McKesson currently trades at $660.88 and has been a dream stock for shareholders. It’s returned 402% since March 2020, more than tripling the S&P 500’s 118% gain. The company has also beaten the index over the past six months as its stock price is up 38%.

Is now still a good time to buy MCK? Or are investors being too optimistic? Find out in our full research report, it’s free.

Why Are We Positive On MCK?

With roots dating back to 1833, making it one of America's oldest continuously operating businesses, McKesson (NYSE: MCK) is a healthcare services company that distributes pharmaceuticals, medical supplies, and provides technology solutions to pharmacies, hospitals, and healthcare providers.

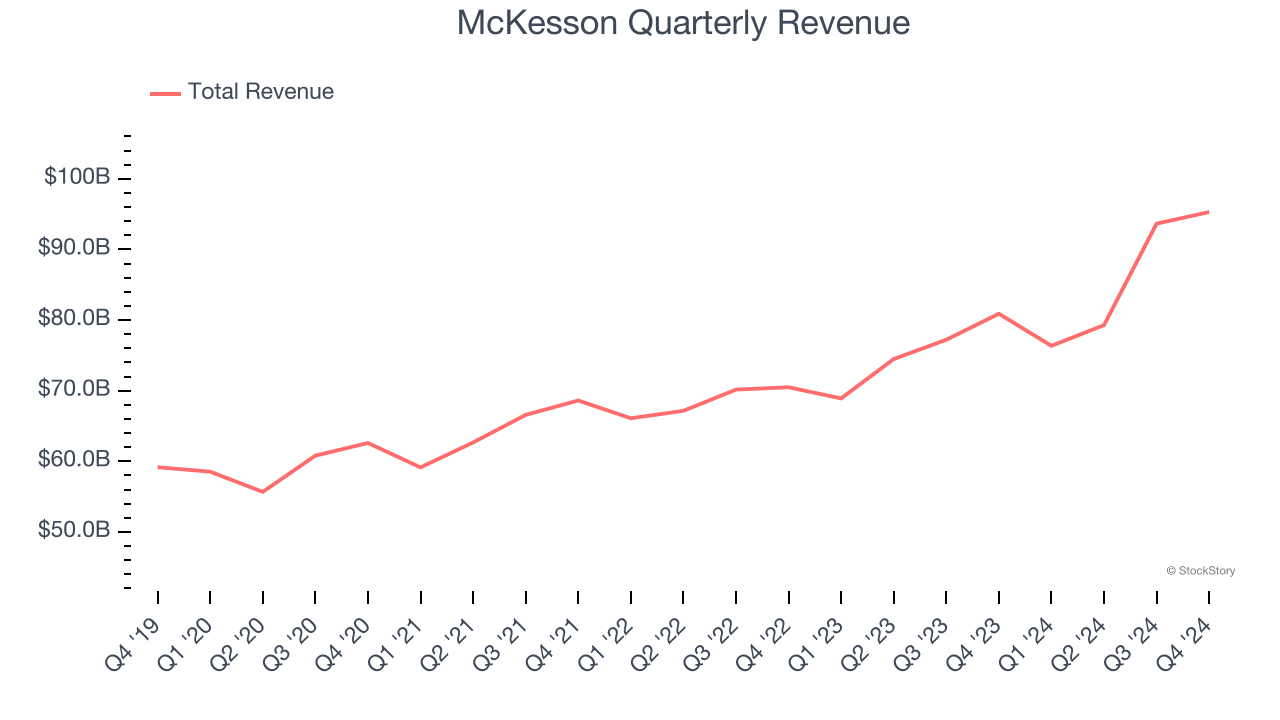

1. Long-Term Revenue Growth Shows Momentum

Examining a company’s long-term performance can provide clues about its quality. Any business can have short-term success, but a top-tier one grows for years. Thankfully, McKesson’s 8.9% annualized revenue growth over the last five years was decent. Its growth was slightly above the average healthcare company and shows its offerings resonate with customers.

2. Economies of Scale Give It Negotiating Leverage with Suppliers

With $344.6 billion in revenue over the past 12 months, McKesson is a behemoth in the healthcare sector and benefits from economies of scale, giving it an edge in distribution. This also enables it to gain more leverage on its fixed costs than smaller competitors and the flexibility to offer lower prices.

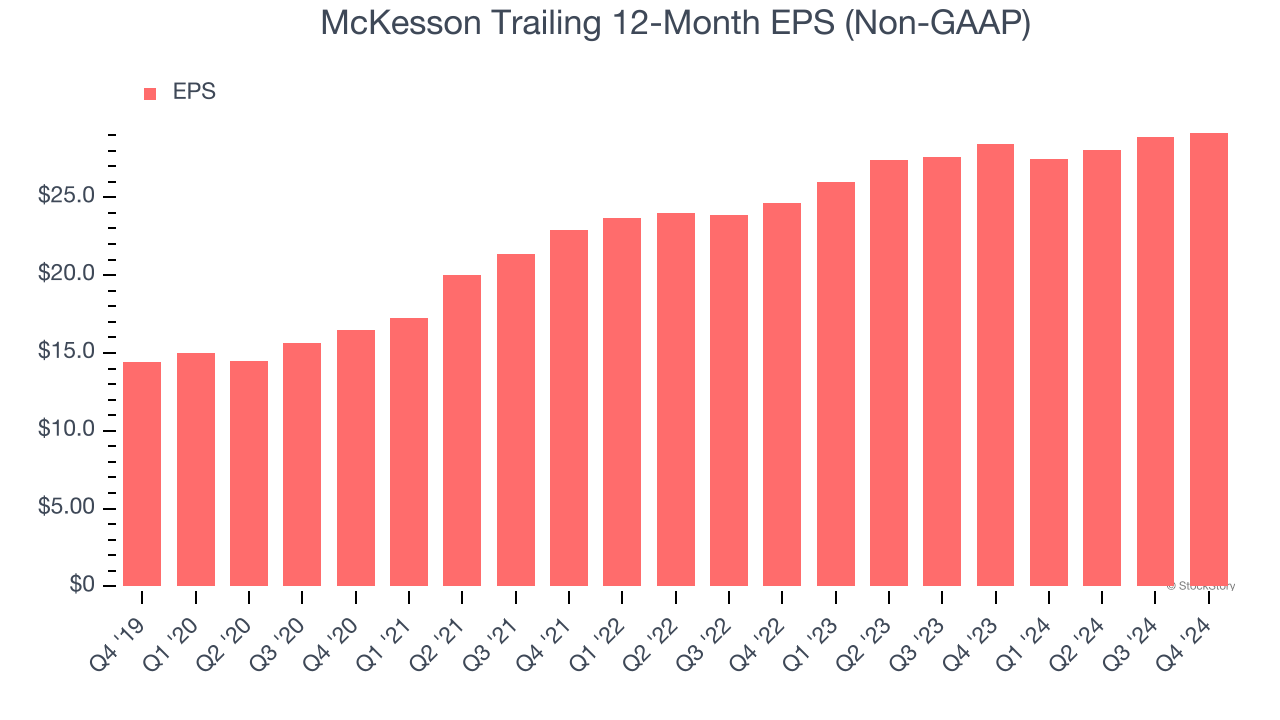

3. Outstanding Long-Term EPS Growth

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

McKesson’s EPS grew at an astounding 15.1% compounded annual growth rate over the last five years, higher than its 8.9% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

Final Judgment

These are just a few reasons why we think McKesson is a great business, and with its shares outperforming the market lately, the stock trades at 18.2× forward price-to-earnings (or $660.88 per share). Is now a good time to buy? See for yourself in our in-depth research report, it’s free.

Stocks We Like Even More Than McKesson

With rates dropping, inflation stabilizing, and the elections in the rearview mirror, all signs point to the start of a new bull run - and we’re laser-focused on finding the best stocks for this upcoming cycle.

Put yourself in the driver’s seat by checking out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Sterling Infrastructure (+1,096% five-year return). Find your next big winner with StockStory today for free.