Over the past six months, United Community Banks’s stock price fell to $27.79. Shareholders have lost 10.5% of their capital, which is disappointing considering the S&P 500 has climbed by 1.9%. This may have investors wondering how to approach the situation.

Is there a buying opportunity in United Community Banks, or does it present a risk to your portfolio? Get the full stock story straight from our expert analysts, it’s free.

Why Is United Community Banks Not Exciting?

Even with the cheaper entry price, we're swiping left on United Community Banks for now. Here are three reasons why there are better opportunities than UCB and a stock we'd rather own.

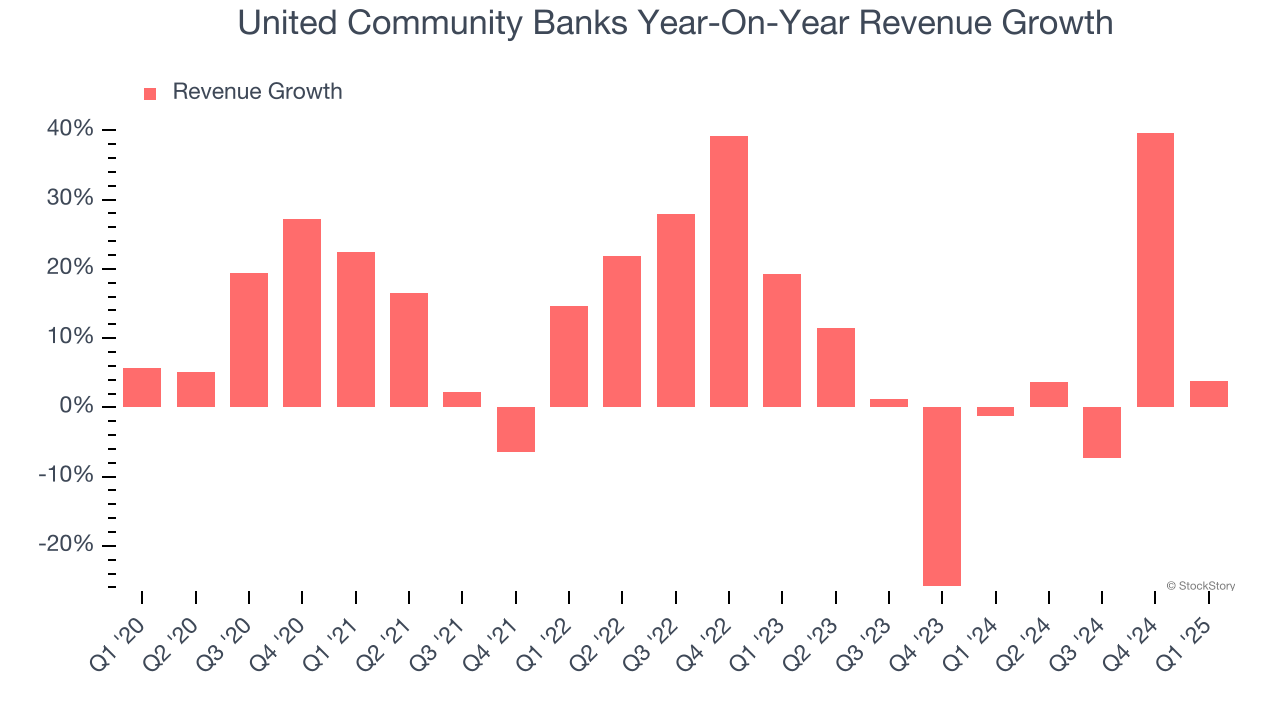

1. Lackluster Revenue Growth

We at StockStory place the most emphasis on long-term growth, but within financials, a stretched historical view may miss recent interest rate changes, market returns, and industry trends. United Community Banks’s recent performance shows its demand has slowed significantly as its annualized revenue growth of 1.8% over the last two years was well below its five-year trend.

2. Low Net Interest Margin Hinders Flexibility

Net interest margin represents how much a bank earns in relation to its outstanding loans. It’s one of the most important metrics to track because it shows how a bank’s loans are performing and whether it has the ability to command higher premiums for its services.

Over the past two years, we can see that United Community Banks’s net interest margin averaged a subpar 3.3%. This metric is well below other banks, signaling its loans aren’t very profitable.

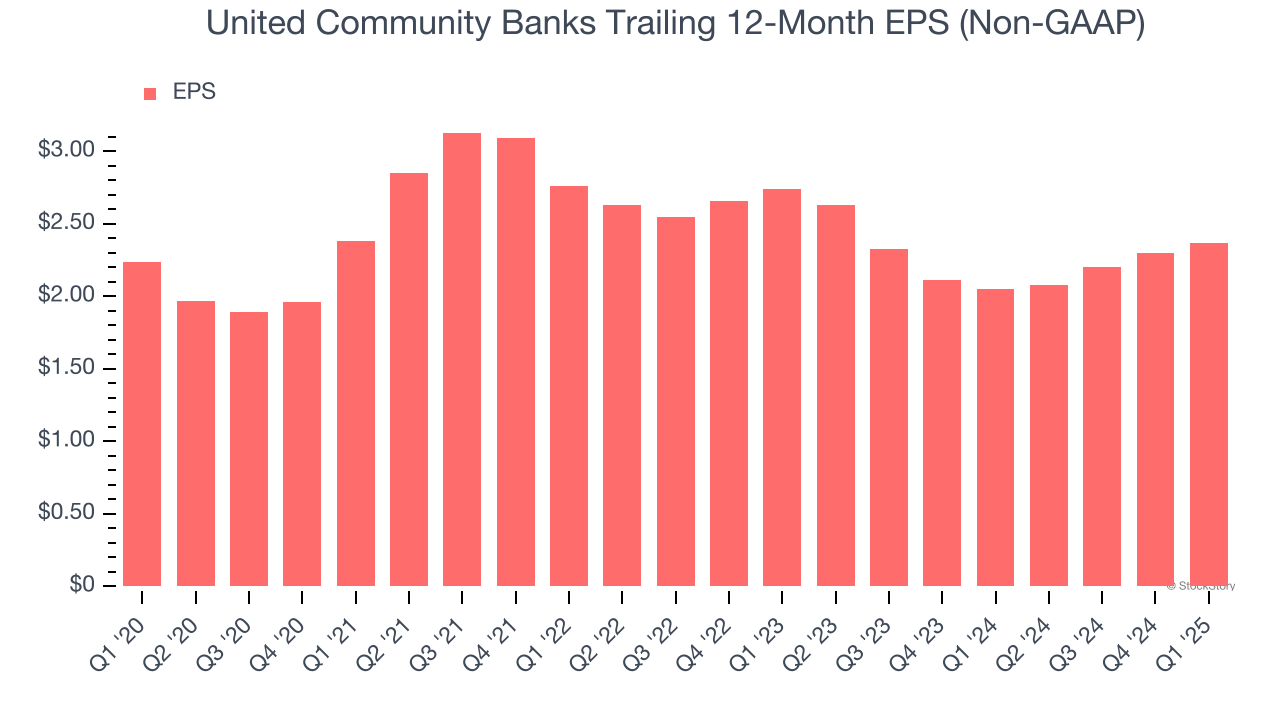

3. EPS Barely Growing

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

United Community Banks’s EPS grew at an unimpressive 1.1% compounded annual growth rate over the last five years, lower than its 10.6% annualized revenue growth. This tells us the company became less profitable on a per-share basis as it expanded.

Final Judgment

United Community Banks’s business quality ultimately falls short of our standards. Following the recent decline, the stock trades at 0.9× forward P/B (or $27.79 per share). This valuation tells us it’s a bit of a market darling with a lot of good news priced in - you can find more timely opportunities elsewhere. Let us point you toward an all-weather company that owns household favorite Taco Bell.

High-Quality Stocks for All Market Conditions

The market surged in 2024 and reached record highs after Donald Trump’s presidential victory in November, but questions about new economic policies are adding much uncertainty for 2025.

While the crowd speculates what might happen next, we’re homing in on the companies that can succeed regardless of the political or macroeconomic environment. Put yourself in the driver’s seat and build a durable portfolio by checking out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.