Quarterly earnings results are a good time to check in on a company’s progress, especially compared to its peers in the same sector. Today we are looking at Silgan Holdings (NYSE: SLGN) and the best and worst performers in the industrial packaging industry.

Industrial packaging companies have built competitive advantages from economies of scale that lead to advantaged purchasing and capital investments that are difficult and expensive to replicate. Recently, eco-friendly packaging and conservation are driving customers preferences and innovation. For example, plastic is not as desirable a material as it once was. Despite being integral to consumer goods ranging from beer to toothpaste to laundry detergent, these companies are still at the whim of the macro, especially consumer health and consumer willingness to spend.

The 8 industrial packaging stocks we track reported a mixed Q2. As a group, revenues beat analysts’ consensus estimates by 1.6%.

While some industrial packaging stocks have fared somewhat better than others, they have collectively declined. On average, share prices are down 4.4% since the latest earnings results.

Silgan Holdings (NYSE: SLGN)

Established in 1987, Silgan Holdings (NYSE: SLGN) is a supplier of rigid packaging for consumer goods products, specializing in metal containers, closures, and plastic packaging.

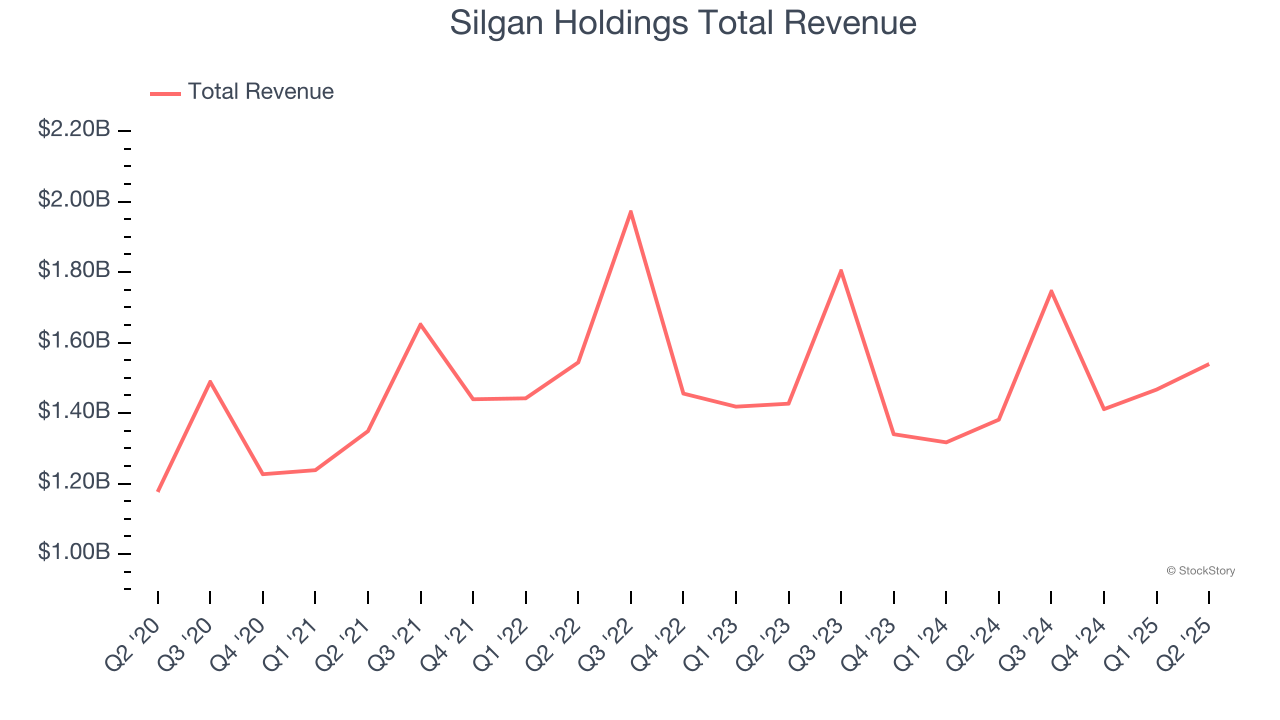

Silgan Holdings reported revenues of $1.54 billion, up 11.4% year on year. This print was in line with analysts’ expectations, but overall, it was a slower quarter for the company with full-year EPS guidance missing analysts’ expectations.

"Our businesses continued to execute in the second quarter and delivered significant adjusted EPS growth of 15%, driven by increased organic volumes in our key product categories, strong contributions from the successful integration of the Weener acquisition and continued best-in-class operating performance. Once again, our diverse portfolio, the strength of our teams, our focus on innovation and our disciplined value creation strategy continue to drive our performance and the long-term success of the Company," said Adam Greenlee, President and CEO.

Unsurprisingly, the stock is down 16.9% since reporting and currently trades at $46.33.

Read our full report on Silgan Holdings here, it’s free.

Best Q2: Ball (NYSE: BALL)

Started with a $200 loan in 1880, Ball (NYSE: BLL) manufactures aluminum packaging for beverages, personal care, and household products as well as aerospace systems and other technologies.

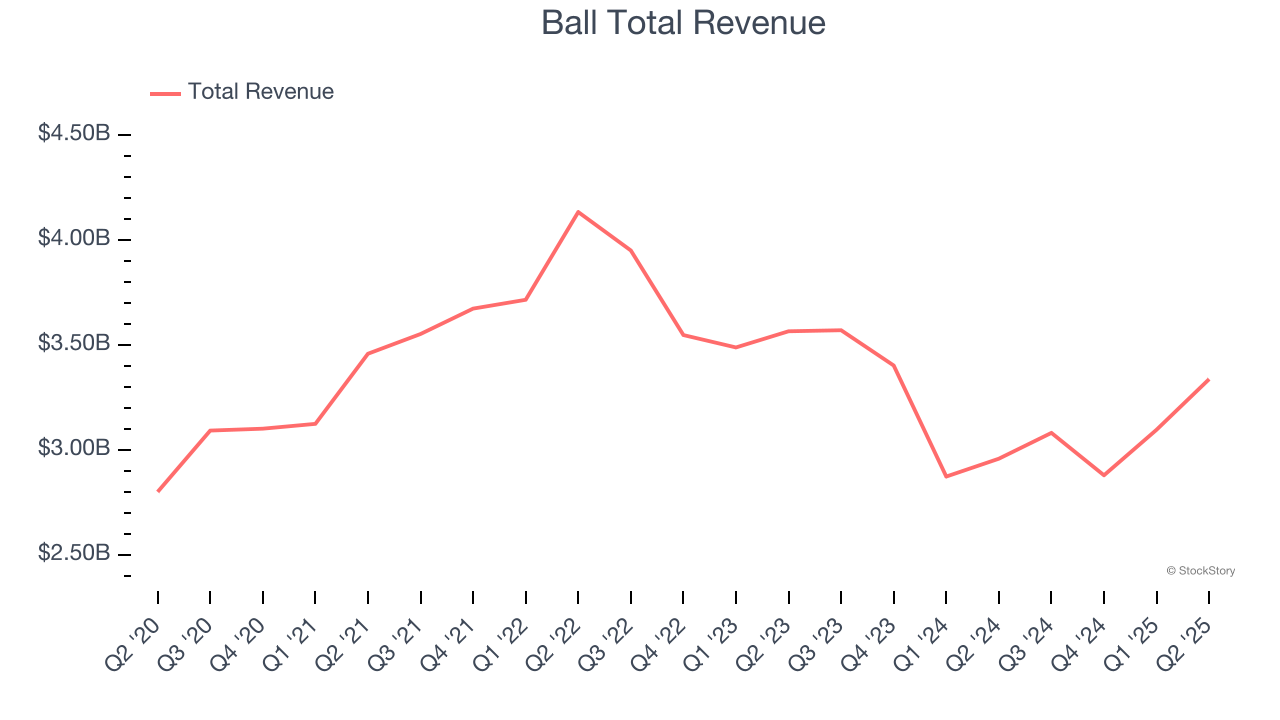

Ball reported revenues of $3.34 billion, up 12.8% year on year, outperforming analysts’ expectations by 7%. The business had an exceptional quarter with an impressive beat of analysts’ organic revenue estimates and a solid beat of analysts’ adjusted operating income estimates.

Ball scored the biggest analyst estimates beat among its peers. Although it had a fine quarter compared its peers, the market seems unhappy with the results as the stock is down 9.2% since reporting. It currently trades at $52.31.

Is now the time to buy Ball? Access our full analysis of the earnings results here, it’s free.

Weakest Q2: International Paper (NYSE: IP)

Established in 1898, International Paper (NYSE: IP) produces containerboard, pulp, paper, and materials used in packaging and printing applications.

International Paper reported revenues of $6.77 billion, up 42.9% year on year, exceeding analysts’ expectations by 1.9%. Still, it was a softer quarter as it posted a significant miss of analysts’ adjusted operating income estimates and a significant miss of analysts’ EBITDA estimates.

As expected, the stock is down 9.9% since the results and currently trades at $48.37.

Read our full analysis of International Paper’s results here.

Crown Holdings (NYSE: CCK)

Formerly Crown Cork & Seal, Crown Holdings (NYSE: CCK) produces packaging products for consumer marketing companies, including food, beverage, household, and industrial products.

Crown Holdings reported revenues of $3.15 billion, up 3.6% year on year. This result topped analysts’ expectations by 0.9%. Overall, it was a very strong quarter as it also produced a solid beat of analysts’ EBITDA estimates and an impressive beat of analysts’ adjusted operating income estimates.

The stock is down 4.7% since reporting and currently trades at $99.83.

Read our full, actionable report on Crown Holdings here, it’s free.

Sealed Air (NYSE: SEE)

Founded in 1960, Sealed Air Corporation (NYSE: SEE) specializes in the development and production of protective and food packaging solutions, serving a variety of industries.

Sealed Air reported revenues of $1.34 billion, flat year on year. This number beat analysts’ expectations by 1.9%. It was a very strong quarter as it also recorded a solid beat of analysts’ EBITDA estimates and an impressive beat of analysts’ adjusted operating income estimates.

Sealed Air scored the highest full-year guidance raise among its peers. The stock is up 9.8% since reporting and currently trades at $31.86.

Read our full, actionable report on Sealed Air here, it’s free.

Market Update

Thanks to the Fed’s series of rate hikes in 2022 and 2023, inflation has cooled significantly from its post-pandemic highs, drawing closer to the 2% goal. This disinflation has occurred without severely impacting economic growth, suggesting the success of a soft landing. The stock market thrived in 2024, spurred by recent rate cuts (0.5% in September and 0.25% in November), and a notable surge followed Donald Trump’s presidential election win in November, propelling indices to historic highs. Nonetheless, the outlook for 2025 remains clouded by potential trade policy changes and corporate tax discussions, which could impact business confidence and growth. The path forward holds both optimism and caution as new policies take shape.

Want to invest in winners with rock-solid fundamentals? Check out our 9 Best Market-Beating Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.