As the craze of earnings season draws to a close, here’s a look back at some of the most exciting (and some less so) results from Q3. Today, we are looking at property & casualty insurance stocks, starting with Essent Group (NYSE: ESNT).

Property & Casualty (P&C) insurers protect individuals and businesses against financial loss from damage to property or from legal liability. This is a cyclical industry, and the sector benefits when there is 'hard market', characterized by strong premium rate increases that outpace loss and cost inflation, resulting in robust underwriting margins. The opposite is true in a 'soft market'. Interest rates also matter, as they determine the yields earned on fixed-income portfolios. On the other hand, P&C insurers face a major secular headwind from the increasing frequency and severity of catastrophe losses due to climate change. Furthermore, the liability side of the business is pressured by 'social inflation'—the trend of rising litigation costs and larger jury awards.

The 33 property & casualty insurance stocks we track reported a strong Q3. As a group, revenues beat analysts’ consensus estimates by 14.9%.

In light of this news, share prices of the companies have held steady as they are up 2.6% on average since the latest earnings results.

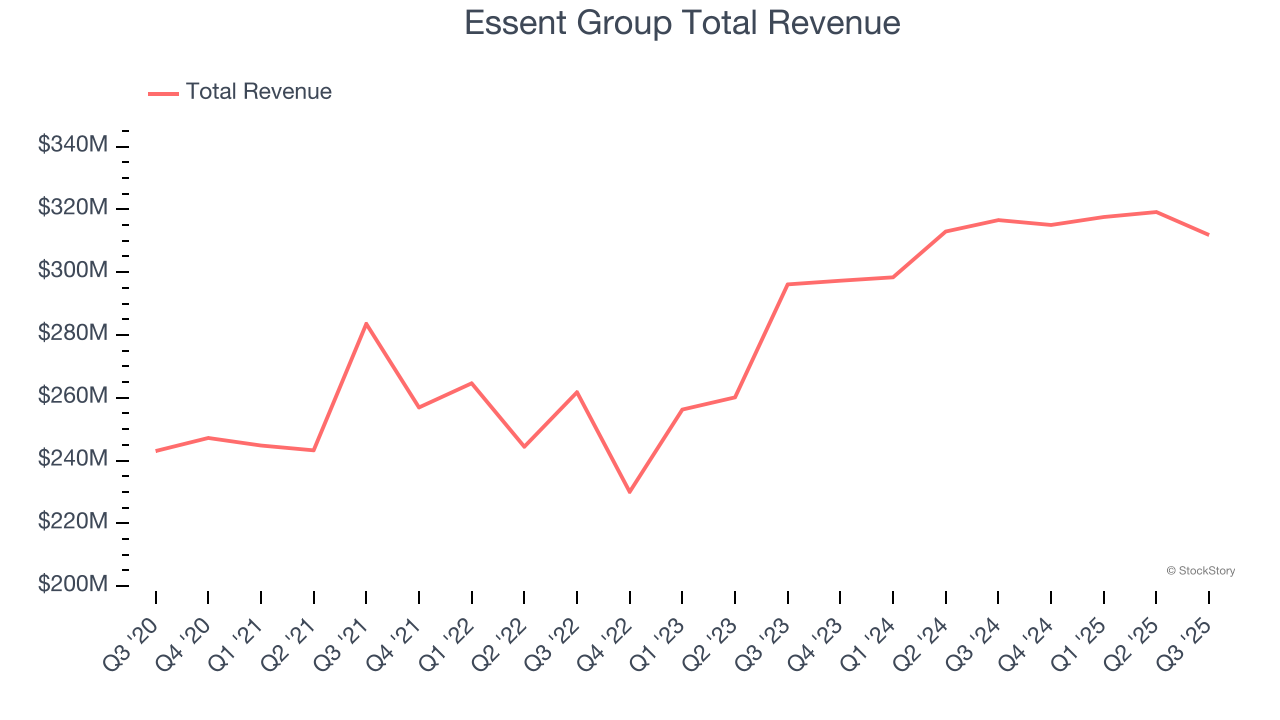

Essent Group (NYSE: ESNT)

Serving as a crucial bridge between homebuyers and the American dream of homeownership, Essent Group (NYSE: ESNT) provides private mortgage insurance and title services that enable lenders to offer home loans with down payments of less than 20%.

Essent Group reported revenues of $311.8 million, down 1.5% year on year. This print fell short of analysts’ expectations by 1.6%. Overall, it was a softer quarter for the company with a significant miss of analysts’ EPS and revenue estimates.

“We are pleased with our third quarter results, which again demonstrate the strength and resilience of our business model,” said Mark A. Casale, Chairman and Chief Executive Officer.

Interestingly, the stock is up 2.5% since reporting and currently trades at $62.31.

Read our full report on Essent Group here, it’s free.

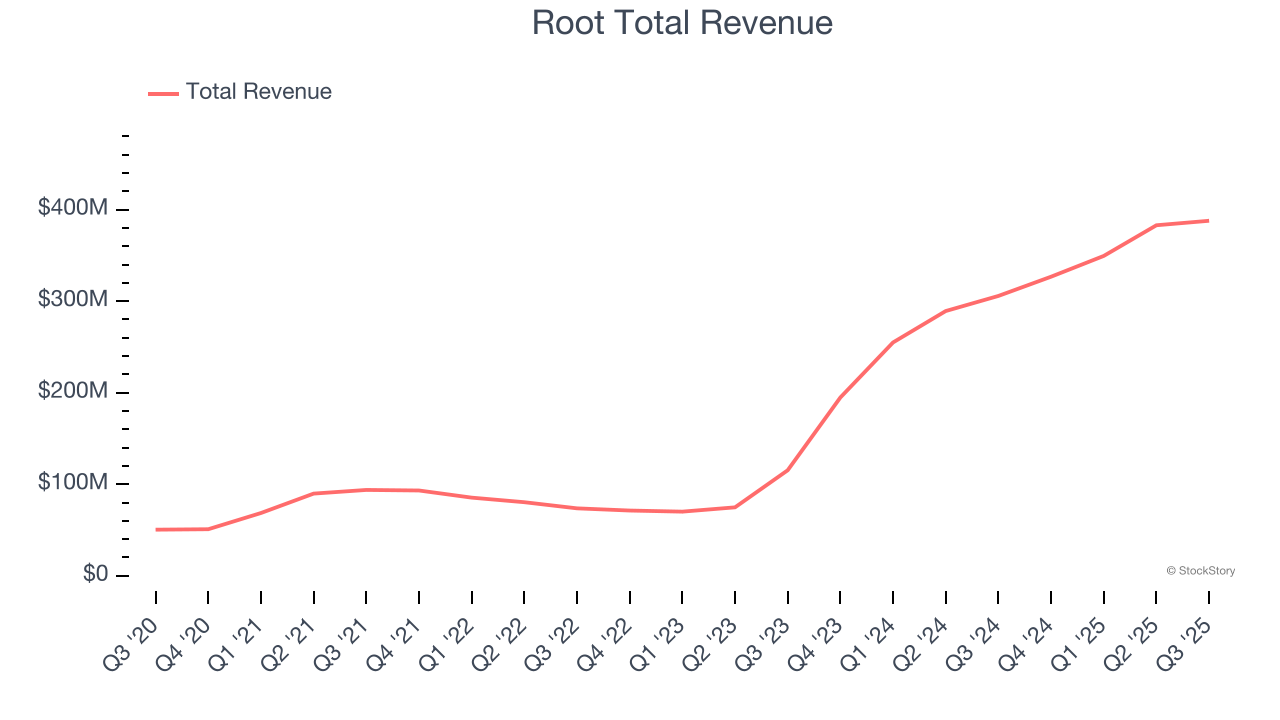

Best Q3: Root (NASDAQ: ROOT)

Pioneering a data-driven approach that rewards good driving habits, Root (NASDAQ: ROOT) is a technology-driven auto insurance company that uses mobile apps to acquire customers and data science to price policies based on individual driving behavior.

Root reported revenues of $387.8 million, up 26.9% year on year, outperforming analysts’ expectations by 4.5%. The business had an incredible quarter with a beat of analysts’ EPS estimates and an impressive beat of analysts’ net premiums earned estimates.

Although it had a fine quarter compared its peers, the market seems unhappy with the results as the stock is down 11.5% since reporting. It currently trades at $79.21.

Is now the time to buy Root? Access our full analysis of the earnings results here, it’s free.

Weakest Q3: Progressive (NYSE: PGR)

Starting as a small auto insurance company in 1937 with a pioneering focus on high-risk drivers, Progressive (NYSE: PGR) is a major auto, property, and commercial insurance provider that offers policies through independent agents, online platforms, and over the phone.

Progressive reported revenues of $22.51 billion, up 14.2% year on year, in line with analysts’ expectations. It was a softer quarter as it posted a significant miss of analysts’ EPS estimates and a miss of analysts’ book value per share estimates.

As expected, the stock is down 10.2% since the results and currently trades at $215.81.

Read our full analysis of Progressive’s results here.

Lemonade (NYSE: LMND)

Built on the principle of giving back unused premiums to charitable causes selected by policyholders, Lemonade (NYSE: LMND) is a technology-driven insurance company that offers homeowners, renters, pet, car, and life insurance through an AI-powered digital platform.

Lemonade reported revenues of $194.5 million, up 42.4% year on year. This number surpassed analysts’ expectations by 4.8%. It was a stunning quarter as it also logged a beat of analysts’ EPS estimates and an impressive beat of analysts’ revenue estimates.

The stock is up 46.2% since reporting and currently trades at $86.58.

Read our full, actionable report on Lemonade here, it’s free.

Trupanion (NASDAQ: TRUP)

Born from a vision to help pet owners avoid economic euthanasia when faced with expensive veterinary bills, Trupanion (NASDAQ: TRUP) provides medical insurance for cats and dogs through data-driven, vertically-integrated products priced specifically for each pet's unique characteristics.

Trupanion reported revenues of $366.9 million, up 12.1% year on year. This print topped analysts’ expectations by 1.3%. Overall, it was an exceptional quarter as it also recorded a beat of analysts’ EPS estimates and a solid beat of analysts’ book value per share estimates.

The stock is down 13.1% since reporting and currently trades at $36.58.

Read our full, actionable report on Trupanion here, it’s free.

Want to invest in winners with rock-solid fundamentals? Check out our Top 6 Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory’s analyst team — all seasoned professional investors — uses quantitative analysis and automation to deliver market-beating insights faster and with higher quality.