Amkor has been on fire lately. In the past six months alone, the company’s stock price has rocketed 77%, reaching $39.48 per share. This was partly thanks to its solid quarterly results, and the performance may have investors wondering how to approach the situation.

Is there a buying opportunity in Amkor, or does it present a risk to your portfolio? Get the full breakdown from our expert analysts, it’s free for active Edge members.

Why Is Amkor Not Exciting?

We’re glad investors have benefited from the price increase, but we're cautious about Amkor. Here are three reasons we avoid AMKR and a stock we'd rather own.

1. Low Gross Margin Reveals Weak Structural Profitability

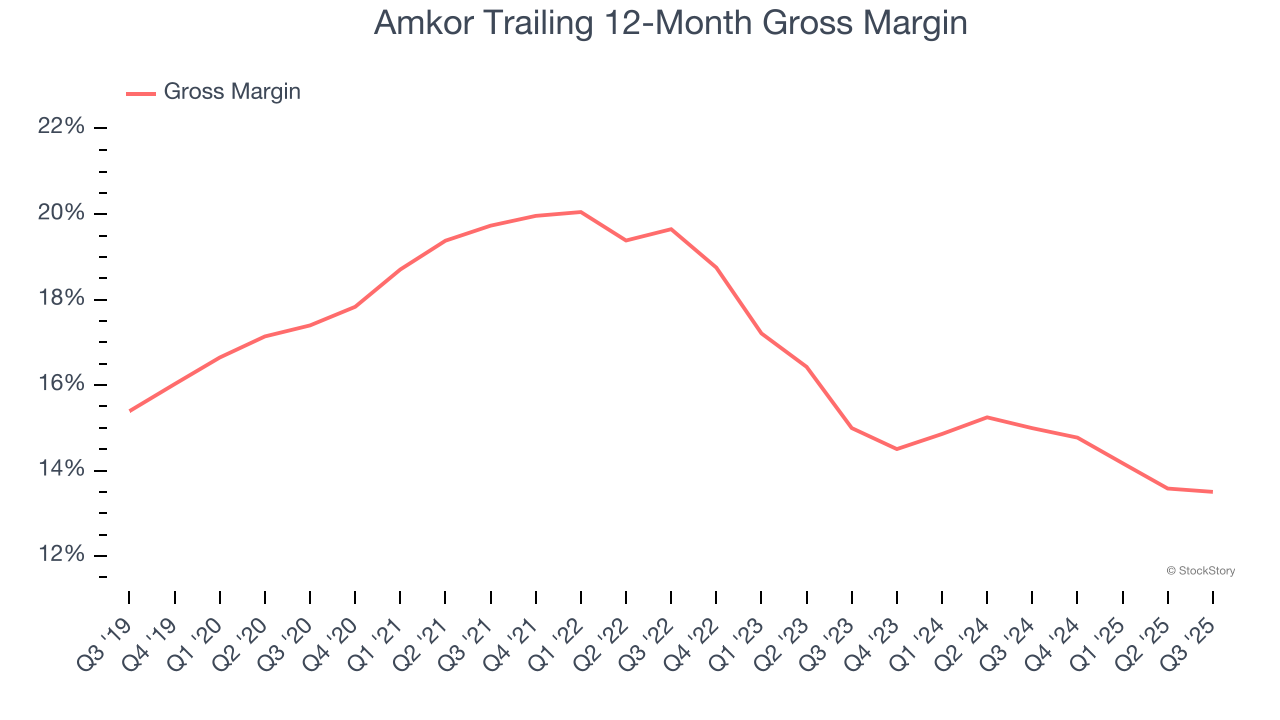

In the semiconductor industry, a company’s gross profit margin is a critical metric to track because it sheds light on its pricing power, complexity of products, and ability to procure raw materials, equipment, and labor.

Amkor’s gross margin is one of the worst in the semiconductor industry, signaling it operates in a competitive market and lacks pricing power. As you can see below, it averaged a 14.2% gross margin over the last two years. That means Amkor paid its suppliers a lot of money ($85.75 for every $100 in revenue) to run its business.

2. EPS Growth Has Stalled

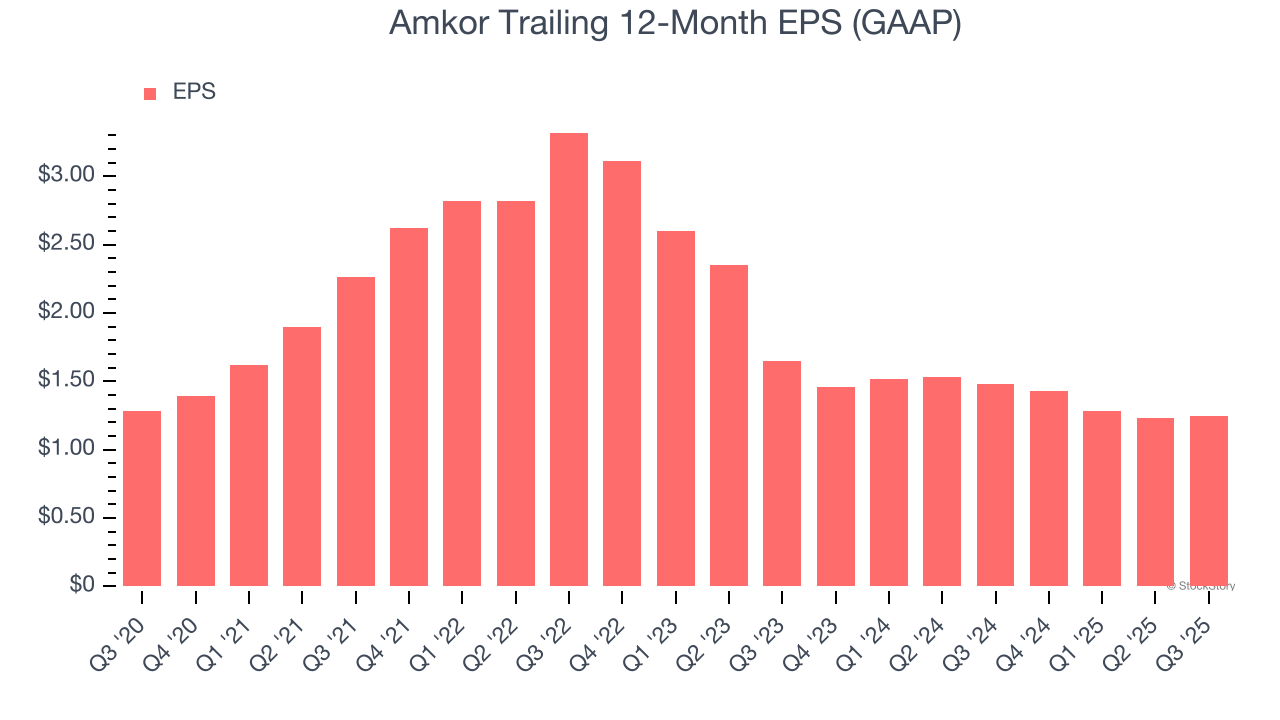

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

Amkor’s flat EPS over the last five years was below its 5.8% annualized revenue growth. This tells us the company became less profitable on a per-share basis as it expanded.

3. Mediocre Free Cash Flow Margin Limits Reinvestment Potential

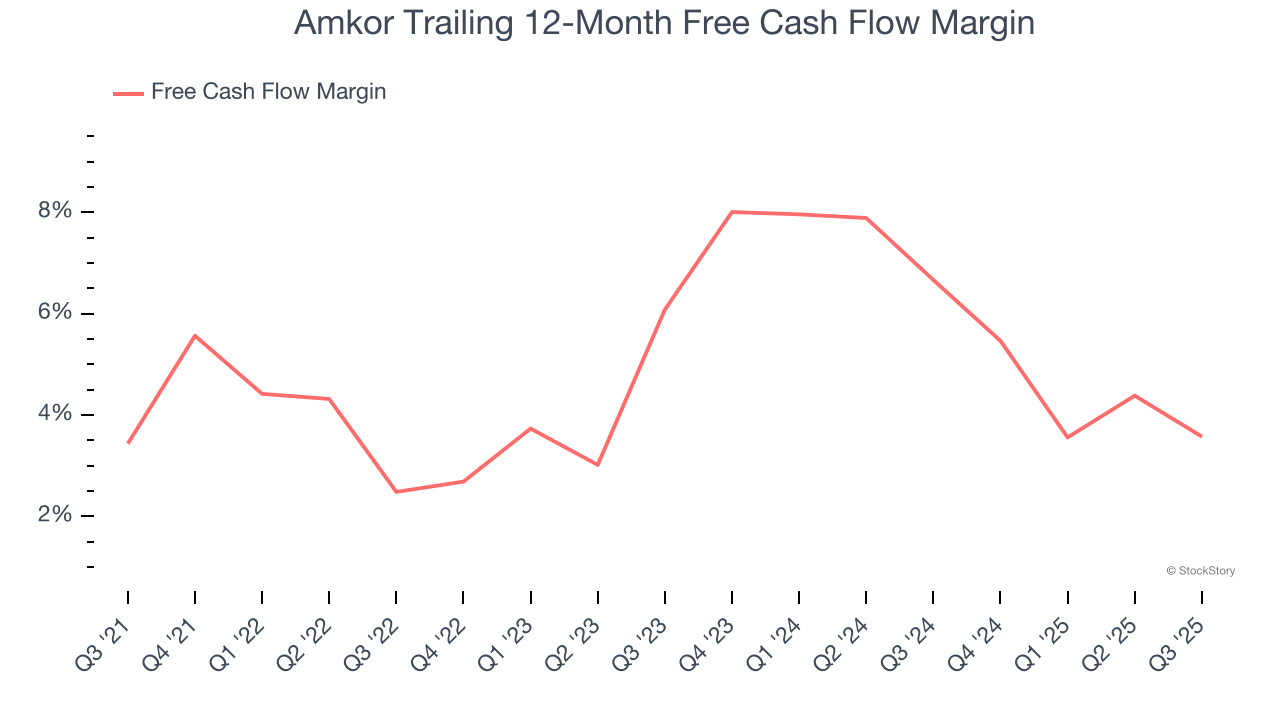

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Amkor has shown poor cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 5.1%, lousy for a semiconductor business.

Final Judgment

Amkor’s business quality ultimately falls short of our standards. Following the recent surge, the stock trades at 25.5× forward P/E (or $39.48 per share). Investors with a higher risk tolerance might like the company, but we think the potential downside is too great. We're fairly confident there are better stocks to buy right now. Let us point you toward one of our top software and edge computing picks.

Stocks We Would Buy Instead of Amkor

Check out the high-quality names we’ve flagged in our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.