Since March 2020, the S&P 500 has delivered a total return of 126%. But one standout stock has nearly doubled the market - over the past five years, GE Aerospace has surged 232% to $191.86 per share. Its momentum hasn’t stopped as it’s also gained 13.1% in the last six months thanks to its solid quarterly results, beating the S&P by 12.9%.

Is now still a good time to buy GE? Or are investors being too optimistic? Find out in our full research report, it’s free.

Why Does GE Aerospace Spark Debate?

One of the original 12 companies on the Dow Jones Industrial Average, General Electric (NYSE: GE) is a multinational conglomerate providing technologies for various sectors including aviation, power, renewable energy, and healthcare.

Two Things to Like:

1. Skyrocketing Revenue Shows Strong Momentum

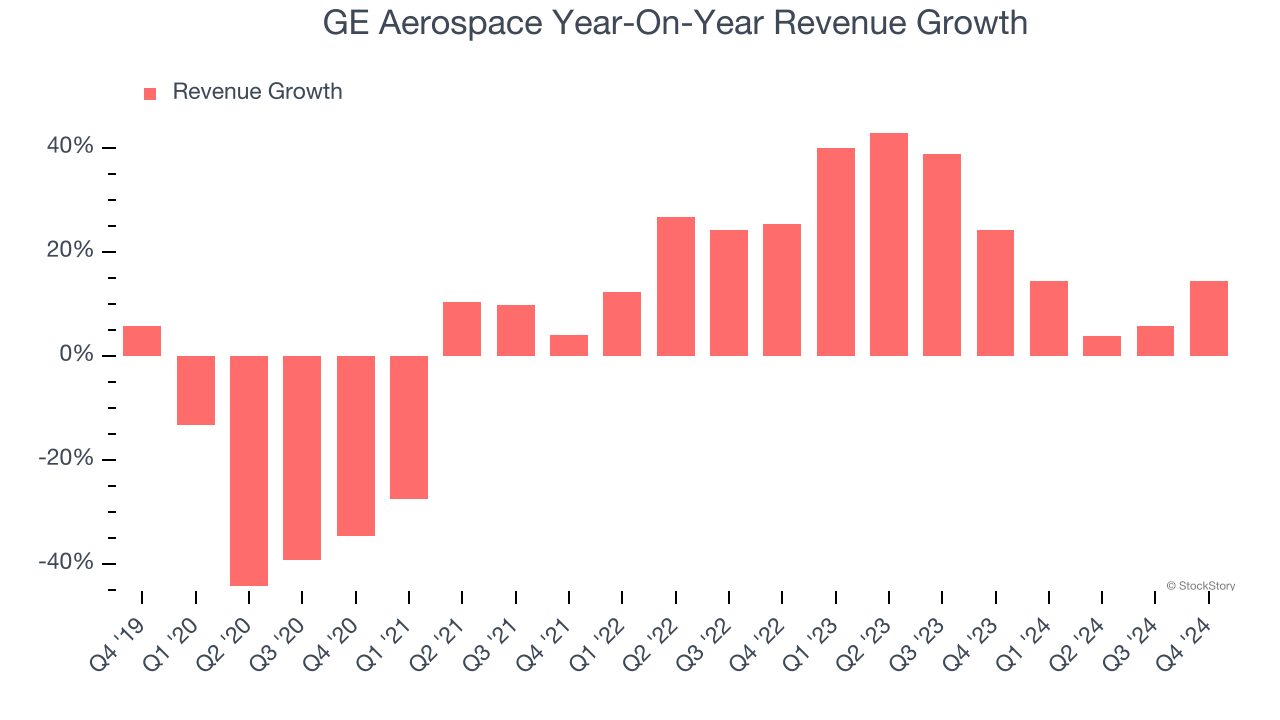

Long-term growth is the most important, but within industrials, a stretched historical view may miss new industry trends or demand cycles. GE Aerospace’s annualized revenue growth of 21.9% over the last two years is above its five-year trend, suggesting its demand recently accelerated.

2. Increasing Free Cash Flow Margin Juices Financials

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

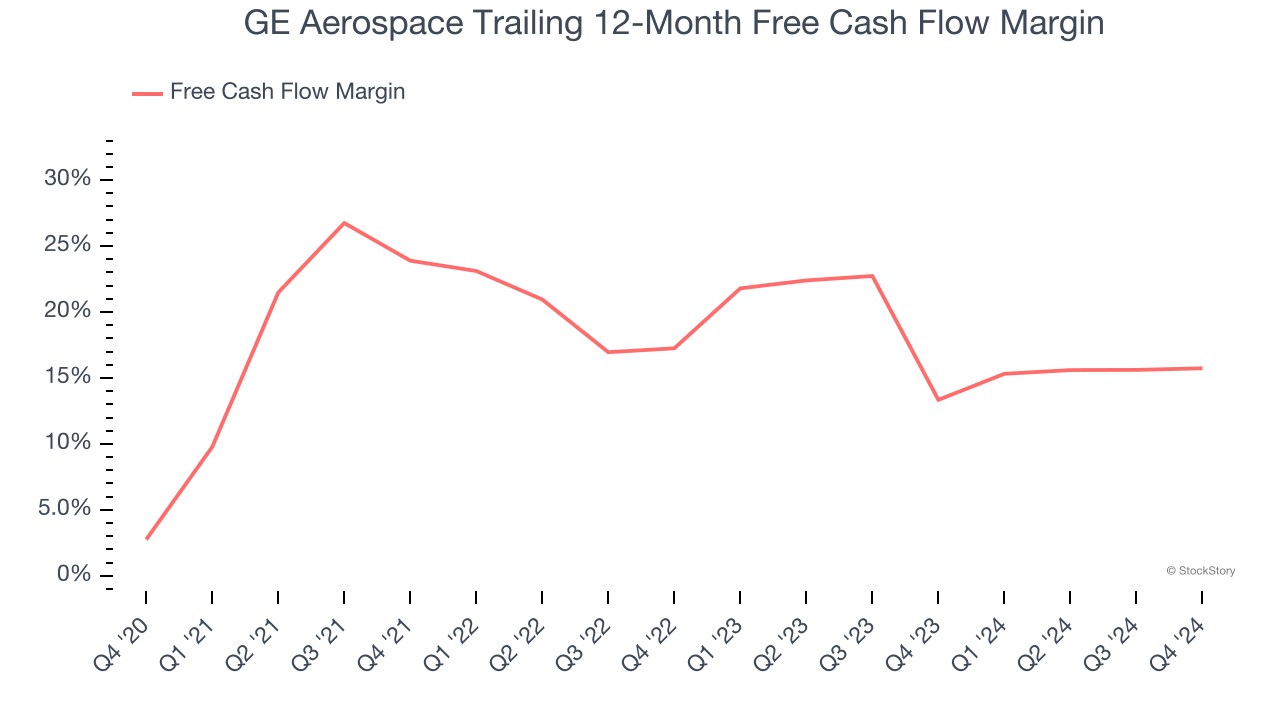

As you can see below, GE Aerospace’s margin expanded by 13 percentage points over the last five years. This is encouraging, and we can see it became a less capital-intensive business because its free cash flow profitability rose more than its operating profitability. GE Aerospace’s free cash flow margin for the trailing 12 months was 15.7%.

One Reason to be Careful:

Slow Organic Growth Suggests Waning Demand In Core Business

In addition to reported revenue, organic revenue is a useful data point for analyzing General Industrial Machinery companies. This metric gives visibility into GE Aerospace’s core business because it excludes one-time events such as mergers, acquisitions, and divestitures along with foreign currency fluctuations - non-fundamental factors that can manipulate the income statement.

Over the last two years, GE Aerospace’s organic revenue averaged 7% year-on-year growth. This performance slightly lagged the sector and suggests it may need to improve its products, pricing, or go-to-market strategy, which can add an extra layer of complexity to its operations.

Final Judgment

GE Aerospace has huge potential even though it has some open questions, and with its shares topping the market in recent months, the stock trades at 36.5× forward price-to-earnings (or $191.86 per share). Is now a good time to buy? See for yourself in our full research report, it’s free.

Stocks We Like Even More Than GE Aerospace

The elections are now behind us. With rates dropping and inflation cooling, many analysts expect a breakout market - and we’re zeroing in on the stocks that could benefit immensely.

Take advantage of the rebound by checking out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Comfort Systems (+751% five-year return). Find your next big winner with StockStory today for free.