Over the past six months, Kinsale Capital Group’s stock price fell to $395.79. Shareholders have lost 11.2% of their capital, which is disappointing considering the S&P 500 has climbed by 10%. This may have investors wondering how to approach the situation.

Given the weaker price action, is now the time to buy KNSL? Find out in our full research report, it’s free.

Why Is Kinsale Capital Group a Good Business?

Founded in 2009 during the aftermath of the financial crisis when many insurers were retreating from riskier markets, Kinsale Capital Group (NYSE: KNSL) is an insurance company that specializes in writing policies for hard-to-place, unusual, or high-risk businesses that standard insurers typically avoid.

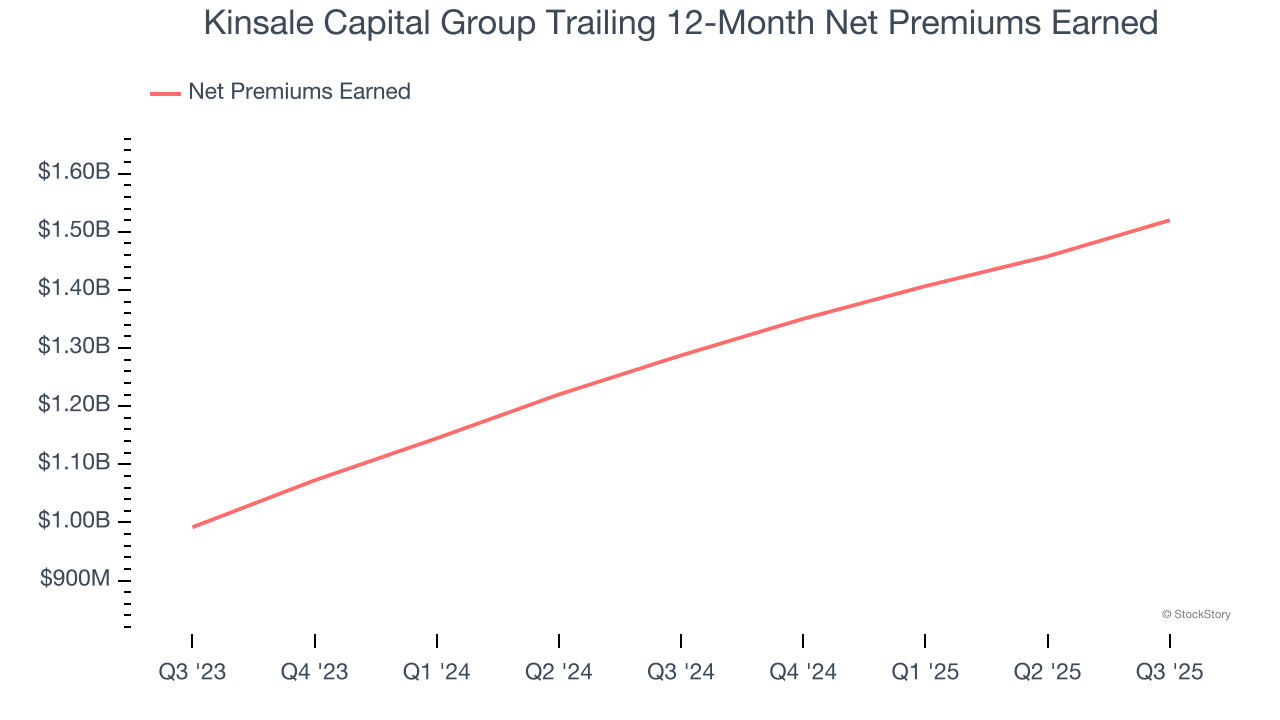

1. Net Premiums Earned Skyrocket, Fueling Growth Opportunities

When insurers sell policies, they protect themselves from extremely large losses or an outsized accumulation of losses with reinsurance (insurance for insurance companies). Net premiums earned are:

- Gross premiums - what’s ceded to reinsurers as a risk mitigation and transfer strategy

Kinsale Capital Group’s net premiums earned has grown at a 23.8% annualized rate over the last two years, much better than the broader insurance industry.

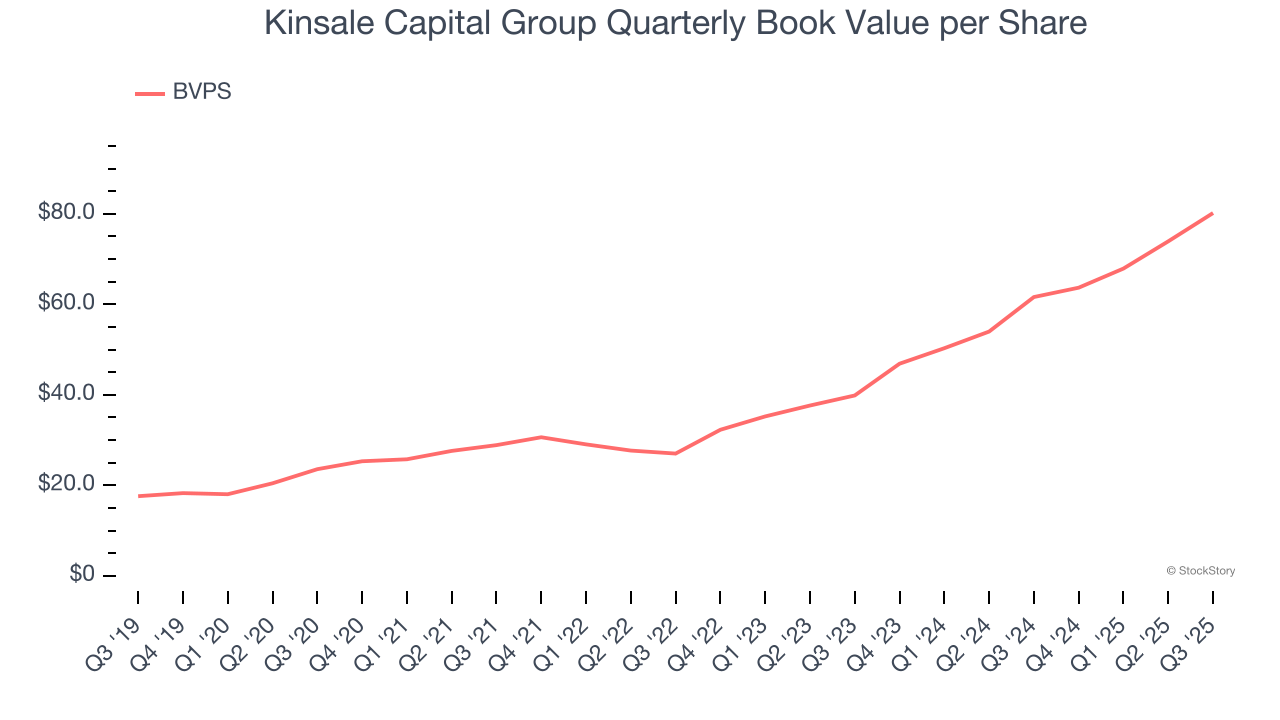

2. Growing BVPS Reflects Strong Asset Base

For insurers, book value per share (BVPS) is a vital measure of financial health, representing the total assets available to shareholders after accounting for all liabilities, including policyholder reserves and claims obligations.

Kinsale Capital Group’s BVPS increased by 27.7% annually over the last five years, and growth has recently accelerated as BVPS grew at an incredible 41.8% annual clip over the past two years (from $39.86 to $80.19 per share).

3. Projected BVPS Growth Is Remarkable

An insurer’s book value per share (BVPS) increases when it maintains a profitable combined ratio and effectively manages its investment portfolio.

Over the next 12 months, Consensus estimates call for Kinsale Capital Group’s BVPS to grow by 20.3% to $80.92, elite growth rate.

Final Judgment

These are just a few reasons why Kinsale Capital Group is a cream-of-the-crop insurance company. After the recent drawdown, the stock trades at 4.7× forward P/B (or $395.79 per share). Is now the right time to buy? See for yourself in our comprehensive research report, it’s free.

Stocks We Like Even More Than Kinsale Capital Group

If your portfolio success hinges on just 4 stocks, your wealth is built on fragile ground. You have a small window to secure high-quality assets before the market widens and these prices disappear.

Don’t wait for the next volatility shock. Check out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.