Toast has gotten torched over the last six months - since August 2025, its stock price has dropped 37.1% to $31.01 per share. This might have investors contemplating their next move.

Following the pullback, is now an opportune time to buy TOST? Find out in our full research report, it’s free.

Why Does TOST Stock Spark Debate?

Born from the frustrations of three friends waiting too long for their restaurant bill, Toast (NYSE: TOST) provides a cloud-based digital technology platform with software, payment processing, and hardware solutions built specifically for restaurants.

Two Positive Attributes:

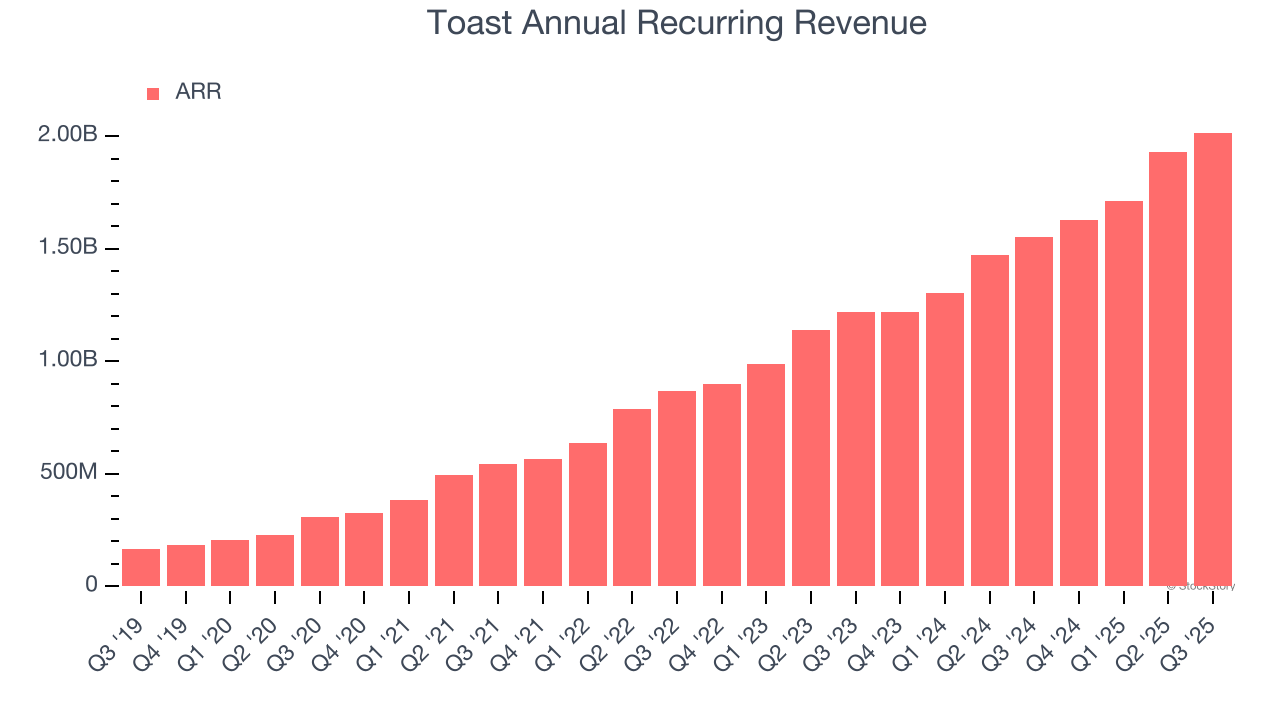

1. ARR Surges as Recurring Revenue Flows In

While reported revenue for a software company can include low-margin items like implementation fees, annual recurring revenue (ARR) is a sum of the next 12 months of contracted revenue purely from software subscriptions, or the high-margin, predictable revenue streams that make SaaS businesses so valuable.

Toast’s ARR punched in at $2.02 billion in Q3, and over the last four quarters, its year-on-year growth averaged 31.3%. This performance was fantastic and shows that customers are willing to take multi-year bets on the company’s technology. Its growth also makes Toast a more predictable business, a tailwind for its valuation as investors typically prefer businesses with recurring revenue.

2. Projected Revenue Growth Is Remarkable

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite, though some deceleration is natural as businesses become larger.

Over the next 12 months, sell-side analysts expect Toast’s revenue to rise by 21.1%. While this projection is below its 27.6% annualized growth rate for the past two years, it is noteworthy and implies the market sees success for its products and services.

One Reason to be Careful:

Long Payback Periods Delay Returns

The customer acquisition cost (CAC) payback period measures the months a company needs to recoup the money spent on acquiring a new customer. This metric helps assess how quickly a business can break even on its sales and marketing investments.

Toast’s recent customer acquisition efforts haven’t yielded returns as its CAC payback period was negative this quarter, meaning its incremental sales and marketing investments outpaced its revenue. The company’s inefficiency indicates it operates in a competitive market and must continue investing to grow.

Final Judgment

Toast’s positive characteristics outweigh the negatives. After the recent drawdown, the stock trades at 2.7× forward price-to-sales (or $31.01 per share). Is now a good time to initiate a position? See for yourself in our in-depth research report, it’s free.

High-Quality Stocks for All Market Conditions

If your portfolio success hinges on just 4 stocks, your wealth is built on fragile ground. You have a small window to secure high-quality assets before the market widens and these prices disappear.

Don’t wait for the next volatility shock. Check out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.