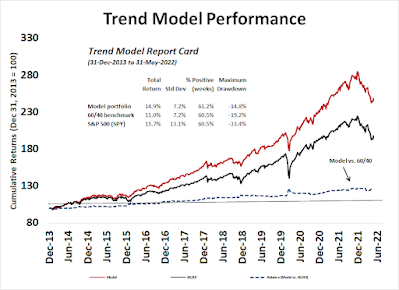

The Trend Asset Allocation Model is an asset allocation model that applies trend following principles based on the inputs of global stock and commodity prices. This model has a shorter time horizon and tends to turn over about 4-6 times a year. The performance and full details of a model portfolio based on the out-of-sample signals of the Trend Model can be found here.

My inner trader uses a trading model, which is a blend of price momentum (is the Trend Model becoming more bullish, or bearish?) and overbought/oversold extremes (don't buy if the trend is overbought, and vice versa). Subscribers receive real-time alerts of model changes, and a hypothetical trading record of the email alerts is updated weekly here. The hypothetical trading record of the trading model of the real-time alerts that began in March 2016 is shown below.

The latest signals of each model are as follows:

- Ultimate market timing model: Sell equities*

- Trend Model signal: Bearish*

- Trading model: Neutral*

Update schedule: I generally update model readings on my site on weekends and tweet mid-week observations at @humblestudent. Subscribers receive real-time alerts of trading model changes, and a hypothetical trading record of those email alerts is shown here.

Subscribers can access the latest signal in real-time here.

Breaking supportSo much for the breadth thrust. After surging off a test off the lows in late May after exhibiting strong price momentum known as breadth thrusts, the S&P 500 consolidated sideways for about a week. The index decisively broke down through a narrow trading range Thursday with a 93% downside volume day, which negated the bullish implications of the previous breadth thrust signal. The index is now testing support as defined by the May lows.

While it would be very easy to turn bearish, sentiment and market internals suggest relatively low downside risk.

The full post can be found here.