Coinbase’s stock price has taken a beating over the past six months, shedding 38.9% of its value and falling to $194.45 per share. This might have investors contemplating their next move.

Given the weaker price action, is now the time to buy COIN? Find out in our full research report, it’s free.

Why Does COIN Stock Spark Debate?

Widely regarded as the face of crypto, Coinbase (NASDAQ: COIN) is a blockchain infrastructure company updating the financial system with its trading, staking, stablecoin, and other payment solutions.

Two Things to Like:

1. Monthly Transacting Users Skyrocket, Fueling Growth Opportunities

As a fintech company, Coinbase generates revenue growth by increasing both the number of users on its platform and the number of transactions they execute.

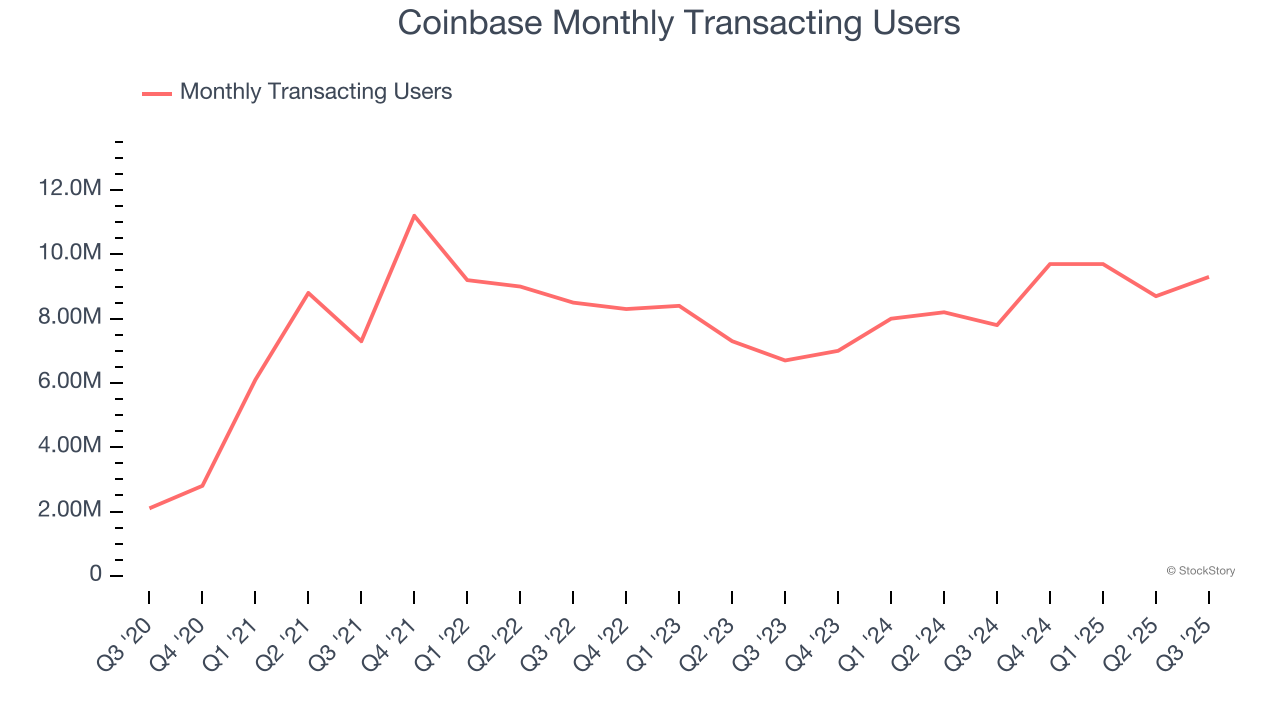

Over the last two years, Coinbase’s monthly transacting users, a key performance metric for the company, increased by 11.7% annually to 9.3 million in the latest quarter. This growth rate is strong for a consumer internet business and indicates people love using its offerings.

2. Eye-Popping Growth in Customer Spending

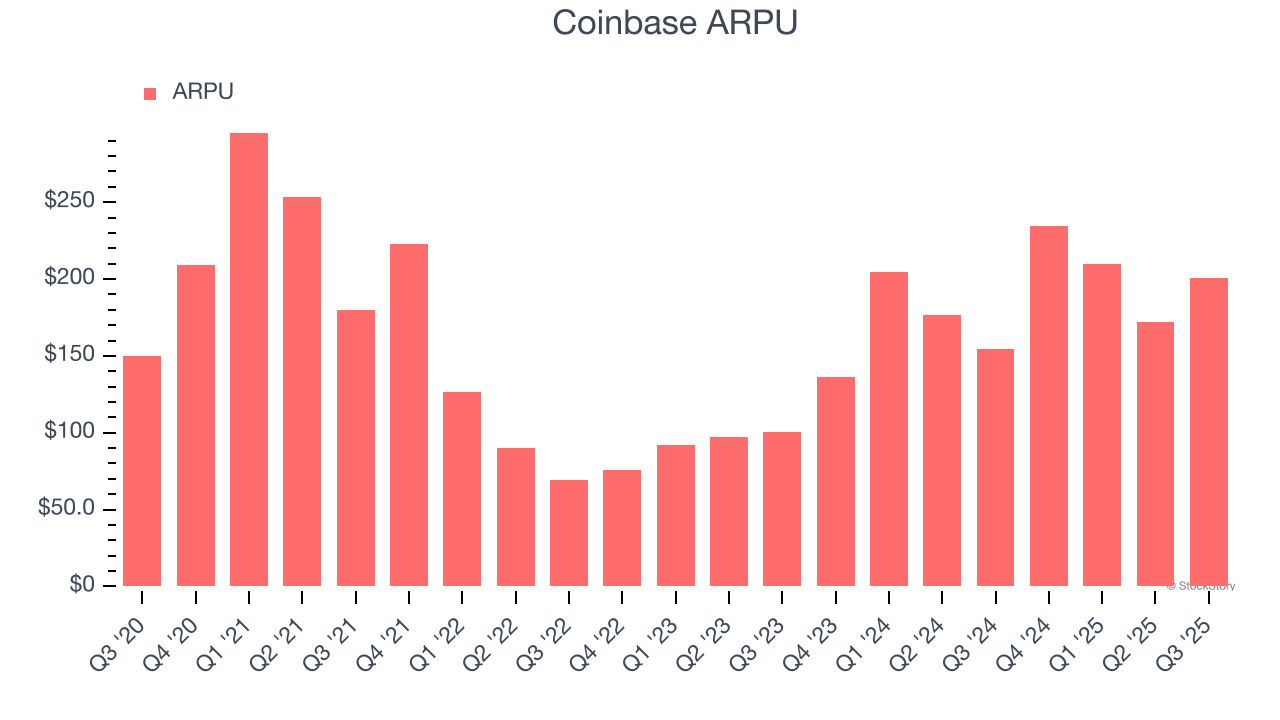

Average revenue per user (ARPU) is a critical metric to track because it measures how much the company earns in fees from each user. ARPU also gives us unique insights into the average transaction size on Coinbase’s platform and the company’s take rate, or "cut", on each transaction.

Coinbase’s ARPU growth has been exceptional over the last two years, averaging 55%. Its ability to increase monetization while growing its monthly transacting users at an impressive rate reflects the strength of its platform, as its users are spending significantly more than last year.

One Reason to be Careful:

Free Cash Flow Margin Dropping

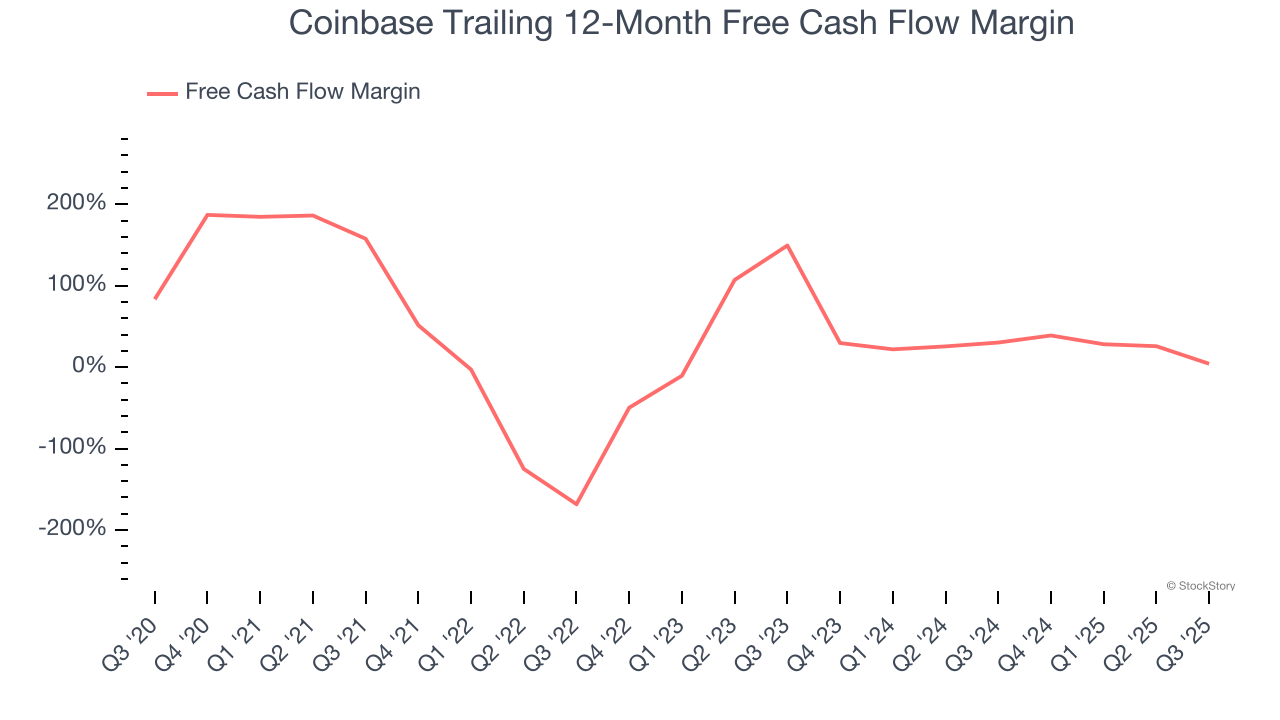

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

As you can see below, Coinbase’s margin dropped meaningfully over the last five years. If its declines continue, it could signal increasing investment needs and capital intensity. Coinbase’s free cash flow margin for the trailing 12 months was 4.2%.

Final Judgment

Coinbase’s positive characteristics outweigh the negatives. After the recent drawdown, the stock trades at 15.6× forward EV/EBITDA (or $194.45 per share). Is now the time to initiate a position? See for yourself in our in-depth research report, it’s free.

High-Quality Stocks for All Market Conditions

While everyone piles into the same crowded names, smart investors are hunting quality where no one’s looking - and paying a fraction of the price. Check out the high-quality names we’ve flagged in our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.