Workforce housing company Target Hospitality (NASDAQ: TH) beat Wall Street’s revenue expectations in Q4 CY2024, but sales fell by 33.7% year on year to $83.69 million. The company’s full-year revenue guidance of $275 million at the midpoint came in 3.5% above analysts’ estimates. Its GAAP profit of $0.12 per share was 80% above analysts’ consensus estimates.

Is now the time to buy Target Hospitality? Find out by accessing our full research report, it’s free.

Target Hospitality (TH) Q4 CY2024 Highlights:

- Revenue: $83.69 million vs analyst estimates of $80.1 million (33.7% year-on-year decline, 4.5% beat)

- EPS (GAAP): $0.12 vs analyst estimates of $0.07 (80% beat)

- Adjusted EBITDA: $41.15 million vs analyst estimates of $33.07 million (49.2% margin, 24.4% beat)

- Management’s revenue guidance for the upcoming financial year 2025 is $275 million at the midpoint, beating analyst estimates by 3.5% and implying -28.8% growth (vs -31.5% in FY2024)

- EBITDA guidance for the upcoming financial year 2025 is $52 million at the midpoint, below analyst estimates of $78.27 million

- Operating Margin: 24.9%, down from 36.6% in the same quarter last year

- Free Cash Flow Margin: 29.4%, up from 24.7% in the same quarter last year

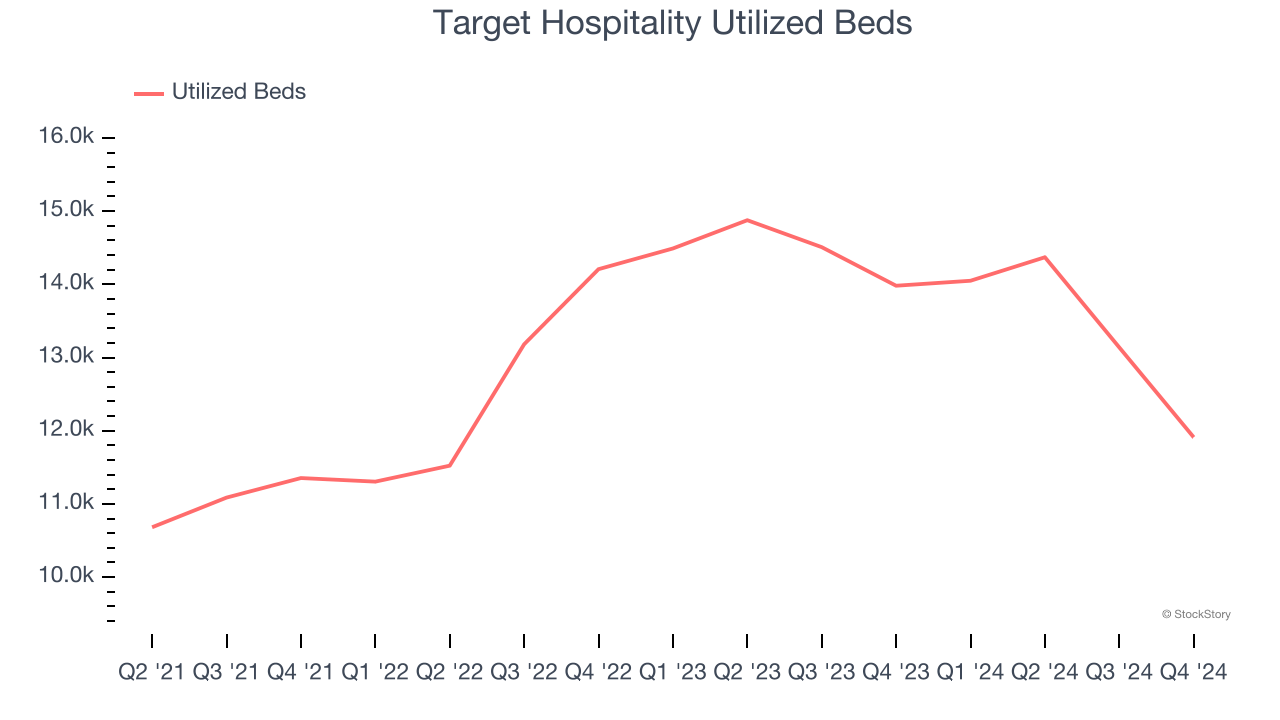

- Utilized Beds: 11,911, down 2,070 year on year

- Market Capitalization: $606.5 million

"Our 2024 performance further illustrates our ability to deliver strong results through a variety of business cycles and dynamic changes in customer demand. This operational flexibility has consistently supported the achievement of our financial goals, while allowing us to simultaneously remain focused on pursuing strategic growth initiatives," stated Brad Archer, President and Chief Executive Officer.

Company Overview

Building mini-communities at places such as oil drilling sites, Target Hospitality (NASDAQ: TH) is a provider of specialty workforce lodging accommodations and services.

Travel and Vacation Providers

Airlines, hotels, resorts, and cruise line companies often sell experiences rather than tangible products, and in the last decade-plus, consumers have slowly shifted from buying "things" (wasteful) to buying "experiences" (memorable). In addition, the internet has introduced new ways of approaching leisure and lodging such as booking homes and longer-term accommodations. Traditional airlines, hotel, resorts, and cruise line companies must innovate to stay relevant in a market rife with innovation.

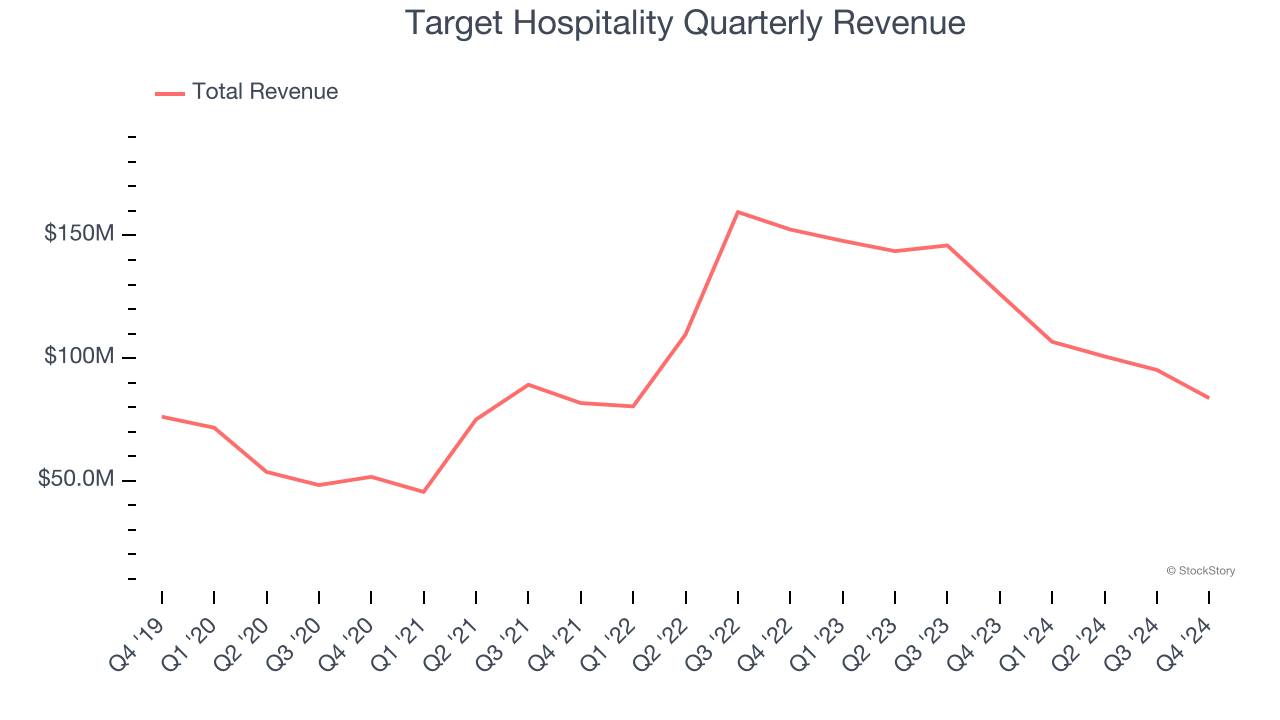

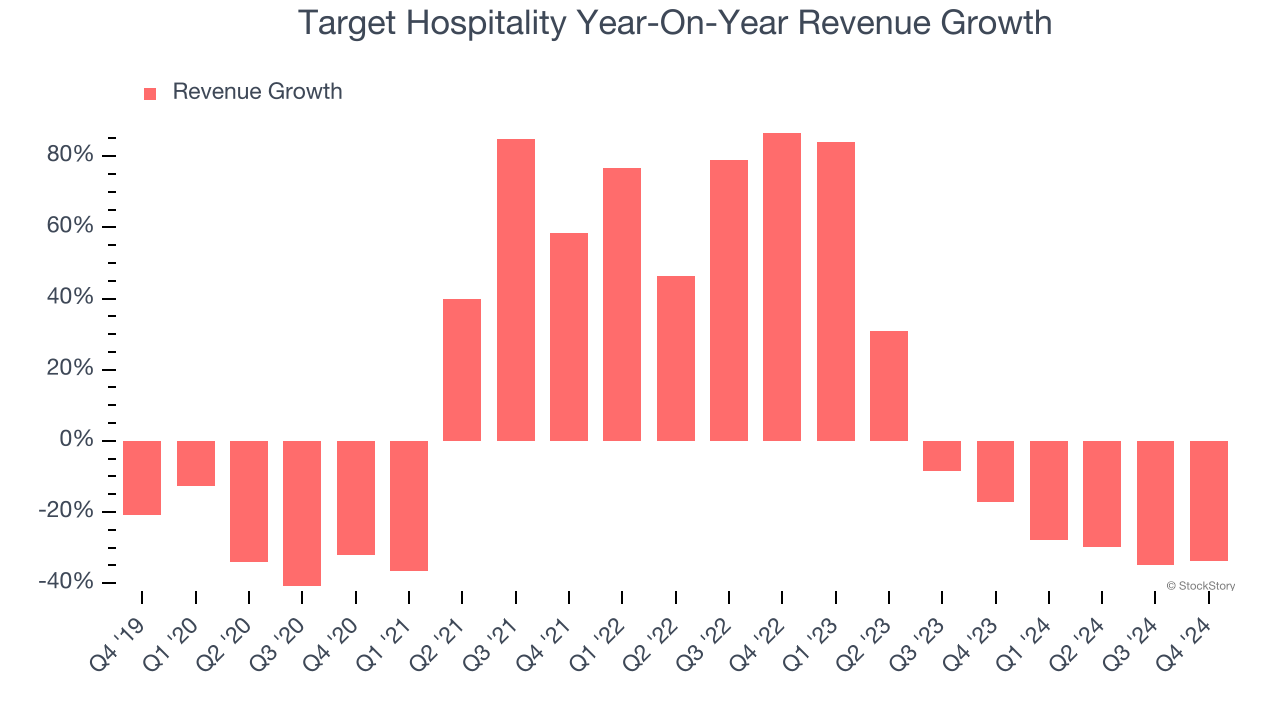

Sales Growth

A company’s long-term sales performance is one signal of its overall quality. Any business can have short-term success, but a top-tier one grows for years. Over the last five years, Target Hospitality grew its sales at a sluggish 3.8% compounded annual growth rate. This fell short of our benchmark for the consumer discretionary sector and is a rough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new property or trend. Target Hospitality’s performance shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 12.3% annually.

Target Hospitality also discloses its number of utilized beds, which reached 11,911 in the latest quarter. Over the last two years, Target Hospitality’s utilized beds averaged 4.4% year-on-year growth. Because this number is higher than its revenue growth during the same period, we can see the company’s monetization has fallen.

This quarter, Target Hospitality’s revenue fell by 33.7% year on year to $83.69 million but beat Wall Street’s estimates by 4.5%.

Looking ahead, sell-side analysts expect revenue to decline by 31.2% over the next 12 months, a deceleration versus the last two years. This projection doesn't excite us and suggests its products and services will face some demand challenges.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

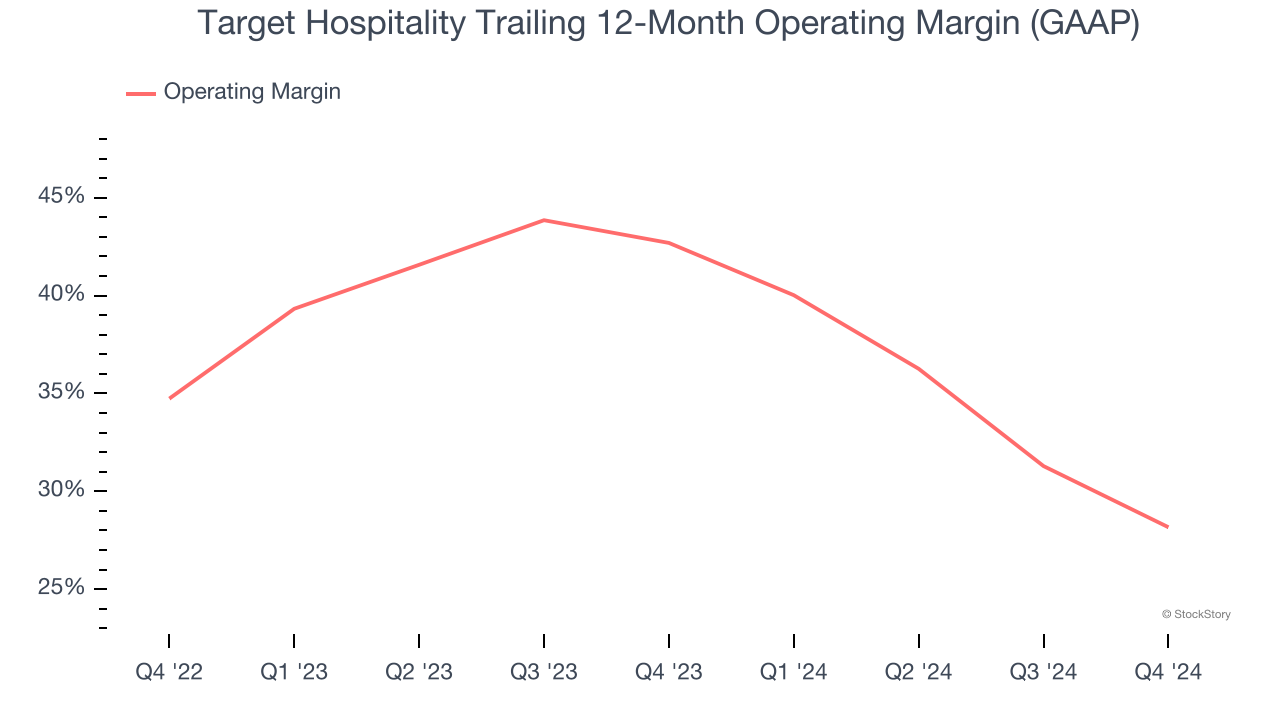

Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

Target Hospitality’s operating margin has shrunk over the last 12 months, but it still averaged 36.8% over the last two years, elite for a consumer discretionary business. This shows it’s an well-run company with an efficient cost structure, and we wouldn’t weigh the short-term trend too heavily.

This quarter, Target Hospitality generated an operating profit margin of 24.9%, down 11.7 percentage points year on year. This contraction shows it was less efficient because its expenses increased relative to its revenue.

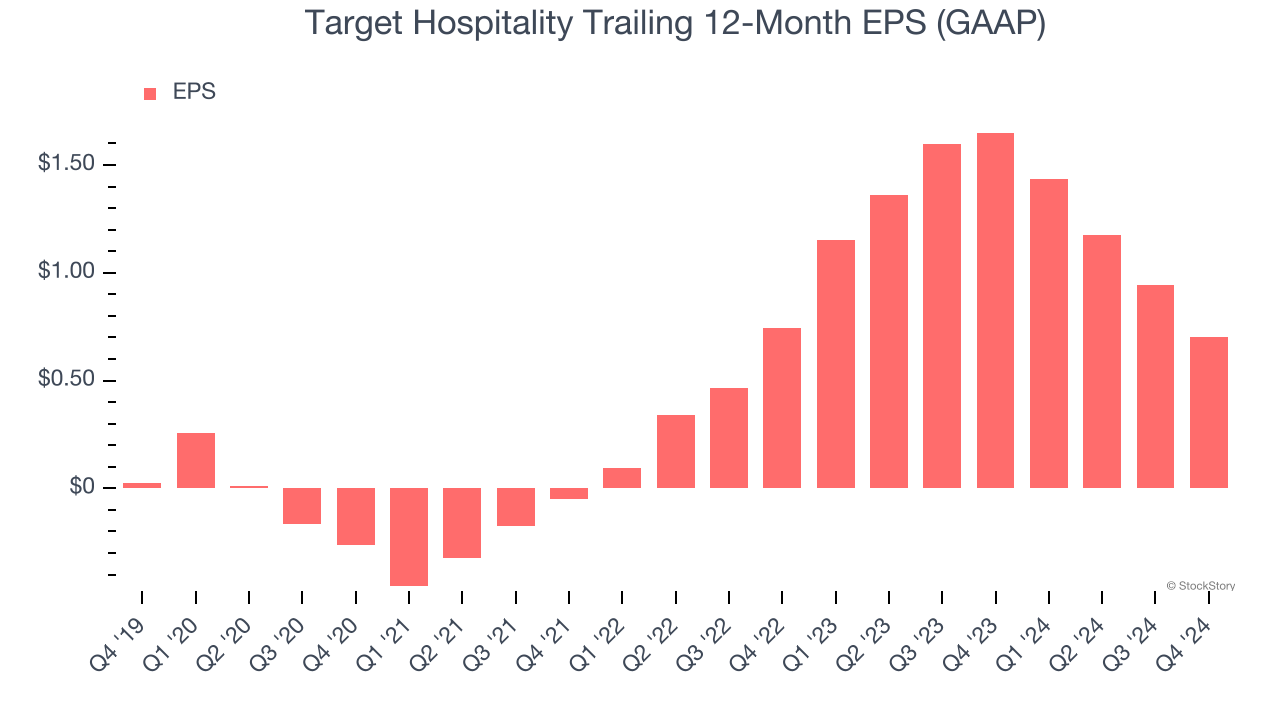

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Target Hospitality’s EPS grew at an astounding 93% compounded annual growth rate over the last five years, higher than its 3.8% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

In Q4, Target Hospitality reported EPS at $0.12, down from $0.36 in the same quarter last year. Despite falling year on year, this print easily cleared analysts’ estimates. Over the next 12 months, Wall Street expects Target Hospitality to perform poorly. Analysts forecast its full-year EPS of $0.70 will hit negative $0.12.

Key Takeaways from Target Hospitality’s Q4 Results

We were impressed by how significantly Target Hospitality blew past analysts’ EPS expectations this quarter. We were also glad its full-year revenue guidance trumped Wall Street’s estimates. On the other hand, its full-year EBITDA guidance missed significantly. Overall, we think this was a decent quarter with some key metrics above expectations. The stock traded up 5.2% to $6.45 immediately following the results.

Target Hospitality had an encouraging quarter, but one earnings result doesn’t necessarily make the stock a buy. Let’s see if this is a good investment. When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.