Luxury watch company Movado (NYSE: MOV) missed Wall Street’s revenue expectations in Q1 CY2025, with sales falling 3.6% year on year to $131.8 million. Its GAAP profit of $0.06 per share was 84.5% below analysts’ consensus estimates.

Is now the time to buy Movado? Find out by accessing our full research report, it’s free.

Movado (MOV) Q1 CY2025 Highlights:

- Revenue: $131.8 million vs analyst estimates of $142.1 million (3.6% year-on-year decline, 7.3% miss)

- EPS (GAAP): $0.06 vs analyst expectations of $0.39 (84.5% miss)

- Operating Margin: 0.2%, down from 2.4% in the same quarter last year

- Free Cash Flow was -$8.75 million compared to -$19.7 million in the same quarter last year

- Market Capitalization: $387.4 million

Efraim Grinberg, Chairman and Chief Executive Officer, stated, “In the first quarter, we navigated a challenging retail environment with discipline and focus, continuing to invest in our iconic brands while driving operational efficiency. We were pleased to execute against our cost savings initiatives while delivering strong product innovation. Overall, our licensed brand portfolio performed very well, reflecting a renewed vibrancy in the fashion watch category. Our Movado brand received a strong response to our new product introductions during the Mother’s Day holiday.”

Company Overview

With its watches displayed in 20 museums around the world, Movado (NYSE: MOV) is a watchmaking company with a portfolio of watch brands and accessories.

Sales Growth

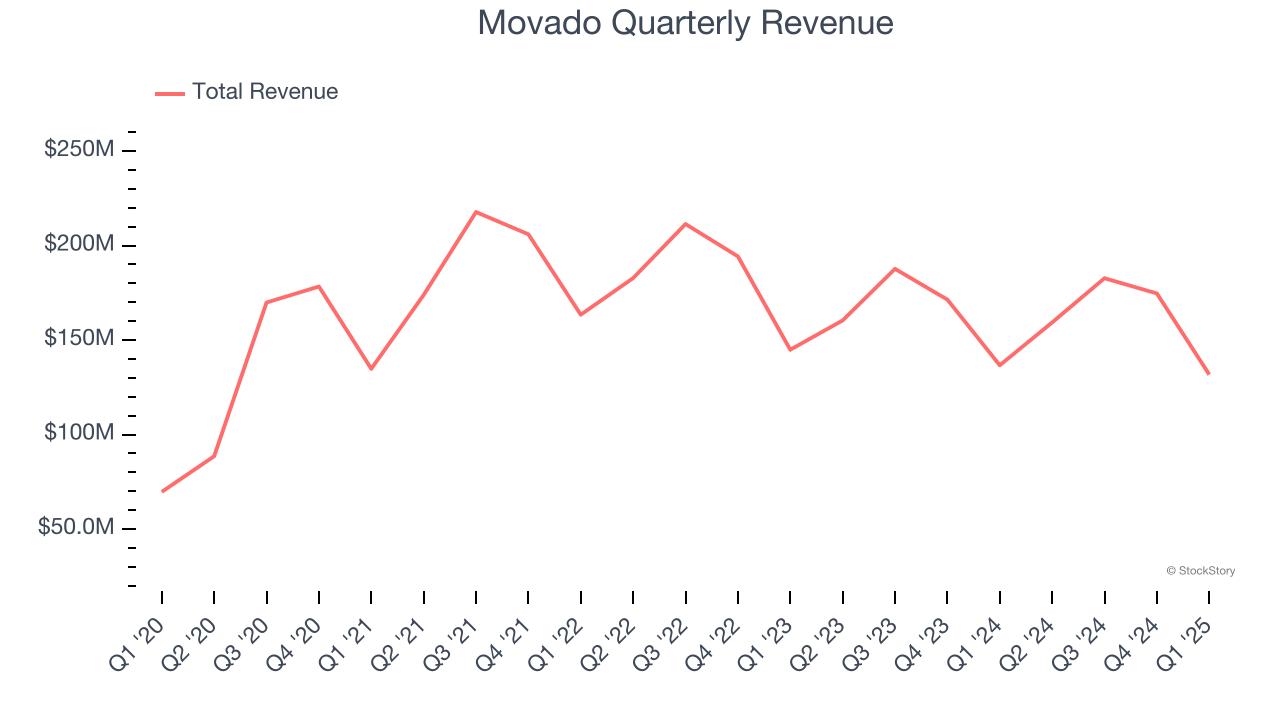

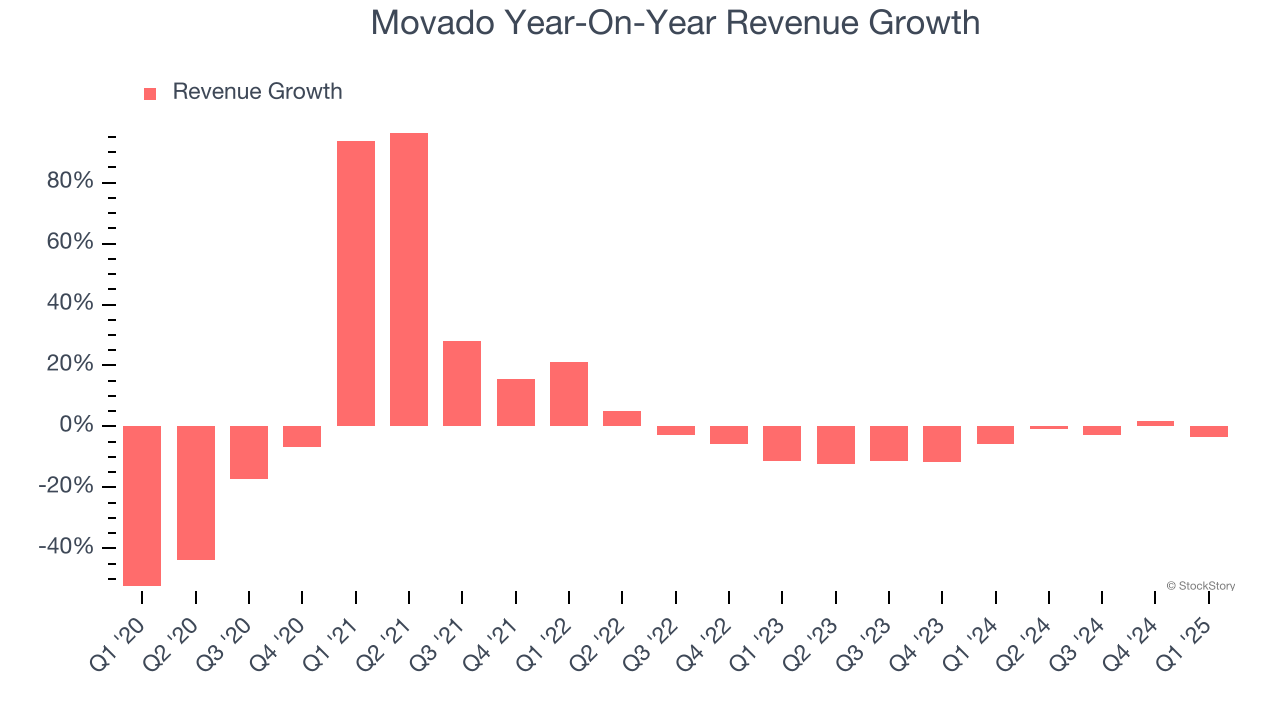

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Unfortunately, Movado struggled to consistently increase demand as its $648.5 million of sales for the trailing 12 months was close to its revenue five years ago. This wasn’t a great result and suggests it’s a low quality business.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new product or trend. Movado’s recent performance shows its demand remained suppressed as its revenue has declined by 6% annually over the last two years.

This quarter, Movado missed Wall Street’s estimates and reported a rather uninspiring 3.6% year-on-year revenue decline, generating $131.8 million of revenue.

We also like to judge companies based on their projected revenue growth, but not enough Wall Street analysts cover the company for it to have reliable consensus estimates.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

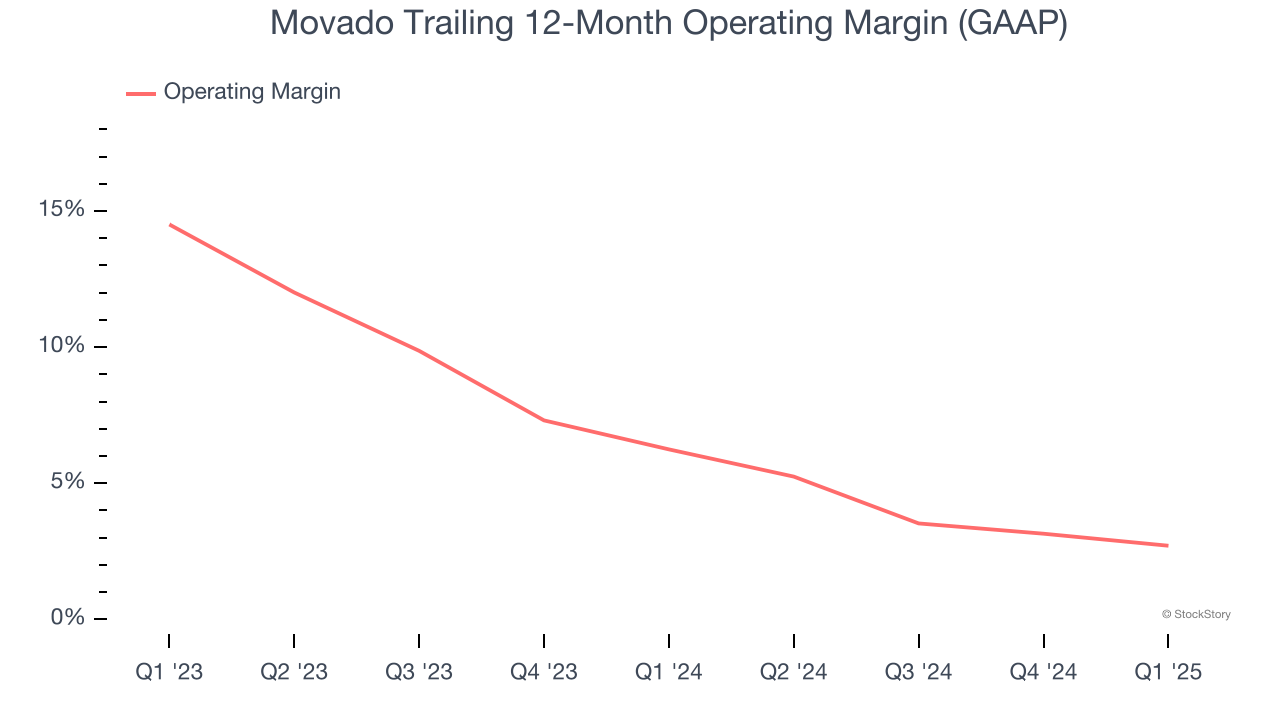

Movado’s operating margin has been trending down over the last 12 months and averaged 4.5% over the last two years. The company’s profitability was mediocre for a consumer discretionary business and shows it couldn’t pass its higher operating expenses onto its customers.

This quarter, Movado’s breakeven margin was down 2.2 percentage points year on year. This contraction shows it was less efficient because its expenses increased relative to its revenue.

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

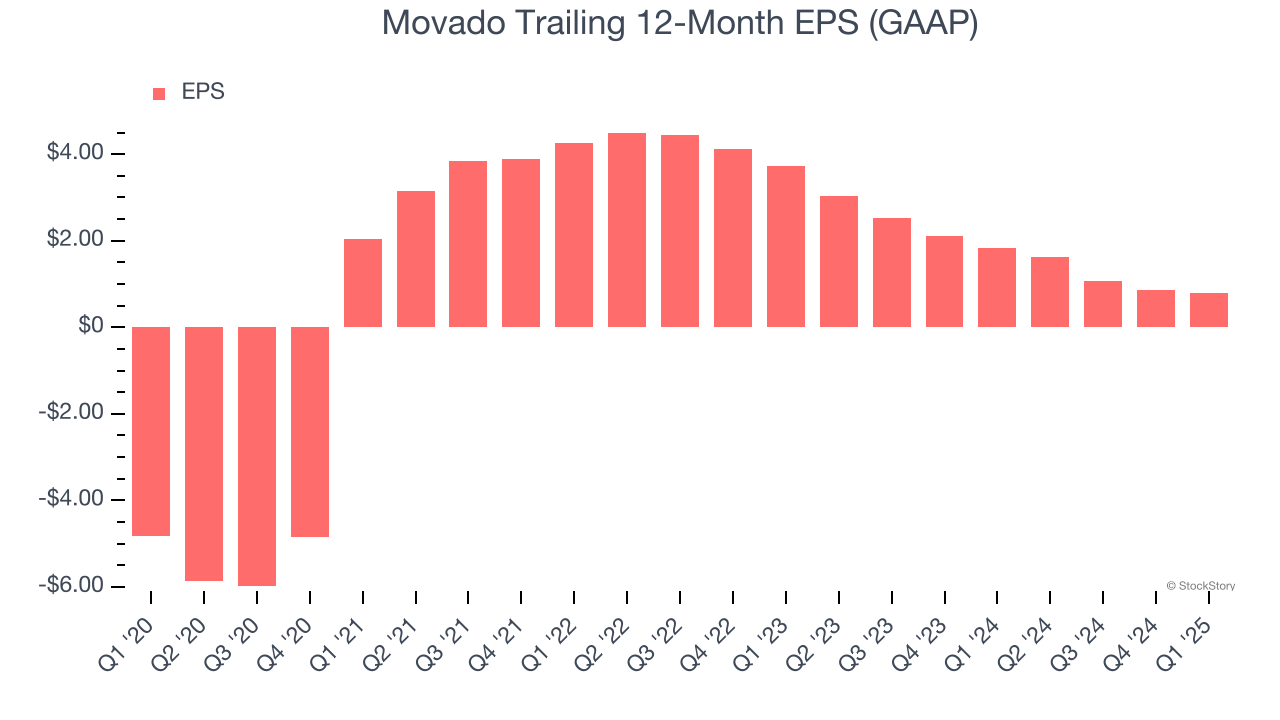

Movado’s full-year EPS flipped from negative to positive over the last five years. This is encouraging and shows it’s at a critical moment in its life.

In Q1, Movado reported EPS at $0.06, down from $0.13 in the same quarter last year. This print missed analysts’ estimates, but we care more about long-term EPS growth than short-term movements. We also like to analyze expected EPS growth based on Wall Street analysts’ consensus projections, but there is insufficient data.

Key Takeaways from Movado’s Q1 Results

We struggled to find many positives in these results as its revenue and EPS fell short of Wall Street’s estimates. Overall, this was a softer quarter. The stock traded down 8.9% to $15.90 immediately after reporting.

Movado’s latest earnings report disappointed. One quarter doesn’t define a company’s quality, so let’s explore whether the stock is a buy at the current price. The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.