caterpillar’s core business because it excludes one-time events such as mergers, acquisitions, and divestitures along with foreign currency fluctuations - non-fundamental factors that can manipulate the income statement.

Over the last two years, Caterpillar’s organic revenue averaged 5% year-on-year growth. This performance was underwhelming and suggests it may need to improve its products, pricing, or go-to-market strategy, which can add an extra layer of complexity to its operations.

Final Judgment

Caterpillar’s positive characteristics outweigh the negatives, but at $340.30 per share (or 15.6× forward price-to-earnings), is now the time to initiate a position? See for yourself in our in-depth research report, it’s free.

Stocks We Like Even More Than Caterpillar

With rates dropping, inflation stabilizing, and the elections in the rearview mirror, all signs point to the start of a new bull run - and we’re laser-focused on finding the best stocks for this upcoming cycle.

Put yourself in the driver’s seat by checking out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Sterling Infrastructure (+1,096% five-year return). Find your next big winner with StockStory today for free.