Cabinet manufacturing company American Woodmark (NASDAQ: AMWD) fell short of the market’s revenue expectations in Q1 CY2025, with sales falling 11.7% year on year to $400.4 million. Its non-GAAP profit of $1.61 per share was 13.4% above analysts’ consensus estimates.

Is now the time to buy American Woodmark? Find out by accessing our full research report, it’s free.

American Woodmark (AMWD) Q1 CY2025 Highlights:

- Revenue: $400.4 million vs analyst estimates of $428.8 million (11.7% year-on-year decline, 6.6% miss)

- Adjusted EPS: $1.61 vs analyst estimates of $1.42 (13.4% beat)

- Adjusted EBITDA: $47.1 million vs analyst estimates of $49.17 million (11.8% margin, 4.2% miss)

- EBITDA guidance for the upcoming financial year 2026 is $187.5 million at the midpoint, below analyst estimates of $206.4 million

- Operating Margin: 7.4%, down from 8.4% in the same quarter last year

- Market Capitalization: $840.2 million

“Demand for our products in the new construction and remodel market were weaker than expected as uncertainty regarding tariff policies and declining consumer confidence slowed foot traffic with builders and retailers. However, our teams continued to execute well and delivered Adjusted EBITDA margins of 11.8% for the fourth fiscal quarter,” said Scott Culbreth, President and CEO.

Company Overview

Starting as a small millwork shop, American Woodmark (NASDAQ: AMWD) is a cabinet manufacturing company that helps customers from inspiration to installation.

Sales Growth

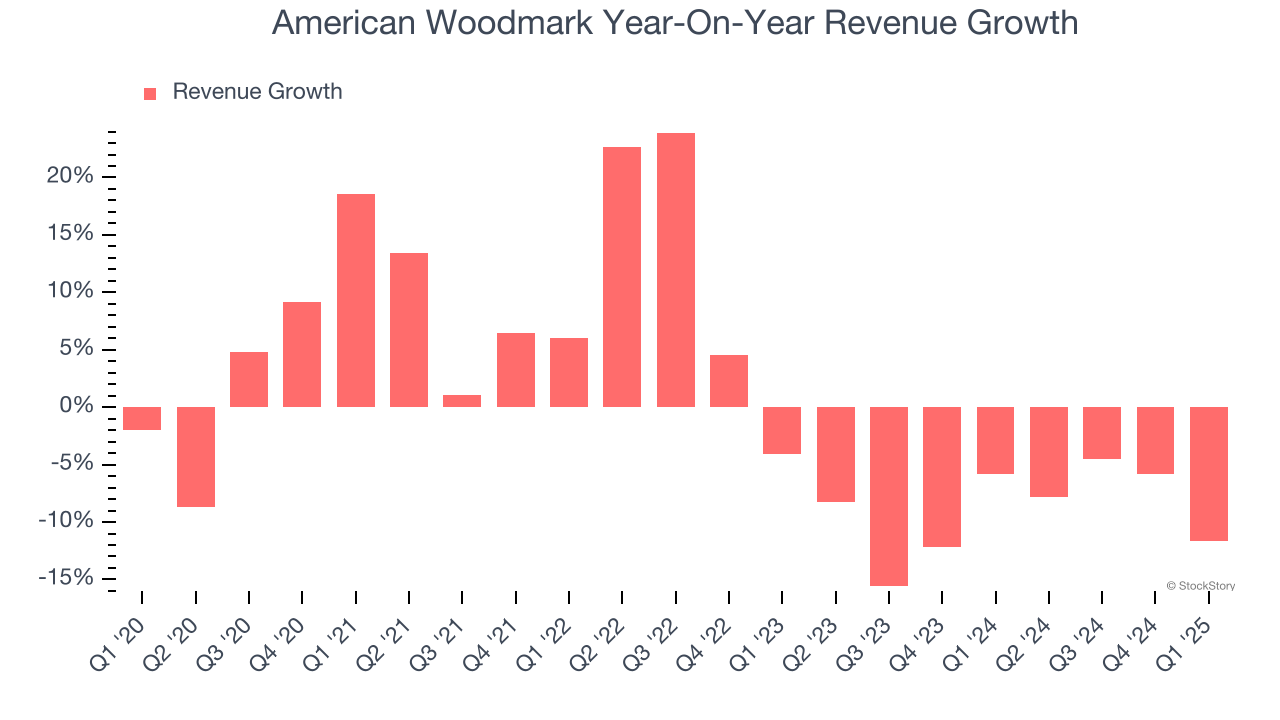

A company’s long-term performance is an indicator of its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Unfortunately, American Woodmark struggled to consistently increase demand as its $1.71 billion of sales for the trailing 12 months was close to its revenue five years ago. This was below our standards and suggests it’s a low quality business.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. American Woodmark’s recent performance shows its demand remained suppressed as its revenue has declined by 9% annually over the last two years.

This quarter, American Woodmark missed Wall Street’s estimates and reported a rather uninspiring 11.7% year-on-year revenue decline, generating $400.4 million of revenue.

Looking ahead, sell-side analysts expect revenue to remain flat over the next 12 months. While this projection suggests its newer products and services will catalyze better top-line performance, it is still below the sector average.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

Operating Margin

American Woodmark was profitable over the last five years but held back by its large cost base. Its average operating margin of 6.4% was weak for an industrials business. This result isn’t too surprising given its low gross margin as a starting point.

On the plus side, American Woodmark’s operating margin rose by 1.6 percentage points over the last five years.

This quarter, American Woodmark generated an operating profit margin of 7.4%, down 1.1 percentage points year on year. Since American Woodmark’s gross margin decreased more than its operating margin, we can assume its recent inefficiencies were driven more by weaker leverage on its cost of sales rather than increased marketing, R&D, and administrative overhead expenses.

Earnings Per Share

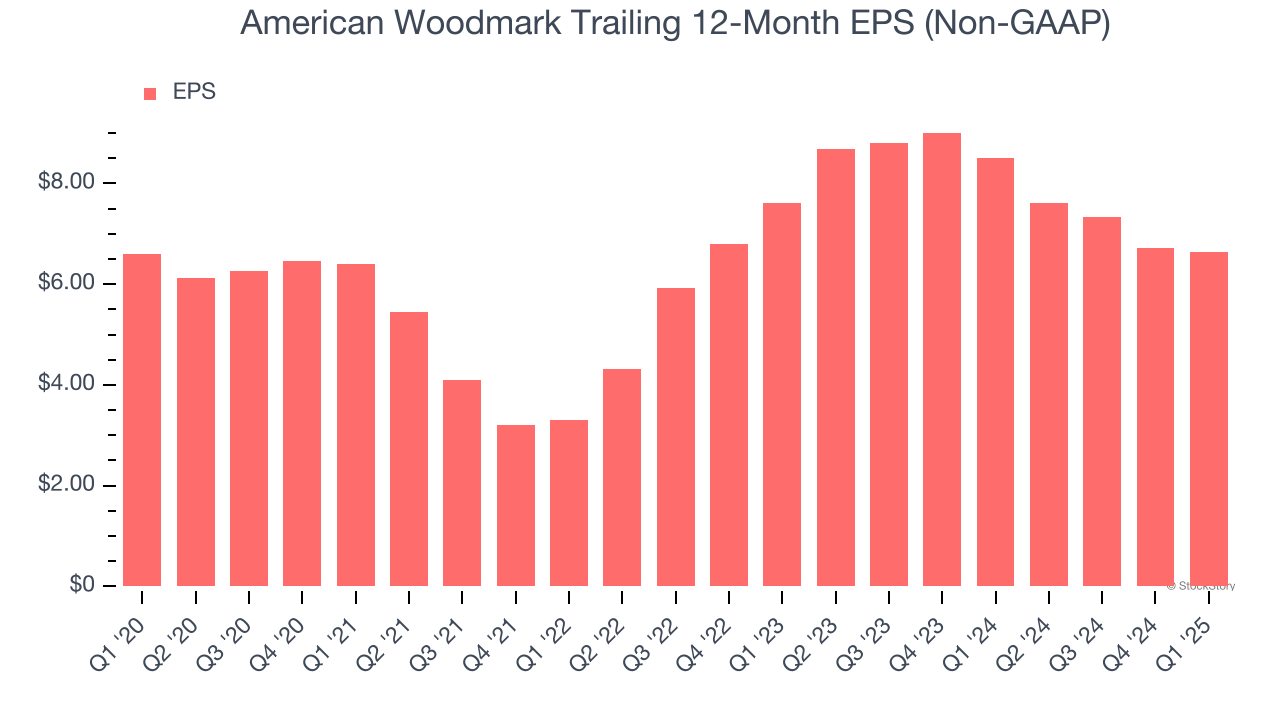

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

American Woodmark’s EPS was flat over the last five years, just like its revenue. This performance was underwhelming across the board.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

Although it wasn’t great, American Woodmark’s two-year annual EPS declines of 6.7% topped its two-year revenue performance.

In Q1, American Woodmark reported EPS at $1.61, down from $1.70 in the same quarter last year. Despite falling year on year, this print easily cleared analysts’ estimates. Over the next 12 months, Wall Street expects American Woodmark’s full-year EPS of $6.63 to shrink by 6.4%.

Key Takeaways from American Woodmark’s Q1 Results

We enjoyed seeing American Woodmark beat analysts’ EPS expectations this quarter. On the other hand, its revenue and EBITDA missed as well as its full-year EBITDA guidance. Overall, this was a weaker quarter. The stock traded down 1.7% to $55.58 immediately after reporting.

American Woodmark’s latest earnings report disappointed. One quarter doesn’t define a company’s quality, so let’s explore whether the stock is a buy at the current price. We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.