Kura Sushi’s stock price has taken a beating over the past six months, shedding 32.5% of its value and falling to $54.36 per share. This may have investors wondering how to approach the situation.

Is there a buying opportunity in Kura Sushi, or does it present a risk to your portfolio? See what our analysts have to say in our full research report, it’s free.

Even with the cheaper entry price, we're sitting this one out for now. Here are three reasons why you should be careful with KRUS and a stock we'd rather own.

Why Is Kura Sushi Not Exciting?

Known for its conveyor belt that transports dishes to diners, Kura Sushi (NASDAQ: KRUS) is a chain of sushi restaurants serving traditional Japanese fare with a touch of modernity and technology.

1. Fewer Distribution Channels Limit its Ceiling

With $250.8 million in revenue over the past 12 months, Kura Sushi is a small restaurant chain, which sometimes brings disadvantages compared to larger competitors benefiting from better brand awareness and economies of scale. On the bright side, it can grow faster because it has more white space to build new restaurants.

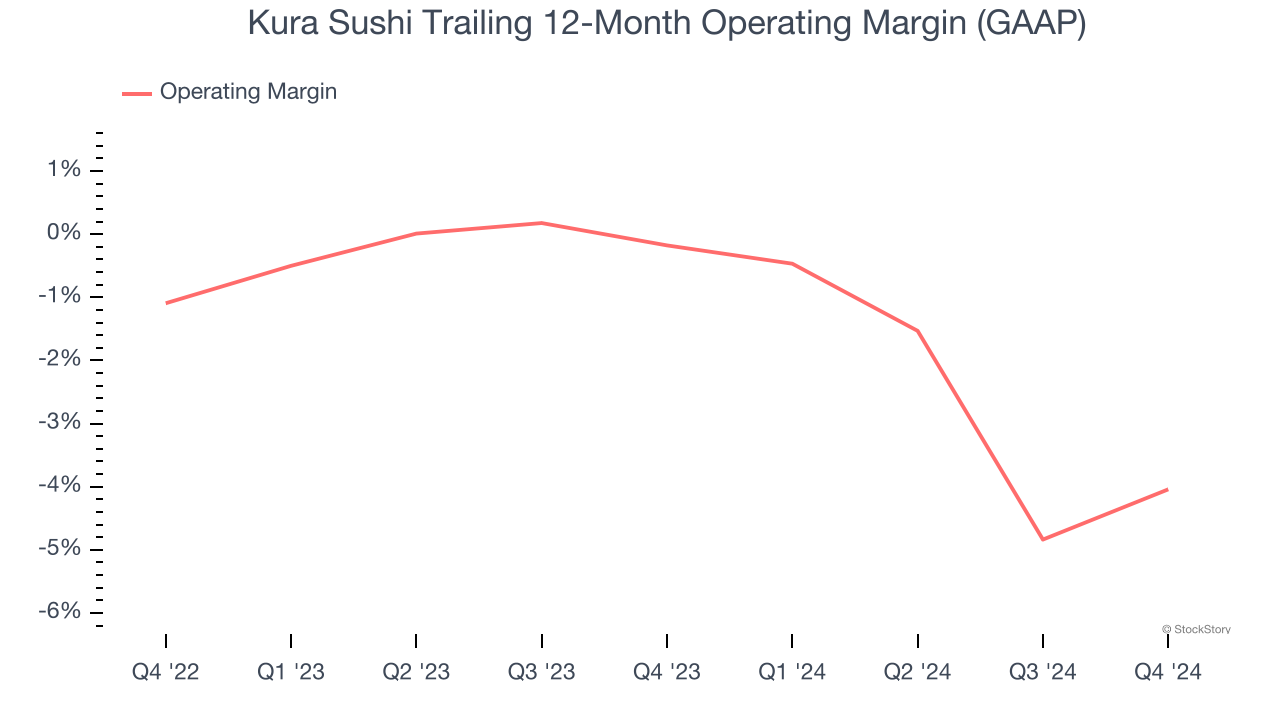

2. Shrinking Operating Margin

Operating margin is a key profitability metric because it accounts for all expenses keeping the business in motion, including food costs, wages, rent, advertising, and other administrative costs.

Analyzing the trend in its profitability, Kura Sushi’s operating margin decreased by 3.9 percentage points over the last year. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability. Kura Sushi’s performance was poor no matter how you look at it - it shows that costs were rising and it couldn’t pass them onto its customers. Its operating margin for the trailing 12 months was negative 4%.

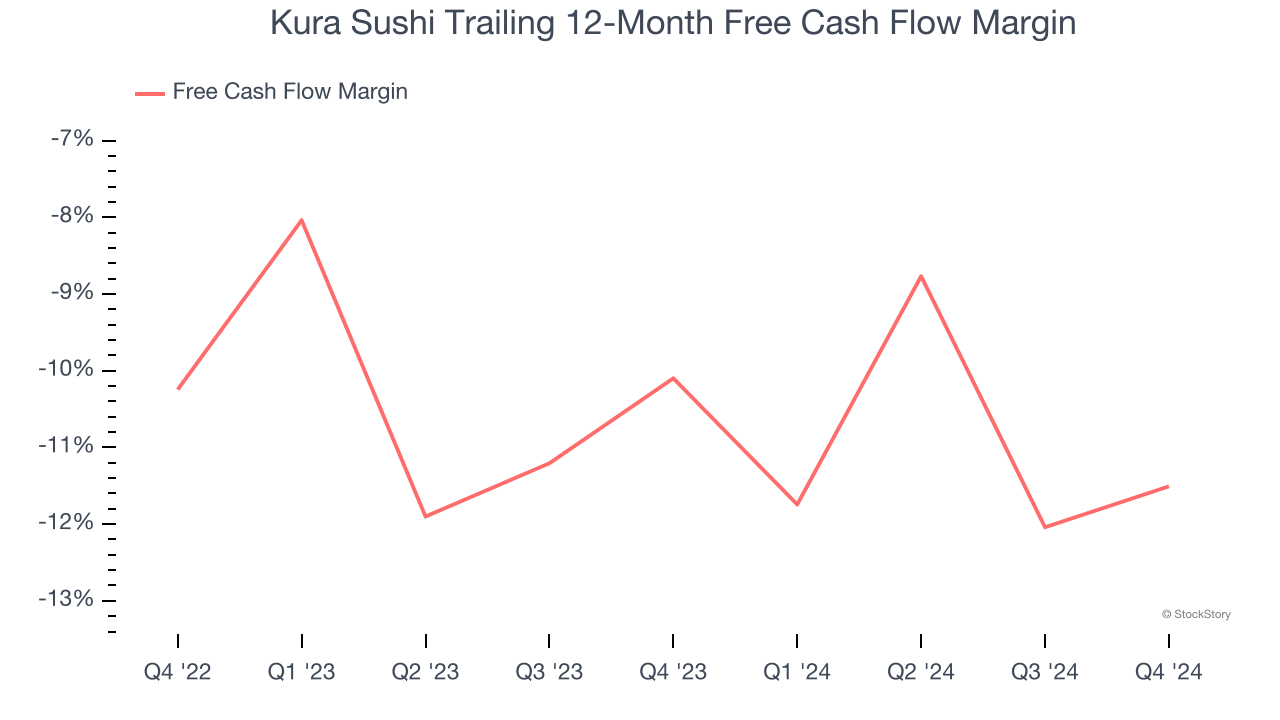

3. Cash Burn Ignites Concerns

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Over the last two years, Kura Sushi’s capital-intensive business model and large investments in new physical locations have drained its resources, putting it in a pinch and limiting its ability to return capital to investors. Its free cash flow margin averaged negative 10.9%, meaning it lit $10.88 of cash on fire for every $100 in revenue.

Final Judgment

Kura Sushi isn’t a terrible business, but it isn’t one of our picks. After the recent drawdown, the stock trades at 27.9× forward EV-to-EBITDA (or $54.36 per share). This multiple tells us a lot of good news is priced in - you can find better investment opportunities elsewhere. We’d recommend looking at one of Charlie Munger’s all-time favorite businesses.

Stocks We Would Buy Instead of Kura Sushi

The elections are now behind us. With rates dropping and inflation cooling, many analysts expect a breakout market - and we’re zeroing in on the stocks that could benefit immensely.

Take advantage of the rebound by checking out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Comfort Systems (+751% five-year return). Find your next big winner with StockStory today for free.