Over the past six months, Oscar Health has been a great trade, beating the S&P 500 by 14.9%. Its stock price has climbed to $19.39, representing a healthy 32.4% increase. This performance may have investors wondering how to approach the situation.

Is it too late to buy OSCR? Find out in our full research report, it’s free.

Why Is OSCR a Good Business?

Founded in 2012 to simplify the notoriously complex American healthcare system, Oscar Health (NYSE: OSCR) is a technology-focused health insurance company that offers individual and small group health plans through its cloud-native platform.

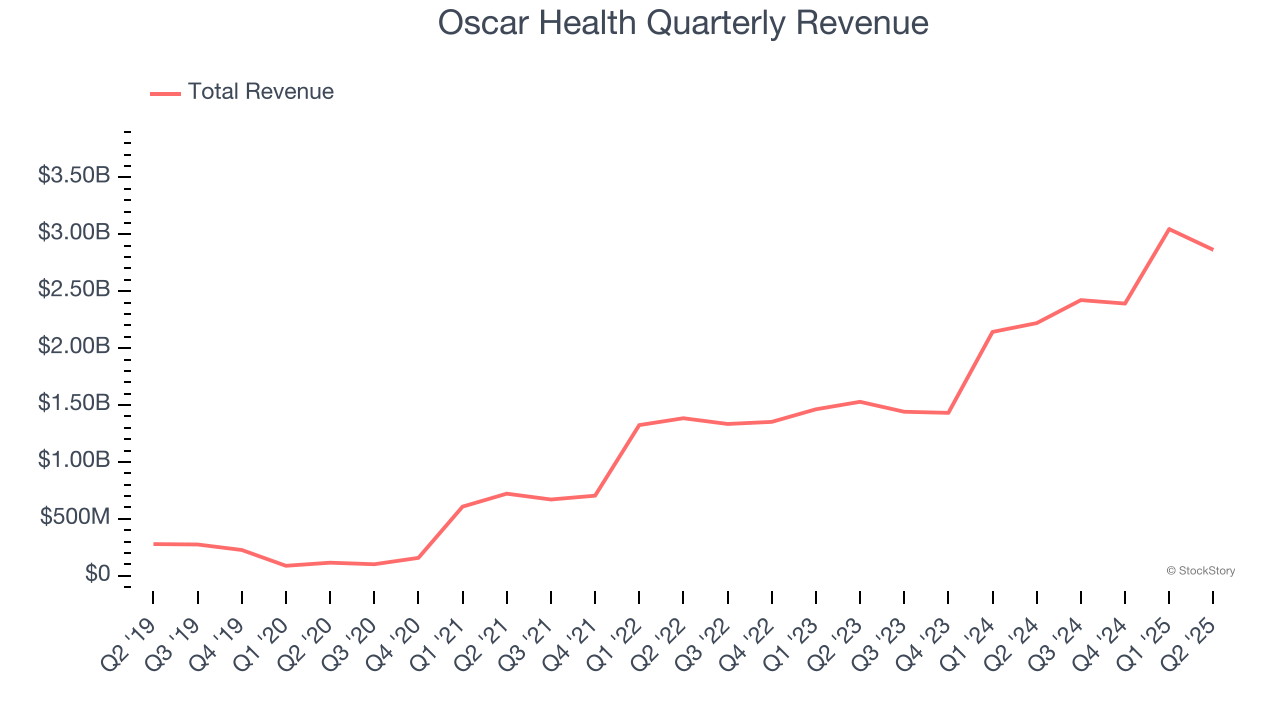

1. Skyrocketing Revenue Shows Strong Momentum

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last five years, Oscar Health grew its sales at an incredible 72.3% compounded annual growth rate. Its growth surpassed the average healthcare company and shows its offerings resonate with customers.

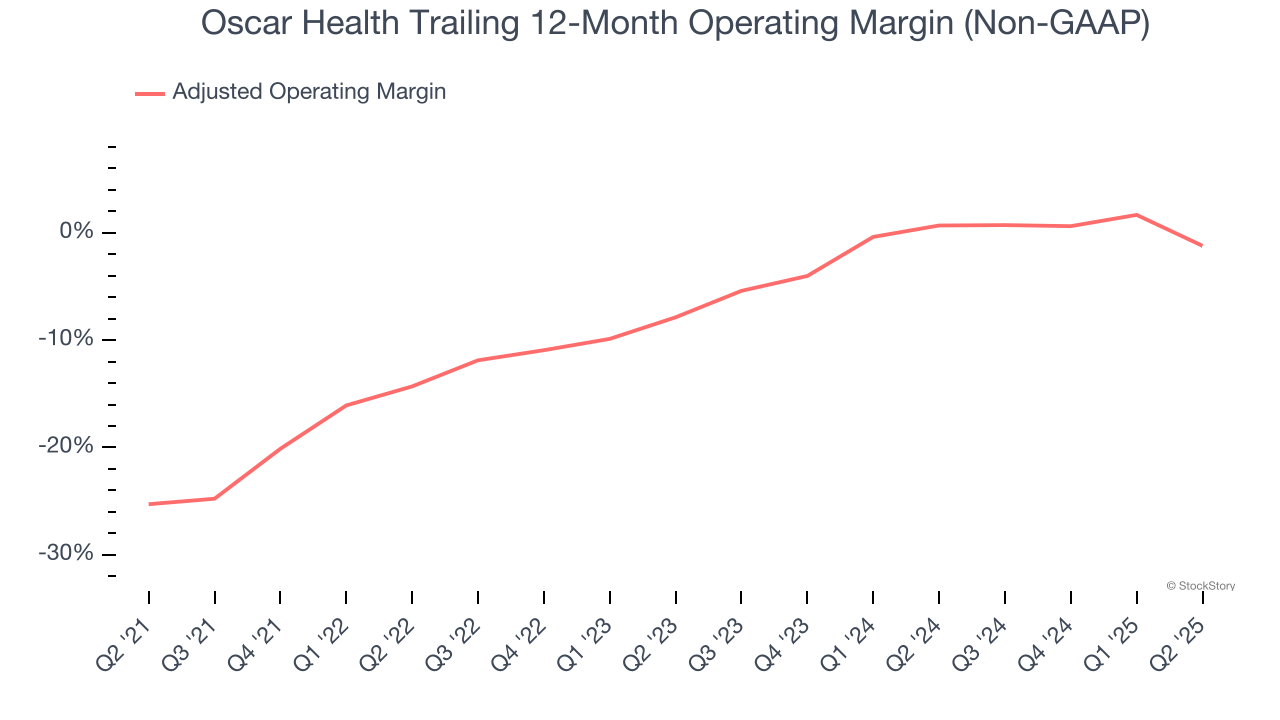

2. Adjusted Operating Margin Rising, Profits Up

Adjusted operating margin is a key measure of profitability. Think of it as net income (the bottom line) excluding the impact of non-recurring expenses, taxes, and interest on debt - metrics less connected to business fundamentals.

Oscar Health’s adjusted operating margin rose by 24.1 percentage points over the last five years, as its sales growth gave it operating leverage. Although its adjusted operating margin for the trailing 12 months was negative 1.2%, we’re confident it can one day reach sustainable profitability.

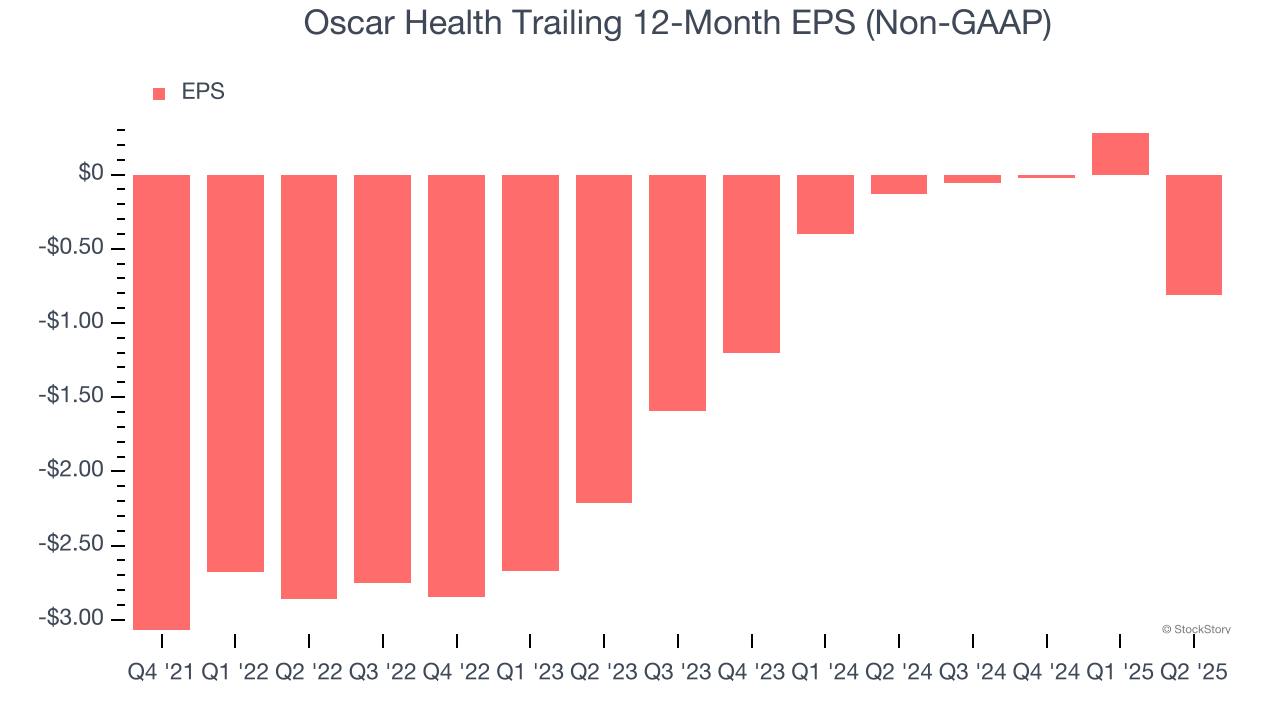

3. EPS Improving Significantly

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Although Oscar Health’s full-year earnings are still negative, it reduced its losses and improved its EPS by 19.3% annually over the last four years. The next few quarters will be critical for assessing its long-term profitability. An inflection point could be coming soon.

Final Judgment

These are just a few reasons why we think Oscar Health is a great business, and with its shares beating the market recently, the stock trades at 127.8× forward EV-to-EBITDA (or $19.39 per share). Is now a good time to buy? See for yourself in our in-depth research report, it’s free.

High-Quality Stocks for All Market Conditions

Donald Trump’s April 2025 "Liberation Day" tariffs sent markets into a tailspin, but stocks have since rebounded strongly, proving that knee-jerk reactions often create the best buying opportunities.

The smart money is already positioning for the next leg up. Don’t miss out on the recovery - check out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.