The end of the earnings season is always a good time to take a step back and see who shined (and who not so much). Let’s take a look at how traditional fast food stocks fared in Q4, starting with Yum China (NYSE: YUMC).

Traditional fast-food restaurants are renowned for their speed and convenience, boasting menus filled with familiar and budget-friendly items. Their reputations for on-the-go consumption make them favored destinations for individuals and families needing a quick meal. This class of restaurants, however, is fighting the perception that their meals are unhealthy and made with inferior ingredients, a battle that's especially relevant today given the consumers increasing focus on health and wellness.

The 14 traditional fast food stocks we track reported a satisfactory Q4. As a group, revenues were in line with analysts’ consensus estimates.

While some traditional fast food stocks have fared somewhat better than others, they have collectively declined. On average, share prices are down 1.8% since the latest earnings results.

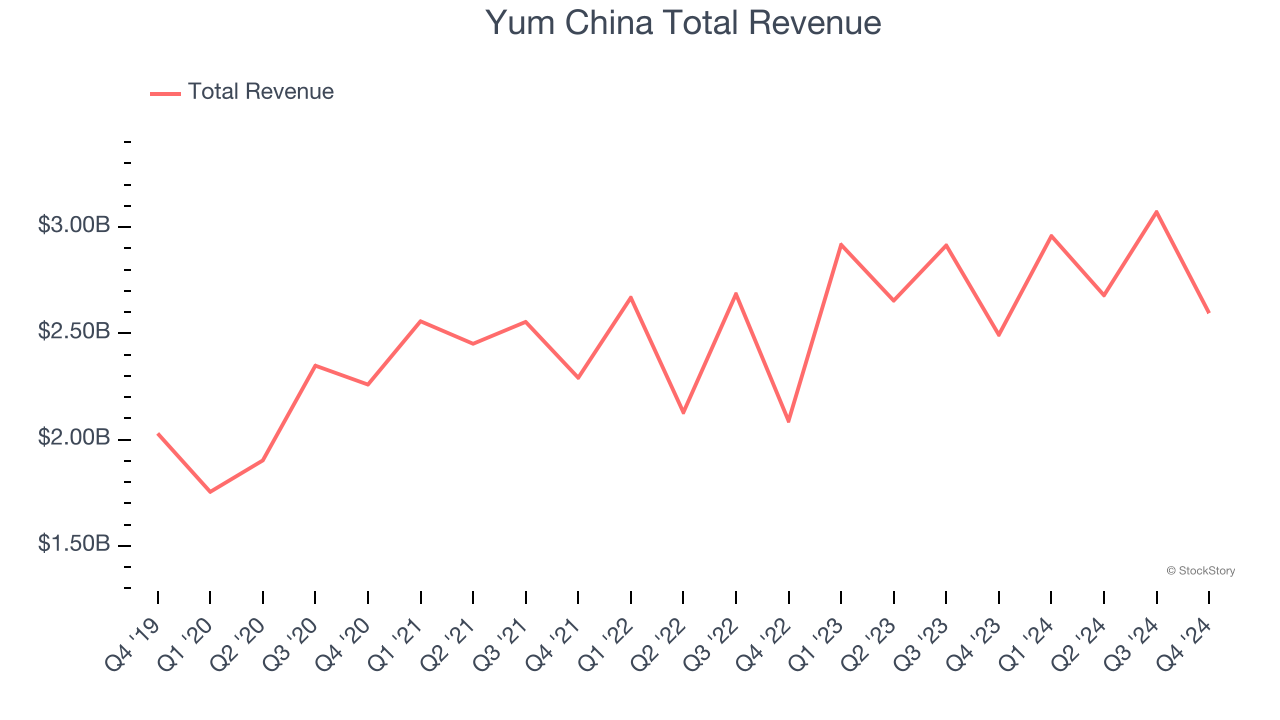

Yum China (NYSE: YUMC)

One of China’s largest restaurant companies, Yum China (NYSE: YUMC) is an independent entity spun off from Yum! Brands in 2016.

Yum China reported revenues of $2.60 billion, up 4.1% year on year. This print fell short of analysts’ expectations by 1.7%. Overall, it was a softer quarter for the company with a significant miss of analysts’ EBITDA estimates and same-store sales in line with analysts’ estimates.

Joey Wat, CEO of Yum China, commented, "We closed the year with a strong fourth quarter, propelling us to a number of record highs in 2024. In the fourth quarter, our system sales growth surpassed the restaurant industry's growth rate. Our same-store sales index improved sequentially to 99% of prior year levels, driven by the eighth consecutive quarter of same-store transaction growth. OP margin expanded by 140 basis points, and restaurant margin increased by 160 basis points, both on a year-over-year basis. We have steadily improved our metrics since the second quarter, with improvement in same-store sales index, margins, and operating profit growth each quarter. These results demonstrate the resilience of our business and the effectiveness of our strategy in improving sales and profitability amid challenging market conditions."

The stock is up 13.5% since reporting and currently trades at $51.66.

Read our full report on Yum China here, it’s free.

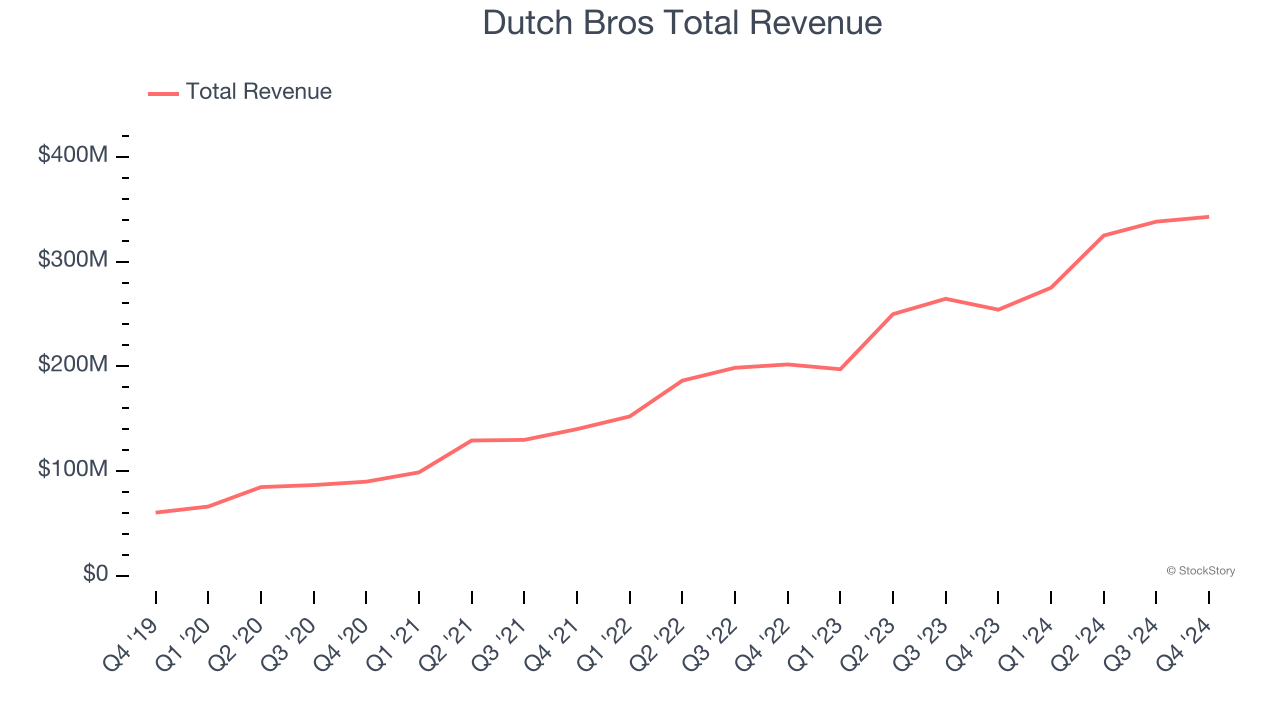

Best Q4: Dutch Bros (NYSE: BROS)

Started in 1992 by two brothers as a single pushcart, Dutch Bros (NYSE: BROS) is a dynamic coffee chain that’s captured the hearts of coffee enthusiasts across the United States.

Dutch Bros reported revenues of $342.8 million, up 34.9% year on year, outperforming analysts’ expectations by 7.6%. The business had an exceptional quarter with an impressive beat of analysts’ EPS estimates and a solid beat of analysts’ EBITDA estimates.

Dutch Bros pulled off the biggest analyst estimates beat, fastest revenue growth, and highest full-year guidance raise among its peers. The market seems happy with the results as the stock is up 9.5% since reporting. It currently trades at $70.90.

Is now the time to buy Dutch Bros? Access our full analysis of the earnings results here, it’s free.

Weakest Q4: Krispy Kreme (NASDAQ: DNUT)

Famous for its Original Glazed doughnuts and parent company of Insomnia Cookies, Krispy Kreme (NASDAQ: DNUT) is one of the most beloved and well-known fast-food chains in the world.

Krispy Kreme reported revenues of $404 million, down 10.4% year on year, falling short of analysts’ expectations by 1.7%. It was a disappointing quarter as it posted full-year revenue guidance missing analysts’ expectations.

Krispy Kreme delivered the slowest revenue growth and weakest full-year guidance update in the group. As expected, the stock is down 39.5% since the results and currently trades at $5.52.

Read our full analysis of Krispy Kreme’s results here.

McDonald's (NYSE: MCD)

With nicknames spanning Mickey D's in the U.S. to Makku in Japan, McDonald’s (NYSE: MCD) is a fast-food behemoth known for its convenience and broken ice cream machines.

McDonald's reported revenues of $6.39 billion, flat year on year. This number missed analysts’ expectations by 1.1%. Aside from that, it was a mixed quarter as it also produced a solid beat of analysts’ same-store sales estimates but a slight miss of analysts’ EPS estimates.

The stock is up 4.3% since reporting and currently trades at $306.90.

Read our full, actionable report on McDonald's here, it’s free.

Portillo's (NASDAQ: PTLO)

Begun as a Chicago hot dog stand in 1963, Portillo’s (NASDAQ: PTLO) is a casual restaurant chain that serves Chicago-style hot dogs and beef sandwiches as well as fries and shakes.

Portillo's reported revenues of $184.6 million, down 1.7% year on year. This print was in line with analysts’ expectations. It was a very strong quarter as it also produced a solid beat of analysts’ EPS estimates and an impressive beat of analysts’ EBITDA estimates.

The stock is down 8.5% since reporting and currently trades at $12.43.

Read our full, actionable report on Portillo's here, it’s free.

Want to invest in winners with rock-solid fundamentals? Check out our Hidden Gem Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.