Facility services provider ABM Industries (NYSE: ABM) met Wall Street’s revenue expectations in Q4 CY2024, with sales up 2.2% year on year to $2.11 billion. Its non-GAAP profit of $0.87 per share was 11.4% above analysts’ consensus estimates.

Is now the time to buy ABM? Find out by accessing our full research report, it’s free.

ABM (ABM) Q4 CY2024 Highlights:

- Revenue: $2.11 billion vs analyst estimates of $2.12 billion (2.2% year-on-year growth, in line)

- Adjusted EPS: $0.87 vs analyst estimates of $0.78 (11.4% beat)

- Adjusted EBITDA: $120.6 million vs analyst estimates of $115.2 million (5.7% margin, 4.7% beat)

- Management slightly raised its full-year Adjusted EPS guidance to $3.72 at the midpoint

- Operating Margin: 3.7%, in line with the same quarter last year

- Free Cash Flow was -$122.9 million compared to -$13.7 million in the same quarter last year

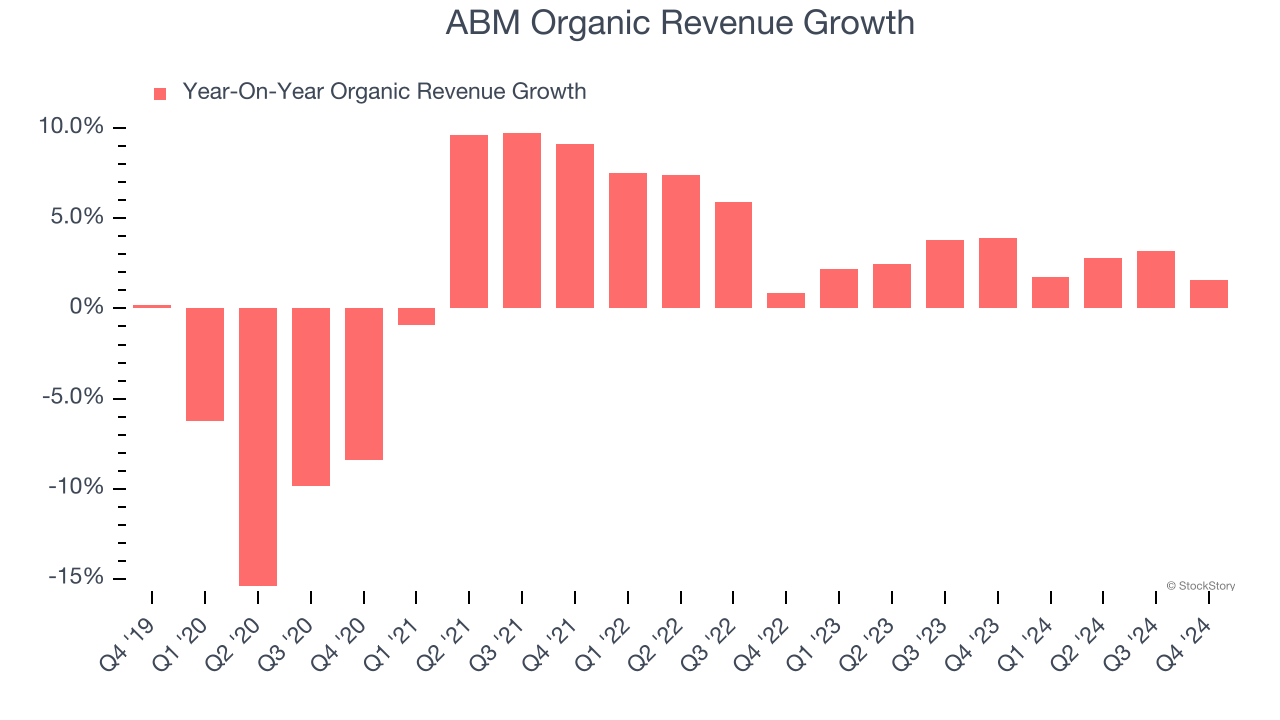

- Organic Revenue rose 1.6% year on year (3.9% in the same quarter last year)

- Market Capitalization: $3.1 billion

“ABM’s first quarter performance reflects a continuation of the key trends we saw in 2024, including strong momentum in Technical Solutions and Aviation, as well as stable conditions in the Education sector. We also delivered solid results in Business & Industry (“B&I”) and Manufacturing & Distribution (“M&D”), despite some moderating headwinds.

Company Overview

Founded over a century ago in 1909 and evolving from a window cleaning company into a comprehensive service provider, ABM Industries (NYSE: ABM) provides integrated facility services, infrastructure solutions, and mobility services across various industries.

Industrial & Environmental Services

Growing regulatory pressure on environmental compliance and increasing corporate ESG commitments should buoy the sector for years to come. On the other hand, environmental regulations continue to evolve, and this may require costly upgrades, volatility in commodity waste and recycling markets, and labor shortages in industrial services. As for digitization, a theme that is impacting nearly every industry, the increasing use of data, analytics, and automation will give rise to improved efficiency of operations. Conversely, though, the benefits of digitization also come with challenges of integrating new technologies into legacy systems.

Sales Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul.

With $8.40 billion in revenue over the past 12 months, ABM is one of the larger companies in the business services industry and benefits from a well-known brand that influences purchasing decisions.

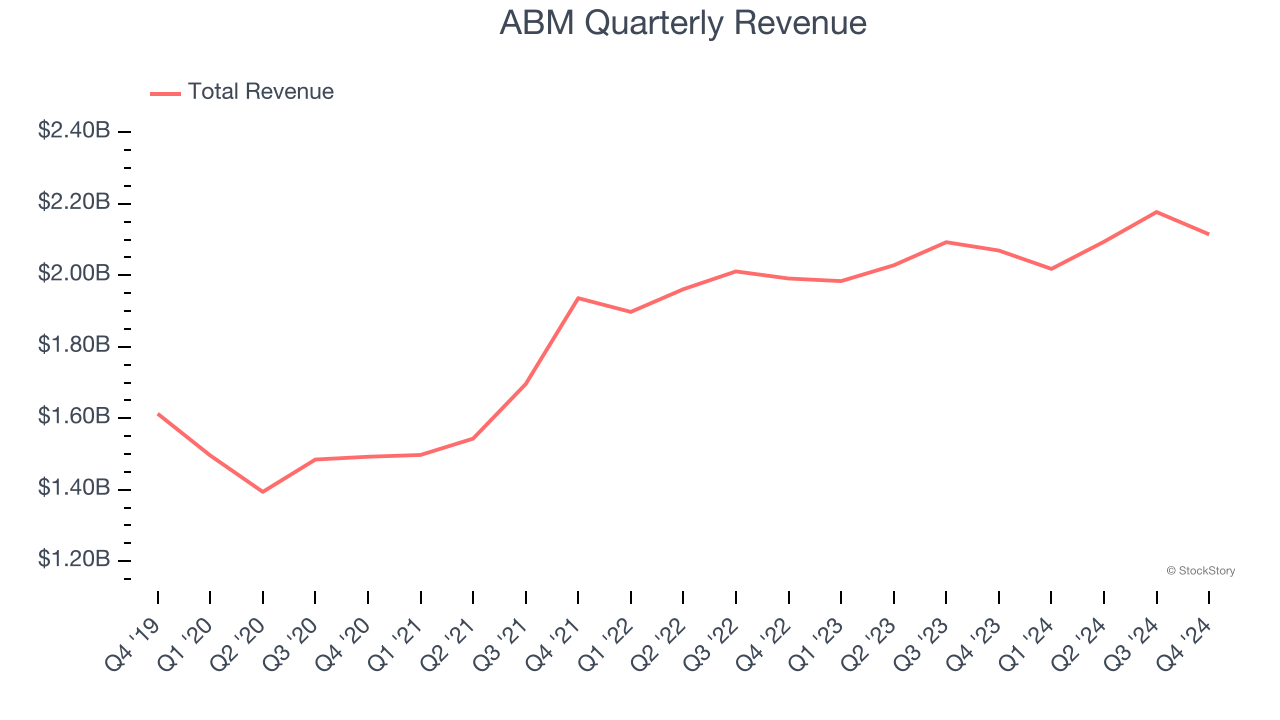

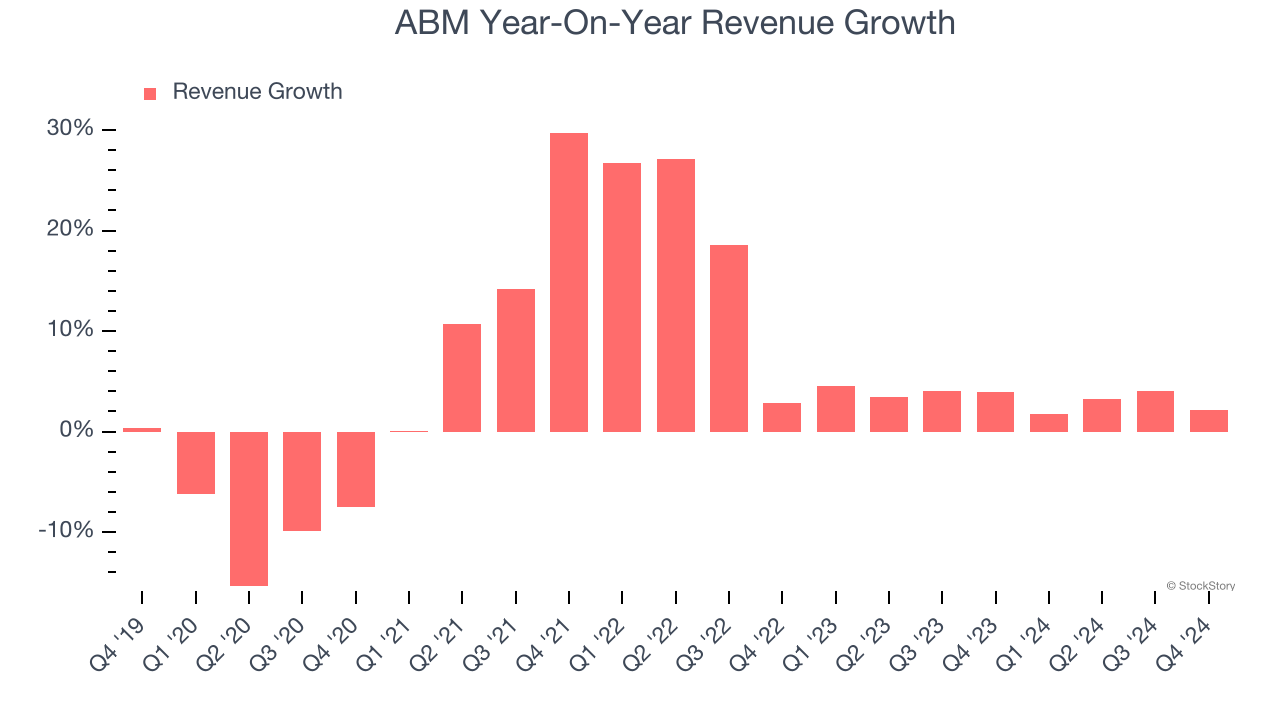

As you can see below, ABM grew its sales at a decent 5.3% compounded annual growth rate over the last five years. This shows its offerings generated slightly more demand than the average business services company, a useful starting point for our analysis.

Long-term growth is the most important, but within business services, a half-decade historical view may miss new innovations or demand cycles. ABM’s recent history shows its demand has slowed as its annualized revenue growth of 3.4% over the last two years was below its five-year trend.

We can dig further into the company’s sales dynamics by analyzing its organic revenue, which strips out one-time events like acquisitions and currency fluctuations that don’t accurately reflect its fundamentals. Over the last two years, ABM’s organic revenue averaged 2.7% year-on-year growth. Because this number aligns with its normal revenue growth, we can see the company’s core operations (not acquisitions and divestitures) drove most of its results.

This quarter, ABM grew its revenue by 2.2% year on year, and its $2.11 billion of revenue was in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 2.6% over the next 12 months, similar to its two-year rate. This projection is underwhelming and implies its newer products and services will not catalyze better top-line performance yet.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

Operating Margin

Operating margin is one of the best measures of profitability because it tells us how much money a company takes home after subtracting all core expenses, like marketing and R&D.

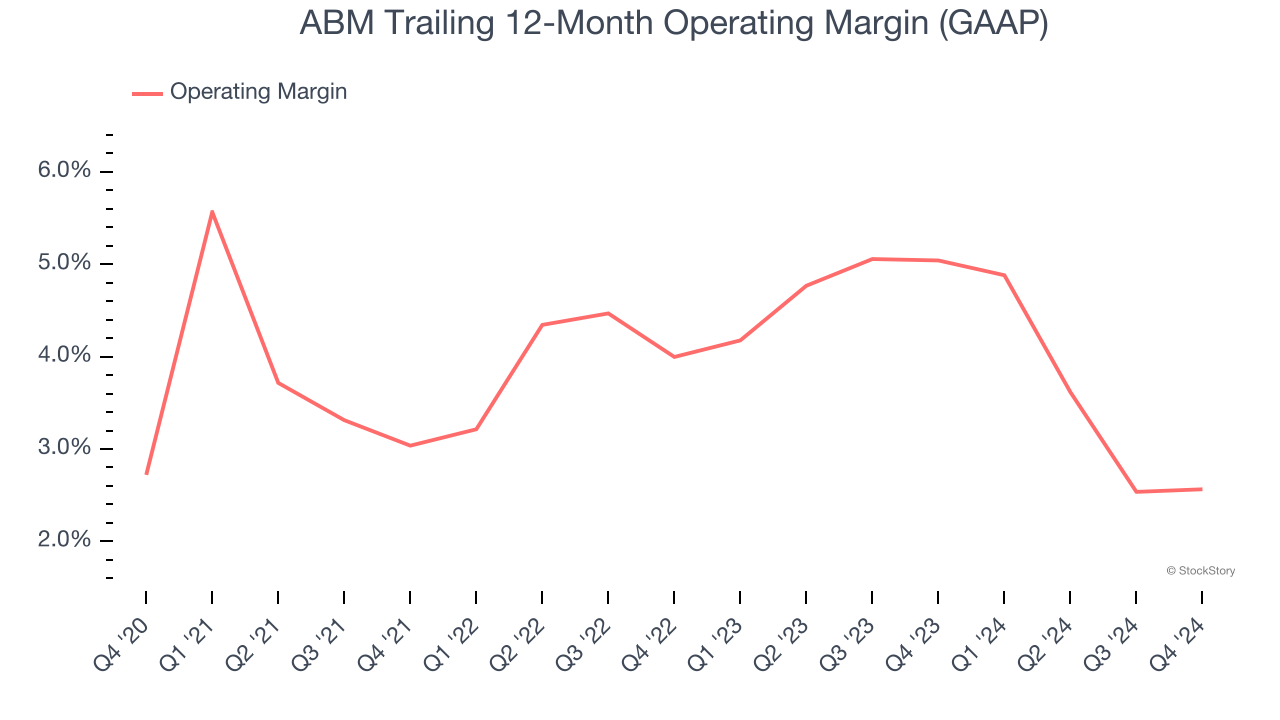

ABM was profitable over the last five years but held back by its large cost base. Its average operating margin of 3.5% was weak for a business services business.

Analyzing the trend in its profitability, ABM’s operating margin might fluctuated slightly but has generally stayed the same over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

In Q4, ABM generated an operating profit margin of 3.7%, in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

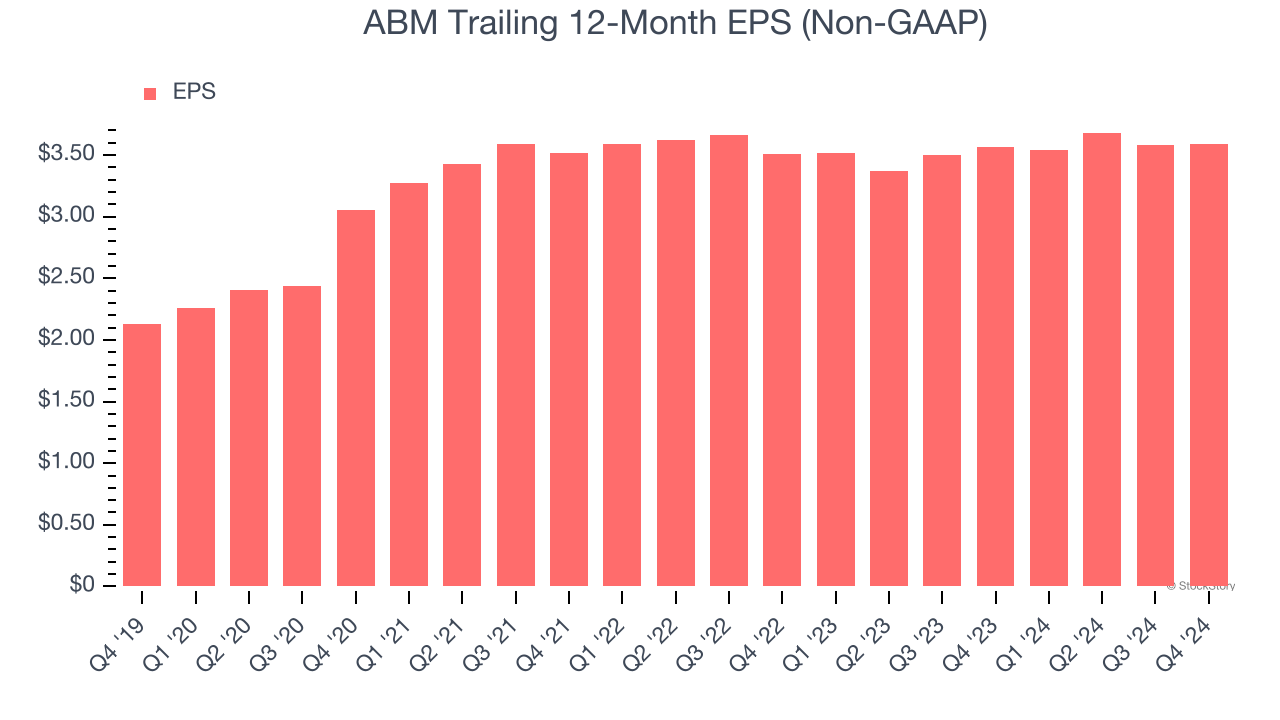

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

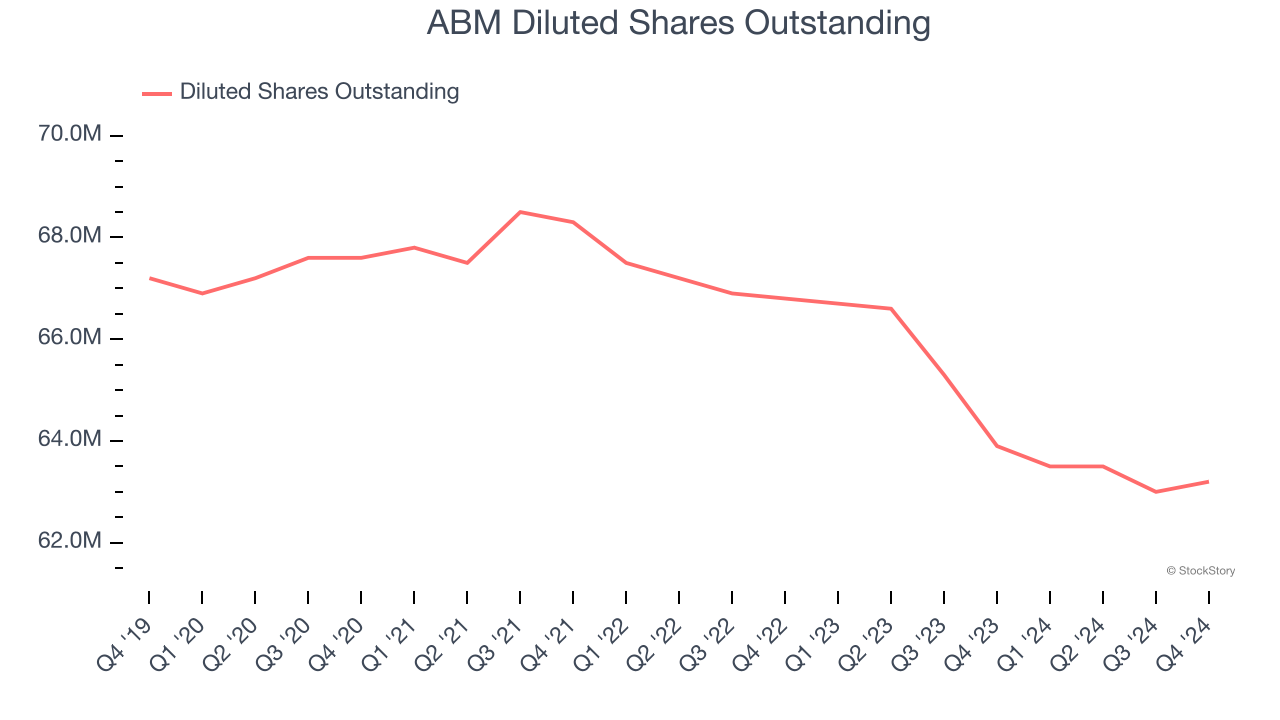

ABM’s EPS grew at a remarkable 11.1% compounded annual growth rate over the last five years, higher than its 5.3% annualized revenue growth. However, this alone doesn’t tell us much about its business quality because its operating margin didn’t expand.

We can take a deeper look into ABM’s earnings to better understand the drivers of its performance. A five-year view shows that ABM has repurchased its stock, shrinking its share count by 6%. This tells us its EPS outperformed its revenue not because of increased operational efficiency but financial engineering, as buybacks boost per share earnings.

In Q4, ABM reported EPS at $0.87, up from $0.86 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects ABM’s full-year EPS of $3.59 to grow 6.4%.

Key Takeaways from ABM’s Q4 Results

We enjoyed seeing ABM beat analysts’ EPS expectations this quarter. We were also happy its organic revenue was in line with Wall Street’s estimates. Overall, this quarter had some key positives. The market seemed to focus on the negatives, and the stock traded down 2% to $48.80 immediately following the results.

Big picture, is ABM a buy here and now? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.