As the Q3 earnings season wraps, let’s dig into this quarter’s best and worst performers in the research tools & consumables industry, including Bruker (NASDAQ: BRKR) and its peers.

The life sciences subsector specializing in research tools and consumables enables scientific discoveries across academia, biotechnology, and pharmaceuticals. These firms supply a wide range of essential laboratory products, ensuring a recurring revenue stream through repeat purchases and replenishment. Their business models benefit from strong customer loyalty, a diversified product portfolio, and exposure to both the research and clinical markets. However, challenges include high R&D investment to maintain technological leadership, pricing pressures from budget-conscious institutions, and vulnerability to fluctuations in research funding cycles. Looking ahead, this subsector stands to benefit from tailwinds such as growing demand for tools supporting emerging fields like synthetic biology and personalized medicine. There is also a rise in automation and AI-driven solutions in laboratories that could create new opportunities to sell tools and consumables. Nevertheless, headwinds exist. These companies tend to be at the mercy of supply chain disruptions and sensitivity to macroeconomic conditions that impact funding for research initiatives.

The 10 research tools & consumables stocks we track reported a mixed Q3. As a group, revenues beat analysts’ consensus estimates by 1.1% while next quarter’s revenue guidance was 1.3% below.

Thankfully, share prices of the companies have been resilient as they are up 5.3% on average since the latest earnings results.

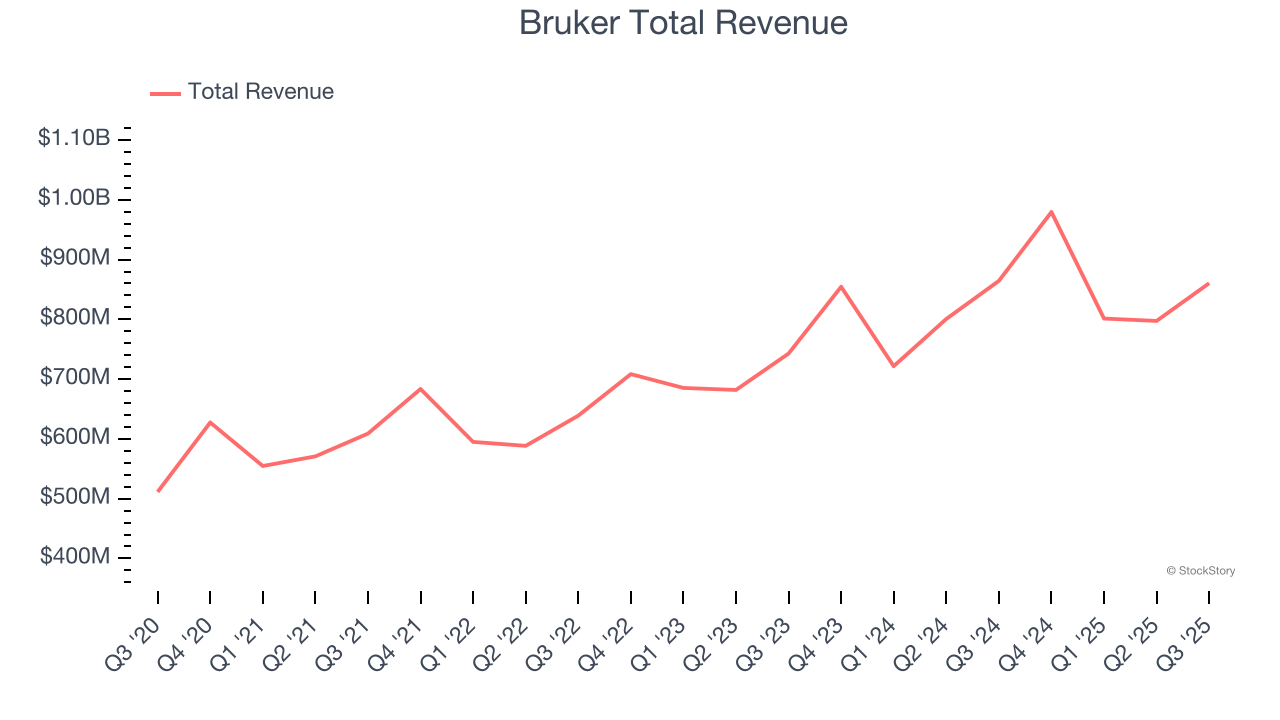

Bruker (NASDAQ: BRKR)

With roots dating back to the pioneering days of nuclear magnetic resonance technology, Bruker (NASDAQ: BRKR) develops and manufactures high-performance scientific instruments that enable researchers and industrial analysts to explore materials at microscopic, molecular, and cellular levels.

Bruker reported revenues of $860.5 million, flat year on year. This print exceeded analysts’ expectations by 1.8%. Overall, it was a satisfactory quarter for the company with a beat of analysts’ EPS estimates but a significant miss of analysts’ full-year EPS guidance estimates.

Bruker delivered the weakest full-year guidance update of the whole group. Interestingly, the stock is up 29% since reporting and currently trades at $50.23.

Is now the time to buy Bruker? Access our full analysis of the earnings results here, it’s free for active Edge members.

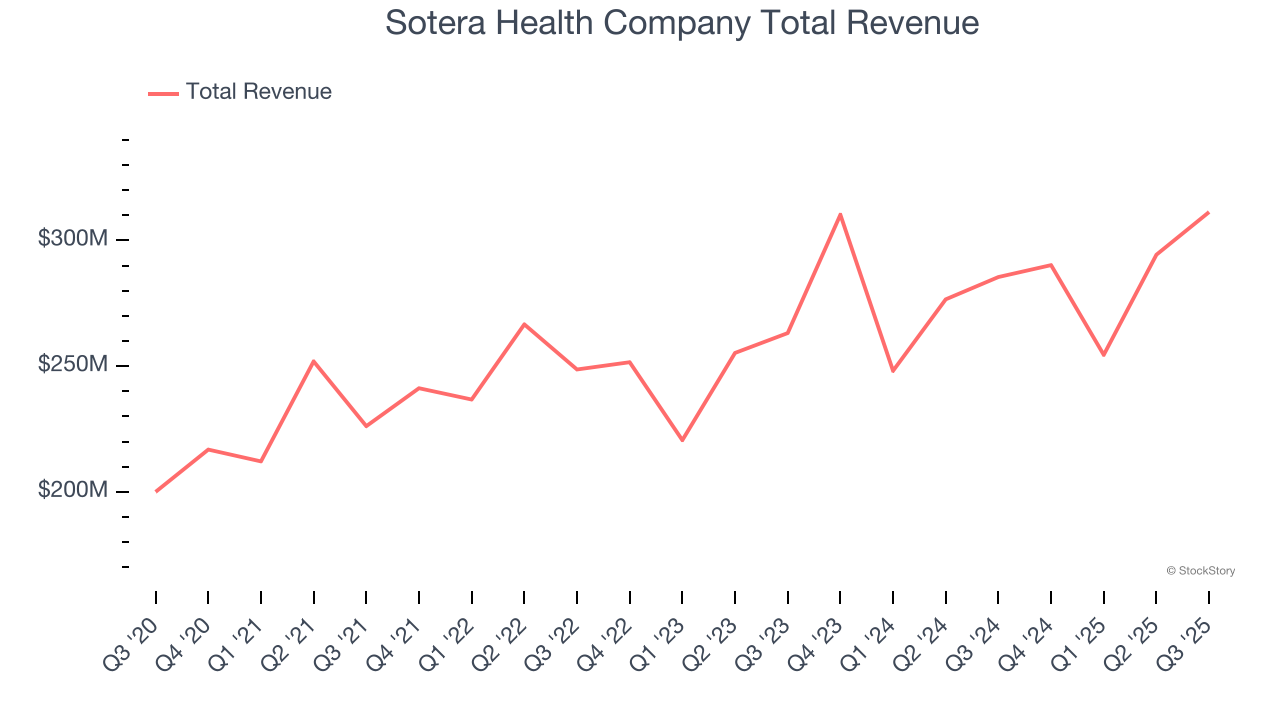

Best Q3: Sotera Health Company (NASDAQ: SHC)

With a critical role in ensuring the safety of millions of patients worldwide, Sotera Health (NASDAQGS:SHC) provides sterilization services, lab testing, and advisory services to ensure medical devices, pharmaceuticals, and food products are safe for use.

Sotera Health Company reported revenues of $311.3 million, up 9.1% year on year, outperforming analysts’ expectations by 2.6%. The business had an exceptional quarter with a solid beat of analysts’ full-year EPS guidance estimates and a solid beat of analysts’ organic revenue estimates.

The market seems happy with the results as the stock is up 10.8% since reporting. It currently trades at $18.40.

Is now the time to buy Sotera Health Company? Access our full analysis of the earnings results here, it’s free for active Edge members.

Weakest Q3: Avantor (NYSE: AVTR)

With roots dating back to 1904 and embedded in virtually every stage of scientific research and production, Avantor (NYSE: AVTR) provides mission-critical products, materials, and services to customers in biopharma, healthcare, education, and advanced technology industries.

Avantor reported revenues of $1.62 billion, down 5.3% year on year, falling short of analysts’ expectations by 1.4%. It was a softer quarter as it posted a slight miss of analysts’ revenue estimates and a miss of analysts’ organic revenue estimates.

Avantor delivered the slowest revenue growth in the group. As expected, the stock is down 21.7% since the results and currently trades at $11.81.

Read our full analysis of Avantor’s results here.

Bio-Techne (NASDAQ: TECH)

With a catalog of hundreds of thousands of specialized biological products used in laboratories worldwide, Bio-Techne (NASDAQ: TECH) develops and manufactures specialized reagents, instruments, and services that help researchers study biological processes and enable diagnostic testing and cell therapy development.

Bio-Techne reported revenues of $286.6 million, down 1% year on year. This result came in 1.7% below analysts' expectations. Overall, it was a softer quarter as it also produced a miss of analysts’ revenue estimates and a miss of analysts’ organic revenue estimates.

Bio-Techne had the weakest performance against analyst estimates among its peers. The stock is up 2.1% since reporting and currently trades at $62.36.

Read our full, actionable report on Bio-Techne here, it’s free for active Edge members.

Mettler-Toledo (NYSE: MTD)

With roots dating back to the precision balance innovations of Swiss engineer Erhard Mettler, Mettler-Toledo (NYSE: MTD) manufactures precision weighing instruments, analytical equipment, and product inspection systems used in laboratories, industrial settings, and food retail.

Mettler-Toledo reported revenues of $1.03 billion, up 7.9% year on year. This print surpassed analysts’ expectations by 3.2%. Aside from that, it was a mixed quarter as it also recorded an impressive beat of analysts’ revenue estimates but revenue guidance for next quarter missing analysts’ expectations significantly.

Mettler-Toledo scored the biggest analyst estimates beat among its peers. The stock is flat since reporting and currently trades at $1,447.

Read our full, actionable report on Mettler-Toledo here, it’s free for active Edge members.

Want to invest in winners with rock-solid fundamentals? Check out our 9 Best Market-Beating Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory’s analyst team — all seasoned professional investors — uses quantitative analysis and automation to deliver market-beating insights faster and with higher quality.